Mangalam Industrial Finance Ltd Sees Strong Buying Momentum Amid Market Volatility

2025-04-03 09:35:08Mangalam Industrial Finance Ltd is currently witnessing strong buying activity, with the stock gaining 4.97% today, significantly outperforming the Sensex, which is down by 0.58%. Over the past week, Mangalam Industrial Finance has shown a robust performance, rising 12.43%, while the Sensex has declined by 1.85%. Notably, the stock has experienced consecutive gains over the last three days, accumulating a total return of 15.15%. Despite this recent uptick, the stock's performance over longer periods reveals a more complex picture. Over the past month, it has decreased by 9.52%, and year-to-date, it is down 48.51%. In stark contrast, the stock has seen a remarkable 809.19% increase over the last five years, while the Sensex has risen by 176.07% during the same timeframe. Today's trading session opened with a gap up, and the intraday high reflects the ongoing buying momentum. The stock's current price is ab...

Read MoreMangalam Industrial Finance Ltd Sees Notable Gains Amid Strong Buying Activity

2025-04-02 09:35:13Mangalam Industrial Finance Ltd is currently witnessing significant buying activity, with the stock rising by 4.62% today, outperforming the Sensex, which gained only 0.54%. This marks the second consecutive day of gains for Mangalam Industrial Finance, with a total increase of 9.7% over this period. Despite this recent uptick, the stock has faced challenges over the longer term, showing a decline of 59.14% over the past year and 68.40% over the last three years. However, it has demonstrated remarkable growth over the past five years, with a staggering increase of 728.46%, compared to the Sensex's 170.41% rise during the same timeframe. Today's trading session opened with a gap up, indicating strong buyer sentiment. The stock's performance is currently above its 5-day moving average but remains below its 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a mixed trend in the short to medium...

Read MoreMangalam Industrial Finance Ltd Sees Increased Buying Activity Amid Market Challenges

2025-04-01 10:15:15Mangalam Industrial Finance Ltd is currently witnessing significant buying activity, with a notable increase of 2.37% in its stock price today, contrasting sharply with the Sensex, which has declined by 0.70%. This uptick marks a day of strong buyer interest, despite the stock's recent performance trends, which show a decline of 8.95% over the past week and a substantial 19.91% drop over the last month. The stock's performance relative to the Sensex reveals a challenging landscape, with Mangalam Industrial Finance Ltd underperforming in various time frames, including a staggering 56.97% decrease over the past year. However, the current buying pressure may be attributed to market corrections or sector-specific developments that have sparked renewed interest among buyers. In terms of price summary, the stock opened with a gap up, indicating positive sentiment at the start of the trading session. The intrada...

Read MoreMangalam Industrial Finance Ltd Sees Notable 4.73% Gain Amidst Market Challenges

2025-03-28 11:10:04Mangalam Industrial Finance Ltd is witnessing significant buying activity today, with a notable increase of 4.73%. This performance stands in stark contrast to the Sensex, which remained unchanged at 0.00%. The stock has shown a trend reversal after three consecutive days of decline, indicating a potential shift in market sentiment. Despite today's gains, Mangalam Industrial Finance has faced challenges over the past week, with a decline of 6.84%, and a more pronounced drop of 18.06% over the past month. Year-to-date, the stock is down 52.03%, while its performance over the last year shows a decrease of 55.97%. In a broader context, the stock has struggled significantly over the past three years, down 69.10%, contrasting sharply with the Sensex's gain of 34.74% during the same period. Today's trading session saw the stock open at a new 52-week low of Rs. 1.61, yet it managed to outperform its sector by 4....

Read More

Mangalam Industrial Finance Faces Significant Decline Amid Broader Market Challenges

2025-03-28 09:42:44Mangalam Industrial Finance has faced notable volatility, reaching a new 52-week low and declining consecutively over four days. The stock has significantly underperformed its sector and reported a substantial year-over-year decline. In contrast, small-cap stocks have shown some resilience amid broader market challenges.

Read MoreMangalam Industrial Finance Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-28 09:35:14Mangalam Industrial Finance Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with its stock price dropping by 4.73% in just one day, while the Sensex has only decreased by 0.20%. Over the past week, Mangalam Industrial Finance has lost 15.26%, contrasting sharply with the Sensex's gain of 0.71%. The stock's performance over the past month reveals a staggering decline of 25.46%, while the Sensex has risen by 5.81%. This trend continues over longer periods, with a 56.49% drop in the last three months and a 59.95% decrease over the past year, compared to the Sensex's 5.16% increase. Today, the stock hit a new 52-week low of Rs. 1.61 and has been on a downward trajectory for four consecutive days, resulting in a total loss of 16.15% during this period. Additionally, Mangalam Industrial Finance is trading below its...

