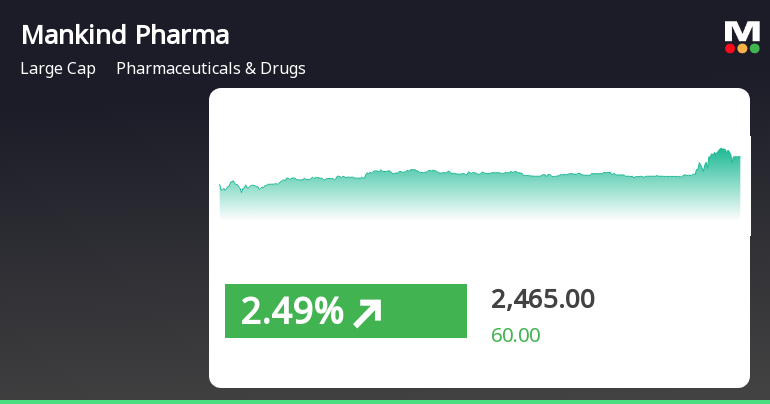

Mankind Pharma Shows Resilience with Consecutive Gains Amid Market Fluctuations

2025-03-27 15:35:33Mankind Pharma has demonstrated strong performance, gaining 3.03% on March 27, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, with a total return of 4.76%. Despite a decline over the past three months, it remains above several key moving averages.

Read More

Mankind Pharma Faces Mixed Technical Signals Amid High Valuation Concerns

2025-03-25 08:26:17Mankind Pharma has recently undergone a score adjustment, reflecting mixed technical indicators and high valuation metrics. Despite a decline in quarterly profits, the company showcases strong management efficiency and a favorable debt-to-equity ratio, positioning it well amid market fluctuations.

Read MoreMankind Pharma Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:06:30Mankind Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,371.00, down from a previous close of 2,400.55, with a notable 52-week high of 3,050.00 and a low of 1,910.10. Today's trading saw the stock reach a high of 2,449.90 and a low of 2,328.30. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly Bollinger Bands indicate a bullish trend. The moving averages on a daily basis also reflect a bearish stance. The Dow Theory presents a mixed view, with weekly indicators showing mild bullishness, contrasting with the monthly outlook that leans mildly bearish. The On-Balance Volume (OBV) shows no clear trend on a weekly basis but indicates a mildly bearish position monthly. When comparing Mankind Pharma's performa...

Read MoreMankind Pharma Adjusts Valuation Grade Amid Competitive Pharmaceutical Landscape

2025-03-24 08:01:14Mankind Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 48.52, while its price-to-book value is noted at 9.37. Additionally, Mankind Pharma's enterprise value to EBITDA ratio is 32.11, and its enterprise value to EBIT is 38.81, indicating a robust valuation relative to its earnings. In terms of performance, Mankind Pharma boasts a return on capital employed (ROCE) of 36.42% and a return on equity (ROE) of 20.02%, showcasing strong profitability metrics. However, the company does not currently offer a dividend yield. When compared to its peers, Mankind Pharma's valuation metrics are notably higher than those of several competitors, such as Sun Pharma and Torrent Pharma, which also reflect elevated valuations. In contrast, companies li...

Read More

Mankind Pharma Shows Positive Short-Term Momentum Amid Broader Market Recovery

2025-03-21 09:50:29Mankind Pharma has demonstrated significant activity, gaining 3.39% on March 21, 2025, and outperforming its sector. The stock has shown a positive trend over the past three days, reaching an intraday high of Rs 2326.25. In the broader market, the Sensex has recovered, with small-cap stocks leading gains.

Read More

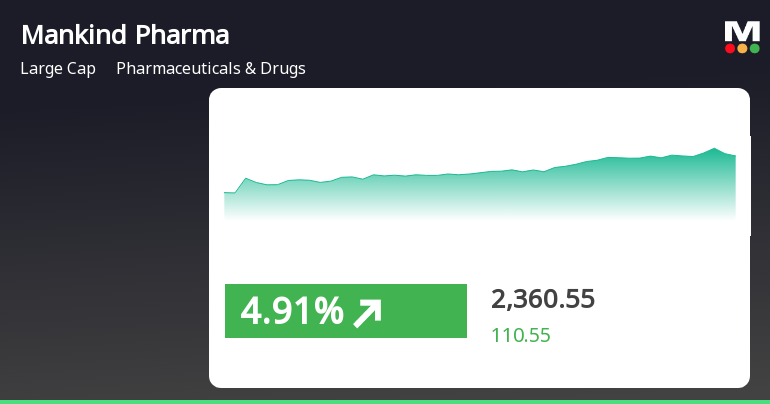

Mankind Pharma Shows Positive Short-Term Gains Amid Broader Market Rally

2025-03-20 14:50:28Mankind Pharma has experienced significant activity, gaining 3.76% on March 20, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, while its current price is above the 5-day moving average but below longer-term averages. The broader market, represented by the Sensex, has also risen.

