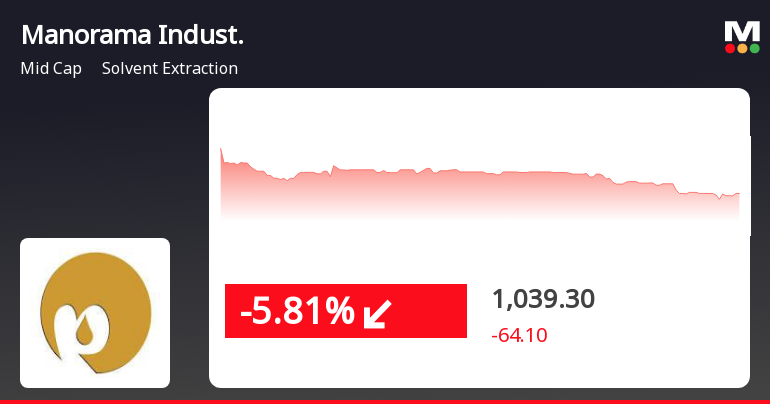

Manorama Industries Faces Short-Term Decline Amid Strong Long-Term Performance Trends

2025-03-25 11:45:40Manorama Industries, a midcap in the solvent extraction sector, saw a decline today while the broader market also faced challenges. Despite this, the company has shown significant long-term growth, with a 198.20% increase over the past year and impressive gains over three and five years.

Read More

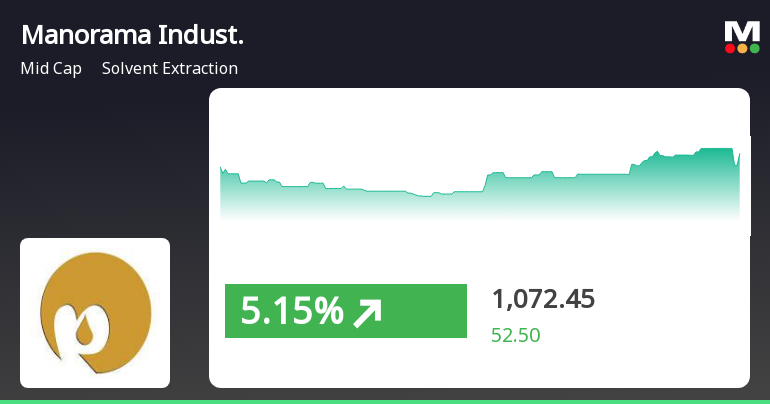

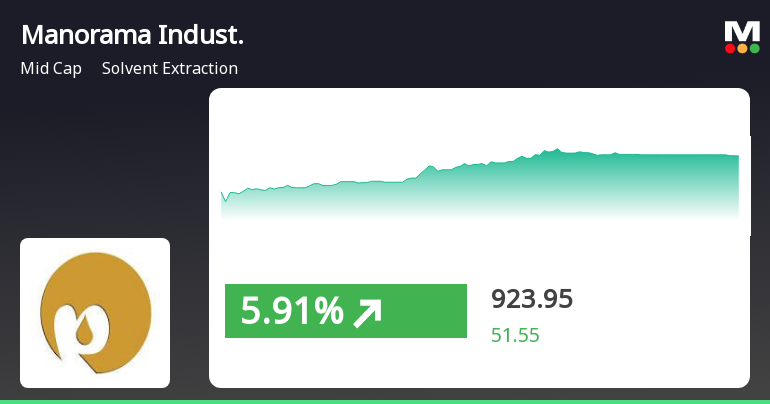

Manorama Industries Demonstrates Strong Market Resilience Amid Broader Midcap Gains

2025-03-24 12:35:25Manorama Industries has demonstrated strong performance, gaining 5.69% on March 24, 2025, and outperforming its sector. The stock trades above key moving averages, indicating a robust trend. Over the past year, it has delivered a remarkable 210.01% return, highlighting its resilience in the solvent extraction industry.