Read MoreMangalam Industrial Finance Faces Intense Selling Pressure Amid Consecutive Losses

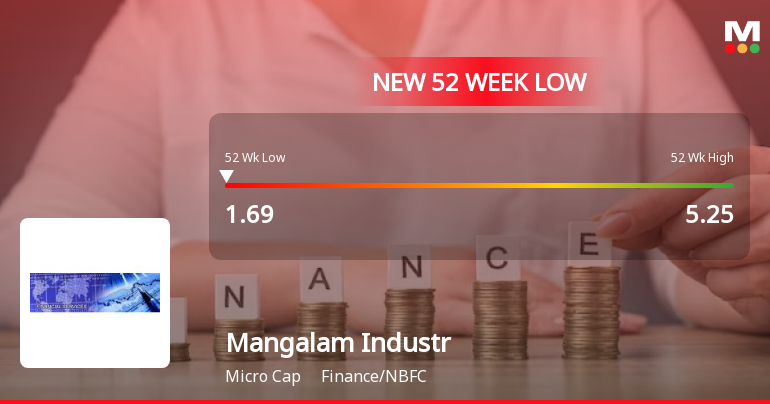

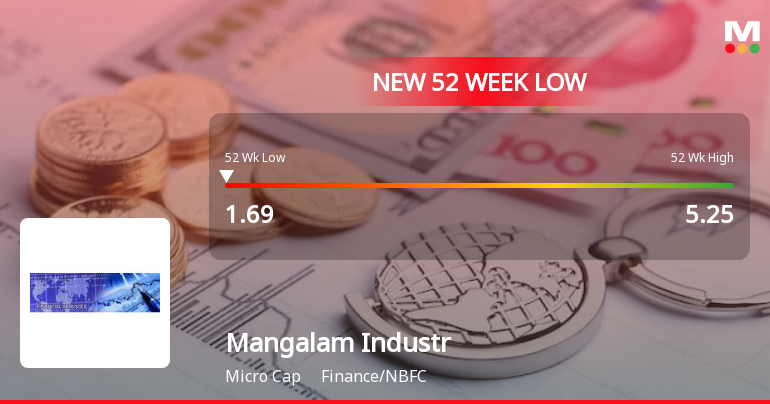

2025-03-27 10:05:05Mangalam Industrial Finance Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past three days, with a total decline of 11.46%. Today, the stock fell by 4.52%, underperforming the Sensex, which gained 0.45%. Over the past week, Mangalam Industrial Finance has seen a steep decline of 14.65%, while the Sensex rose by 1.68%. The stock's performance over the past month is similarly concerning, with a drop of 23.18% compared to the Sensex's increase of 4.05%. Year-to-date, the stock has plummeted by 54.20%, contrasting sharply with the Sensex's slight decline of 0.65%. Notably, Mangalam Industrial Finance has hit a new 52-week low of Rs. 1.69 today. The stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent downward trend. The substantial selling press...

Read More

Mangalam Industrial Finance Faces Declining Performance Amid Weak Fundamentals and Promoter Confidence

2025-03-27 09:46:53Mangalam Industrial Finance, a microcap in the finance sector, has hit a new 52-week low and has underperformed its sector significantly. The stock has declined over the past three days and shows a substantial year-over-year drop. Weak fundamentals and reduced promoter stake further complicate its outlook.

Read More

Mangalam Industrial Finance Hits 52-Week Low Amidst Declining Stakeholder Confidence

2025-03-27 09:46:44Mangalam Industrial Finance has reached a new 52-week low, continuing a downward trend over the past three days. The stock has significantly underperformed its sector and experienced a substantial decline over the past year. Weak fundamentals and reduced promoter stake further highlight challenges for the company.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEEnclosed herewith Confirmation certificate for the Fourth Quarter and Financial Year ended 31st March 2025

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

02-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Wardwizard Solutions India Pvt Ltd

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Wardwizard Solutions India Pvt Ltd

Corporate Actions

No Upcoming Board Meetings

Mangalam Industrial Finance Ltd has declared 1% dividend, ex-date: 28 Jan 25

Mangalam Industrial Finance Ltd has announced 1:10 stock split, ex-date: 29 Nov 16

No Bonus history available

Mangalam Industrial Finance Ltd has announced 21:163 rights issue, ex-date: 29 Jan 24