Marksans Pharma Outperforms Sector Amid High Volatility and Mixed Long-Term Trends

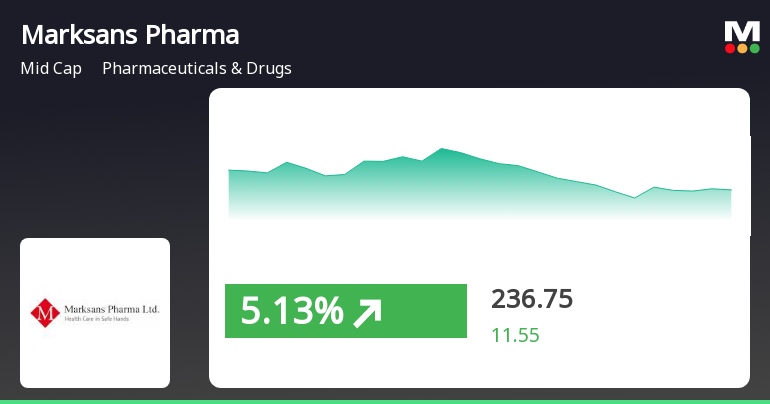

2025-04-03 09:30:33Marksans Pharma has experienced notable activity, with a significant stock increase on April 3, 2025, outperforming the pharmaceuticals sector. The stock reached an intraday high and has shown a positive trend over the past two days, despite high volatility and mixed longer-term performance metrics.

Read MoreMarksans Pharma Shows Mixed Technical Trends Amid Strong Long-Term Performance

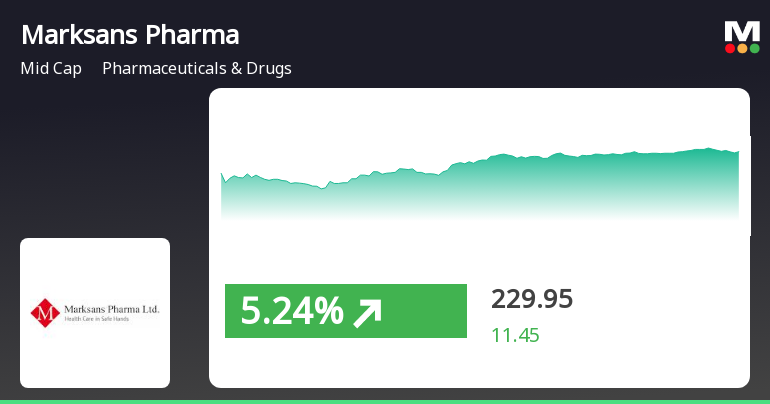

2025-04-03 08:03:30Marksans Pharma, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 225.20, showing a slight increase from the previous close of 220.30. Over the past year, Marksans Pharma has demonstrated a notable return of 39.79%, significantly outperforming the Sensex, which recorded a return of 3.67% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments, indicating a neutral momentum. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Daily moving averages indicate a bearish sentiment, while the On-Balance Volume (OBV) reflects a mildly bullish stance on a weekly ba...

Read MoreMarksans Pharma Faces Technical Trend Shifts Amid Market Evaluation Adjustments

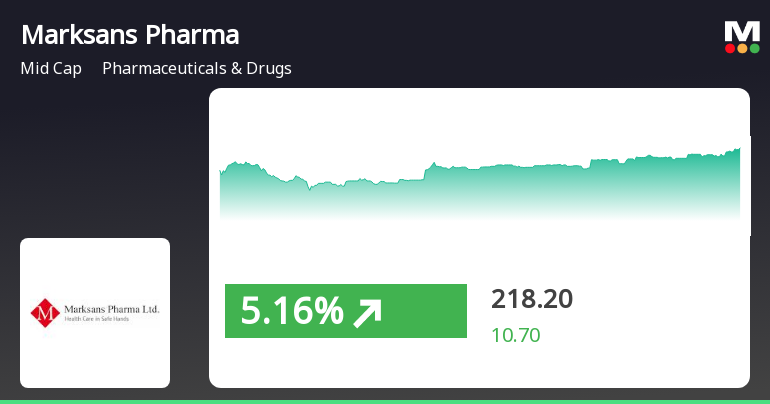

2025-04-02 08:05:24Marksans Pharma, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 220.30, slightly down from the previous close of 222.00. Over the past year, Marksans Pharma has shown a notable return of 39.52%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD and KST are both indicating bearish trends, while the monthly readings show a mildly bearish stance. The Bollinger Bands present a mixed picture, with weekly indicators suggesting bearish conditions and monthly indicators leaning towards a mildly bullish outlook. The daily moving averages also reflect bearish sentiment. Looking at the company's performance over various time frames, Marksans Pharma has demonstrated resilience, particularly over the l...

