MAS Financial Services Reports Strong Profit Growth Amidst Stock Performance Divergence

2025-03-18 08:19:50MAS Financial Services has recently adjusted its evaluation, reflecting a nuanced perspective on its financial health in the finance/NBFC sector. The company reported a 24.81% growth in net profit for Q3 FY24-25, achieving record net sales and demonstrating strong operational efficiency over 14 consecutive quarters.

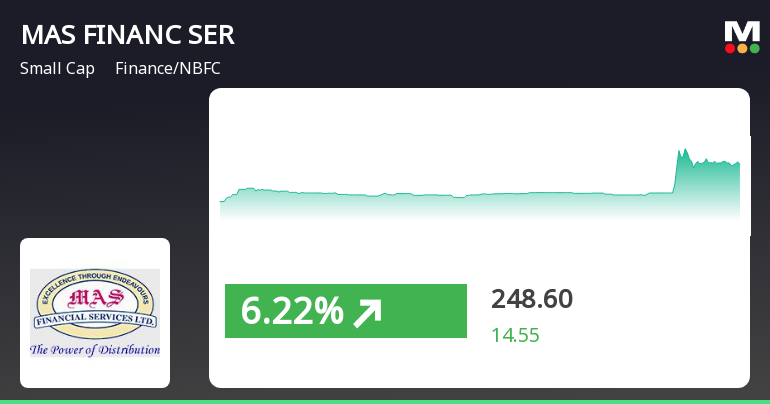

Read MoreMAS Financial Services Shows Mixed Technical Trends Amidst Market Resilience

2025-03-18 08:04:00MAS Financial Services, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 245.95, showing a slight increase from the previous close of 241.00. Over the past week, MAS Financial Services has demonstrated a stock return of 2.05%, significantly outperforming the Sensex, which returned just 0.07%. In terms of technical indicators, the company presents a mixed picture. The MACD shows a mildly bullish trend on a weekly basis, while the monthly outlook remains bearish. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish monthly. Bollinger Bands and KST both reflect mildly bearish trends, suggesting some caution in the market. When examining the company's performance over various time frames, it has faced challenges, particularl...

Read MoreTechnical Indicators Signal Caution for MAS Financial Services Amid Market Dynamics

2025-03-11 08:04:56MAS Financial Services, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 241.00, down from a previous close of 252.50, with a 52-week high of 331.00 and a low of 221.50. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly MACD remains bearish as well. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. The Bollinger Bands and moving averages also reflect bearish tendencies, suggesting a cautious outlook. When comparing the stock's performance to the Sensex, MAS Financial Services has shown varied returns. Over the past week, the stock returned 4.78%, outperforming the Sensex's 1.41%. However, on a year-to-date basis, the stock has declined b...

Read MoreMAS Financial Services Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-07 08:03:41MAS Financial Services, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 255.00, showing a notable increase from the previous close of 249.10. Over the past year, MAS Financial Services has experienced a decline of 14.16%, contrasting with a slight gain of 0.34% in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents no signal weekly but indicates a bullish stance monthly. Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious market environment. Despite the recent challenges, MAS Financial Services has demonstrated resilience, particularly over a three-year ho...

Read More

MAS Financial Services Experiences Significant Short-Term Gains Amid Broader Market Rally

2025-03-05 13:05:23MAS Financial Services has experienced significant activity, achieving consecutive gains over two days and reaching an intraday high. The stock has shown high volatility and is currently above its short-term moving averages. In the broader market, the Sensex has risen sharply, with mid-cap stocks leading the gains.

Read More

MAS Financial Services Hits 52-Week Low Amid Broader Market Decline and Resilience Indicators

2025-03-04 10:33:18MAS Financial Services reached a new 52-week low today but showed resilience by outperforming its sector. The stock recorded an intraday high of Rs. 235.55 and has demonstrated strong long-term fundamentals, including a return on equity of 12.92% and significant net profit growth.

Read MoreMAS Financial Services Adjusts Quality Grade Amidst Strong Sales Growth and Leverage Concerns

2025-03-04 08:00:03MAS Financial Services has recently undergone an evaluation revision, reflecting its current standing within the finance and non-banking financial company (NBFC) sector. The company has demonstrated notable sales growth over the past five years, reported at 16.77%, alongside EBIT growth of 16.41%. These metrics indicate a solid operational performance, although the company's net debt to equity ratio averages at 3.45, which may raise concerns regarding leverage. Institutional holdings in MAS Financial Services stand at 23.03%, suggesting a moderate level of institutional interest. The average return on equity (ROE) is recorded at 12.92%, which is a critical indicator of profitability relative to shareholder equity. When compared to its peers, MAS Financial Services holds a competitive position, with several companies in the sector exhibiting below-average performance metrics. For instance, Indus Inf. Trust...

Read More

MAS Financial Services Reports Strong Quarterly Performance Amidst Stock Challenges and Market Trends

2025-03-03 18:56:09MAS Financial Services has recently experienced a change in its evaluation, influenced by its financial metrics and market conditions. The company reported strong quarterly results for Q3 FY24-25, with record net sales and profit figures, despite facing challenges in stock performance and a bearish technical outlook.

Read More

MAS Financial Services Hits New Low Amid Ongoing Downward Trend and Sector Underperformance

2025-03-03 14:21:10MAS Financial Services has reached a new 52-week low, continuing a downward trend with a notable decline over the past year. Despite an initial gain, the stock faced selling pressure, underperforming its sector and trading below key moving averages, indicating a bearish outlook.

Read MoreShareholder Meeting / Postal Ballot-Scrutinizers Report

07-Apr-2025 | Source : BSEScrutinizers Report for Postal Ballot

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

07-Apr-2025 | Source : BSEOutcome of Postal Ballot

Closure of Trading Window

29-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

MAS Financial Services Ltd has declared 10% dividend, ex-date: 05 Feb 25

No Splits history available

MAS Financial Services Ltd has announced 2:1 bonus issue, ex-date: 22 Feb 24

No Rights history available