Read More

Mankind Pharma Faces Market Sentiment Shift Amid Declining Financial Performance

2025-03-20 08:11:44Mankind Pharma has experienced a recent evaluation adjustment reflecting a shift in its technical outlook, influenced by bearish indicators. The company reported a decline in financial performance for Q3 FY24-25, ending a six-quarter streak of negative results, while maintaining strong management efficiency and a favorable debt-to-equity ratio.

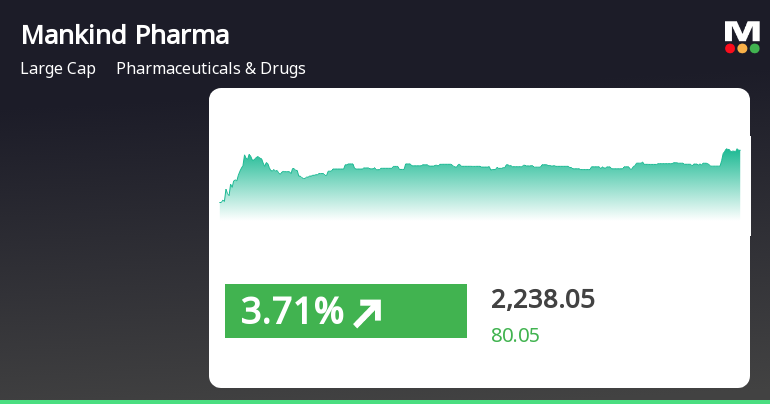

Read MoreMankind Pharma Faces Bearish Technical Trends Amidst Mixed Market Performance

2025-03-20 08:04:18Mankind Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2158.00, showing a slight increase from the previous close of 2146.45. Over the past year, Mankind Pharma has experienced a stock return of 2.5%, contrasting with a 4.77% return from the Sensex, indicating a mixed performance relative to the broader market. The technical summary for Mankind Pharma reveals a bearish sentiment across various indicators. The MACD and Bollinger Bands both reflect bearish trends on a weekly basis, while moving averages also indicate a bearish stance. The KST and Dow Theory metrics align with this sentiment, suggesting a cautious outlook in the short term. In terms of stock performance, Mankind Pharma has faced challenges, particularly in the year-to-date period, where it has recorded a ...

Read MoreMankind Pharma Faces Mixed Stock Performance Amid Premium Valuation Concerns

2025-03-19 18:00:46Mankind Pharma, a prominent player in the Pharmaceuticals & Drugs industry, has shown notable activity in the stock market today. With a market capitalization of Rs 88,787.00 crore, the company operates within the large-cap segment. Currently, Mankind Pharma's price-to-earnings (P/E) ratio stands at 43.61, significantly higher than the industry average of 36.61, indicating a premium valuation relative to its peers. In terms of performance, Mankind Pharma has experienced a mixed trajectory over various time frames. Over the past year, the stock has gained 2.50%, while the benchmark Sensex has risen by 4.77%. However, the stock has faced challenges in the short term, with a decline of 8.70% over the past month and a substantial drop of 25.31% over the last three months. Year-to-date, Mankind Pharma has seen a decrease of 24.99%, contrasting with the Sensex's decline of only 3.44%. Technical indicators sugge...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018

Announcement under Regulation 30 (LODR)-Amendments to Memorandum & Articles of Association

29-Mar-2025 | Source : BSEIncrease in Authorized Share Capital of the Company pursuant to effect of the Scheme of arrangement of amalgamation amongst Shree Jee Laboratory Private Limited JPR Labs Private Limited and Jaspack Industries Private Limited with Mankind Pharma Limited

Effective Date Of The Scheme Of Arrangement For Amalgamation Amongst Shree Jee Laboratory Private Limited JPR Labs Private Limited And Jaspack Industries Private Limited With Mankind Pharma Limited

29-Mar-2025 | Source : BSEEffective date of the Scheme of Arrangement for Amalgamation amongst Shree Jee Laboratory Private Limited JPR Labs Private Limited and Jaspack Industries Private Limited with Mankind Pharma Limited

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available