Read More

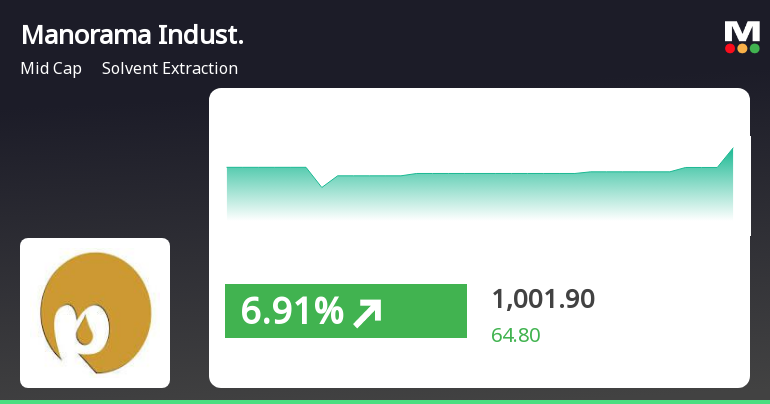

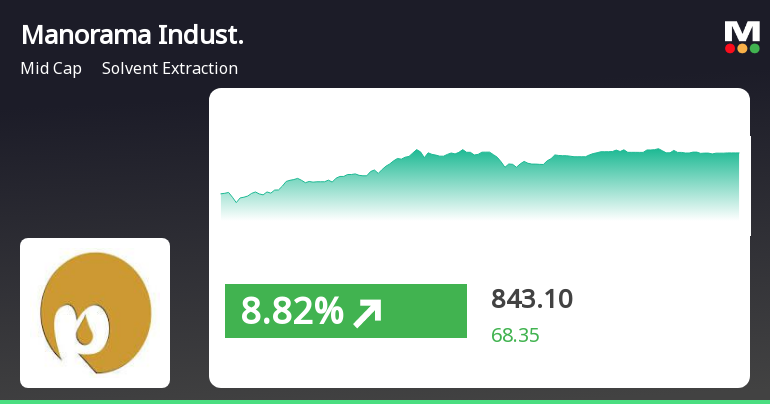

Manorama Industries Shows Strong Resilience Amidst Broader Market Fluctuations

2025-03-12 09:35:22Manorama Industries, a midcap player in the solvent extraction sector, has demonstrated strong performance, gaining 6.3% on March 12, 2025. The stock has shown impressive growth over the past year and significantly outperformed its sector, reflecting its robust position amid a generally bearish market.

Read More

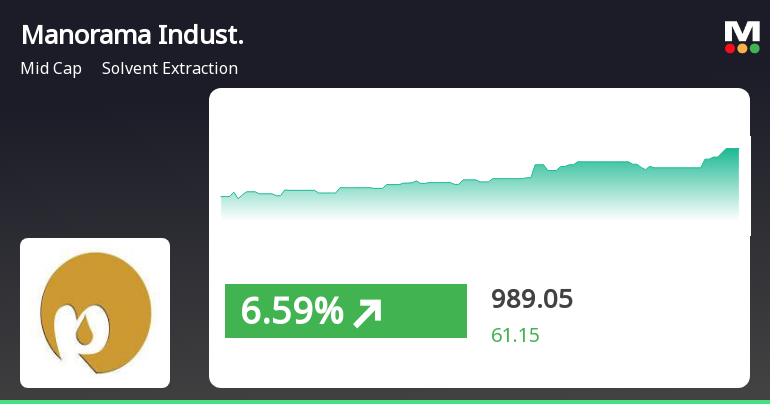

Manorama Industries Achieves Significant Stock Surge Amidst Market Fluctuations

2025-03-07 11:16:03Manorama Industries has demonstrated strong performance, gaining 6.02% on March 7, 2025, and outperforming its sector. The stock has risen 24.6% over the past four days and has shown resilience with a 147.70% increase over the past year, significantly surpassing the Sensex's growth.

Read More

Manorama Industries Shows Strong Performance Amid Market Volatility and Sector Outperformance

2025-03-05 10:35:23Manorama Industries, a midcap player in the solvent extraction sector, has experienced notable stock activity, outperforming its sector amid market volatility. The stock has shown impressive long-term growth, with significant returns over the past year and five years, while also demonstrating mixed momentum in moving averages.

Read More

Manorama Industries Shows Strong Rebound Amid Broader Market Challenges

2025-03-04 10:26:11Manorama Industries, a small-cap company in the solvent extraction sector, experienced a notable rebound today, reversing a three-day decline. The stock outperformed its sector and showed significant intraday volatility. Despite this positive movement, it remains below key moving averages, while the broader market faces challenges.

