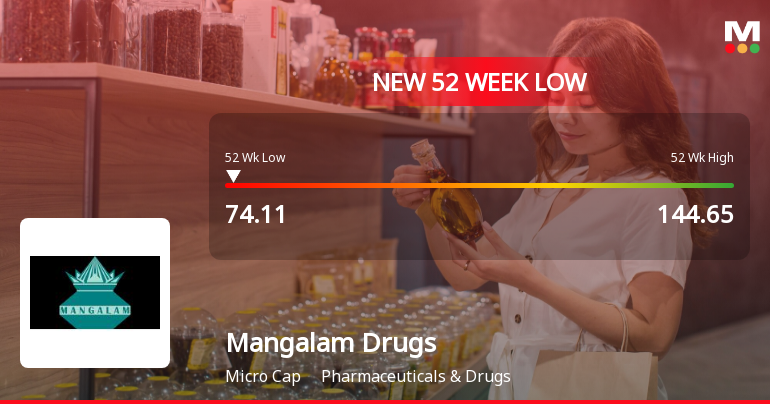

Mangalam Drugs Hits 52-Week Low Amidst Mixed Performance and Valuation Opportunities

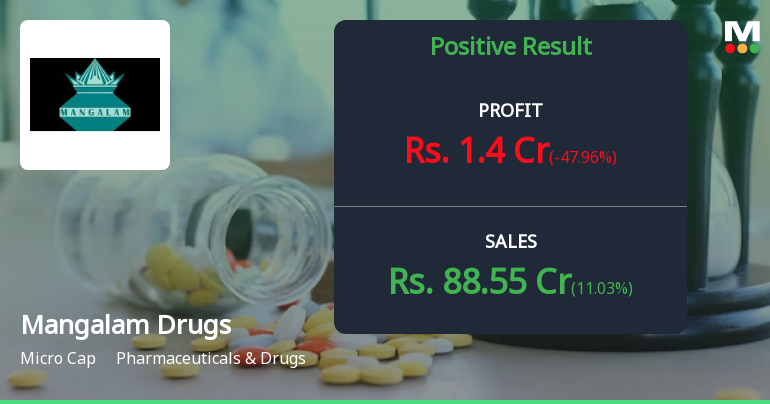

2025-03-28 09:40:14Mangalam Drugs and Organics, a microcap in the Pharmaceuticals & Drugs sector, reached a new 52-week low amid a three-day decline. Despite recent positive quarterly results and a strong growth rate in operating profits, the stock has underperformed over the past year compared to benchmark indices.

Read More

Mangalam Drugs Hits 52-Week Low Amid Mixed Financial Performance and Market Challenges

2025-03-28 09:40:08Mangalam Drugs and Organics has reached a new 52-week low, following a three-day decline. Despite a slight outperformance against its sector today, the stock remains below key moving averages and has underperformed over the past year. Financial metrics show mixed results, with weak long-term fundamentals.

Read More

Mangalam Drugs and Organics Adjusts Valuation Amid Mixed Performance Indicators

2025-03-25 08:10:26Mangalam Drugs and Organics has recently experienced a change in its evaluation, reflecting attractive valuation metrics. Key indicators include a PE ratio of 12.43 and a price-to-book value of 0.87. Despite these strengths, the company has faced challenges in long-term performance and has underperformed against market indices.

Read MoreMangalam Drugs Adjusts Valuation Grade, Highlighting Competitive Market Position and Efficiency

2025-03-25 08:00:06Mangalam Drugs and Organics, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting a more favorable assessment of its financial metrics. The company currently boasts a price-to-earnings (PE) ratio of 12.43 and a price-to-book value of 0.87, indicating a competitive position in the market. Its enterprise value to EBITDA stands at 5.50, while the enterprise value to sales ratio is notably low at 0.59, suggesting efficient operations relative to its revenue generation. In comparison to its peers, Mangalam Drugs demonstrates a more attractive valuation profile. For instance, competitors like Kopran and Anuh Pharma have higher PE ratios of 19.3 and 15.96, respectively, while others in the sector, such as Shree Ganesh Remedies and Fermenta Biotec, exhibit significantly elevated valuations. Additionally, Mangalam's return on capital employed (ROCE) is r...

Read More

Mangalam Drugs Faces Volatility Amidst Declining Stock Performance and Market Challenges

2025-03-04 12:05:15Mangalam Drugs and Organics, a microcap in the Pharmaceuticals sector, has faced significant volatility, recently hitting a 52-week low. The stock has underperformed its sector and is trading below key moving averages. Despite reporting positive quarterly results, its long-term growth fundamentals appear weak.

Read More

Mangalam Drugs Faces Significant Volatility Amidst Ongoing Market Challenges

2025-03-03 10:35:21Mangalam Drugs and Organics, a microcap in the Pharmaceuticals & Drugs sector, has faced significant volatility, reaching a new 52-week low. The stock has declined 18.67% over six days and is trading below key moving averages, reflecting ongoing challenges in the market compared to broader indices.

Read More

Mangalam Drugs Reports Profit Growth Amid Ongoing Market Challenges and Valuation Concerns

2025-02-28 18:25:24Mangalam Drugs and Organics, a microcap in the Pharmaceuticals & Drugs sector, recently adjusted its evaluation following a strong third-quarter performance, with profit after tax reaching Rs 4.09 crore. Despite this, the company's long-term fundamentals show weakness, and it has underperformed against benchmark indices over the past three years.

Read More

Mangalam Drugs Faces Debt Challenges Despite Consistent Profit Growth and Sales Increase

2025-02-14 18:29:45Mangalam Drugs and Organics, a microcap in the Pharmaceuticals & Drugs sector, has experienced a recent evaluation adjustment. The company has shown a 9.23% CAGR in net sales over five years but faces challenges with debt servicing. Despite consistent quarterly profits, it has underperformed against benchmark indices.

Read More

Mangalam Drugs and Organics Reports Financial Results, Signals Reevaluation of Market Positioning

2025-02-14 11:19:18Mangalam Drugs and Organics has announced its financial results for the quarter ending December 2024, revealing a reevaluation of its performance score from 9 to 8. This adjustment reflects the company's response to industry trends and market conditions, highlighting its ongoing challenges within the pharmaceuticals sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories Participants) Regulations 2018 received from MUFG Intime India Private Limited (previously Link Intime India Private Limited)-RTA on 5th April 2025

Regulatory Update As Per Regulation 31(4) Of Substantial Acquisition Of Shares And Takeover Regulations 2011

07-Apr-2025 | Source : BSERegulatory update as per Regulation 31(4) of Substantial Acquisition of shares and Takeover Regulations 2011

Board Meeting Intimation for Intimation Of Board Meeting To Be Held On 11Th April 2025 To Approve Appointment Of Chief Financial Officer Of The Company W.E.F. 11Th April 2025

04-Apr-2025 | Source : BSEMangalam Drugs & Organics Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/04/2025 inter alia to consider and approve Intimation of Board Meeting to be held on 11th April 2025 for approval of appointment of Chief Financial Officer of the Company w.e.f. 11th April 2025.

Corporate Actions

No Upcoming Board Meetings

Mangalam Drugs and Organics Ltd has declared 5% dividend, ex-date: 21 Dec 17

No Splits history available

No Bonus history available

No Rights history available