Read MoreMarksans Pharma Shows Mixed Technical Trends Amid Strong Long-Term Performance

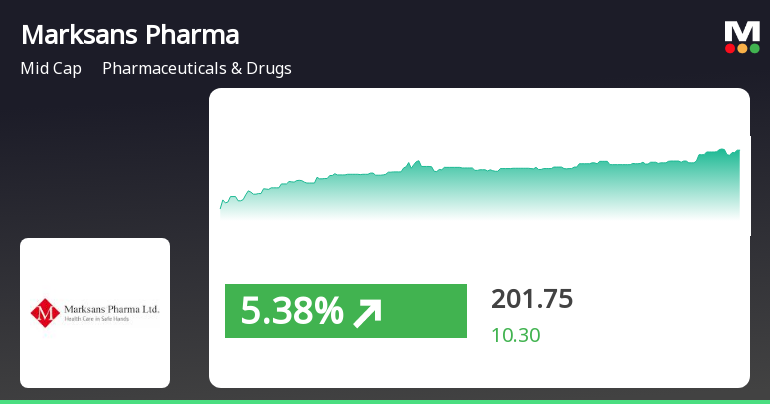

2025-03-26 08:02:35Marksans Pharma, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 225.75, slightly down from the previous close of 228.30. Over the past year, Marksans Pharma has shown a notable return of 55.15%, significantly outperforming the Sensex, which recorded a return of 7.12% during the same period. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish signal on a monthly basis. Additionally, the KST and moving averages reflect bearish tendencies, although the Dow Theory suggests a mildly bullish trend on a weekly basis. Marksans Pharma's perfo...

Read More

Marksans Pharma Shows Strong Intraday Performance Amid Broader Market Gains

2025-03-24 11:05:24Marksans Pharma experienced notable activity on March 24, 2025, outperforming its sector and reaching an intraday high. The broader market, represented by the Sensex, continued its upward trend, with small-cap stocks leading the gains. Marksans Pharma's performance has been mixed over various time frames, showing strong long-term growth.

Read MoreMarksans Pharma Adjusts Valuation Grade Amid Competitive Pharmaceuticals Landscape

2025-03-21 08:00:24Marksans Pharma, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company’s price-to-earnings ratio stands at 26.92, while its price-to-book value is noted at 4.35. Additionally, Marksans Pharma reports an EV to EBIT of 21.92 and an EV to EBITDA of 18.42, indicating its operational efficiency relative to its enterprise value. The company has demonstrated a return on capital employed (ROCE) of 23.44% and a return on equity (ROE) of 15.21%, showcasing its ability to generate profits from its investments. Despite a modest dividend yield of 0.27%, these metrics position Marksans Pharma competitively within its industry. In comparison to its peers, Marksans Pharma's valuation metrics reveal a diverse landscape. For instance, while Pfizer and Concord Biotech are categorized similarly in terms o...

Read More

Marksans Pharma Experiences Notable Gains Amid Broader Market Uptrend

2025-03-20 14:15:23Marksans Pharma has experienced notable gains, marking its third consecutive day of increases. The stock has outperformed its sector and reached an intraday high. While it shows strong long-term growth, its year-to-date performance indicates a decline. The broader market also saw positive movement today.

Read More

Marksans Pharma Shows Signs of Trend Reversal Amid Broader Market Dynamics

2025-03-18 12:35:23Marksans Pharma experienced a notable increase in stock price on March 18, 2025, following a series of declines, suggesting a potential trend reversal. While the stock is above its 5-day moving average, it remains below longer-term averages, indicating mixed signals. The broader market, represented by the Sensex, continues to rise despite some bearish indicators.

Read More

Marksans Pharma Reports Strong Quarterly Results Amid Long-Term Growth Concerns

2025-03-12 08:05:38Marksans Pharma has recently experienced an evaluation adjustment, reflecting its financial performance for Q3 FY24-25, with net sales of Rs 681.85 crore and PBDIT of Rs 138.77 crore. Despite positive results, long-term growth appears limited, and the company maintains a strong financial position with low debt and increased institutional holdings.

Read MoreAnnouncement under Regulation 30 (LODR)-Cessation

31-Mar-2025 | Source : BSEPursuant to Reg 30 of SEBI (LODR) Reg 2015 Mr. SR Buddharaju - Independent Director has ceased to be an Independent Director of the Company upon completion of his tenure of two terms of 5 consecutive years w.e.f end of the day on March 31 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEKindly find enclosed intimation for closure of trading window under SEBI (Prohibition of Insider Trading) Regulations 2015

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Mar-2025 | Source : BSEThis is to inform that official of the Company will participate in the investor/analyst conference i.e. Motilal Oswal India Ideation conference on 25 March 2025 at 10:00 am at Grand Hyatt Mumbai.

Corporate Actions

No Upcoming Board Meetings

Marksans Pharma Ltd has declared 60% dividend, ex-date: 17 Sep 24

Marksans Pharma Ltd has announced 1:10 stock split, ex-date: 11 Mar 08

No Bonus history available

No Rights history available