Read MoreManorama Industries Experiences Valuation Grade Change Amidst Strong Long-Term Performance

2025-03-04 08:00:13Manorama Industries, a small-cap player in the solvent extraction industry, has recently undergone a valuation adjustment. The company's current price stands at 774.75, reflecting a notable decline from its previous close of 936.80. Over the past year, Manorama has demonstrated a strong return of 86.86%, significantly outperforming the Sensex, which recorded a slight decline of 0.98% during the same period. Key financial metrics for Manorama Industries include a PE ratio of 56.12 and an EV to EBITDA ratio of 33.05, indicating a premium valuation compared to its peers. In contrast, CIAN Agro, a competitor in the same sector, has a PE ratio of 27.15 and an EV to EBITDA of 23.86, showcasing a more attractive valuation profile. Despite recent price fluctuations, Manorama's return over three years has been impressive at 213.93%, compared to the Sensex's 32.64%. This performance highlights the company's resilie...

Read More

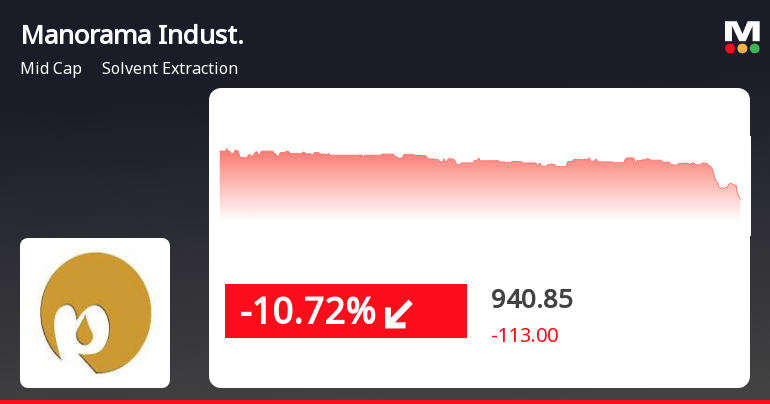

Manorama Industries Faces Stock Volatility Amid Broader Sector Resilience

2025-03-03 09:35:27Manorama Industries, a midcap player in the solvent extraction sector, has faced notable stock volatility, declining significantly over recent days. Currently trading below key moving averages, the company has underperformed its sector amid broader market fluctuations, prompting interest from investors and market observers regarding its future performance.

Read More

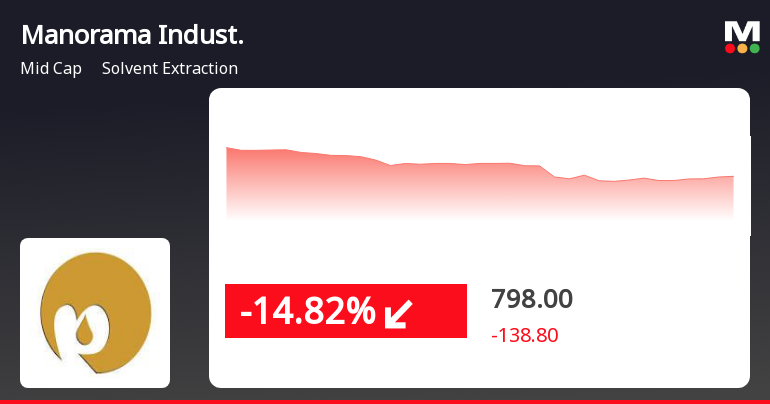

Manorama Industries Faces Continued Decline Amid Challenging Solvent Extraction Sector Conditions

2025-02-28 15:20:25Manorama Industries, a midcap in the solvent extraction sector, has seen its shares decline significantly over the past two days, contributing to an overall drop of 11.8%. The stock is currently positioned above its 200-day moving average but below several shorter-term averages, indicating mixed momentum.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulation 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Intimation Of Incorporation Of Wholly Owned Subsidiary Company Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015.

26-Mar-2025 | Source : BSEIntimation of Incorporation of wholly Owned Subsidiary Company in Brazil with the name of MANORAMA LATIN AMERICA LTDA.

Corporate Actions

No Upcoming Board Meetings

Manorama Industries Ltd has declared 20% dividend, ex-date: 27 Aug 24

Manorama Industries Ltd has announced 2:10 stock split, ex-date: 07 Mar 24

No Bonus history available

No Rights history available