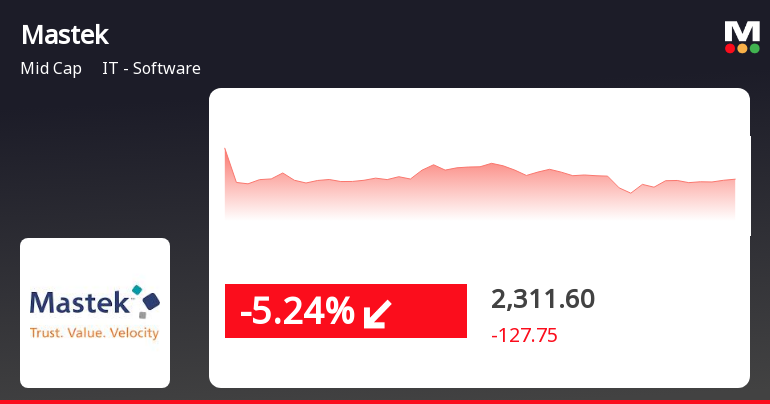

Mastek Faces Significant Decline Amid Broader Market Stability and Long-Term Growth Trends

2025-03-19 09:35:23Mastek, an IT software midcap, saw a decline of 5.17% on March 19, 2025, underperforming against the Sensex. Over the past three months, the stock has dropped 28.35%, and year-to-date, it is down 21.85%. However, Mastek has experienced substantial growth of 1,053.56% over the last five years.

Read MoreMastek Ltd Shows Strong Recovery Amid Increased Trading Activity and Investor Interest

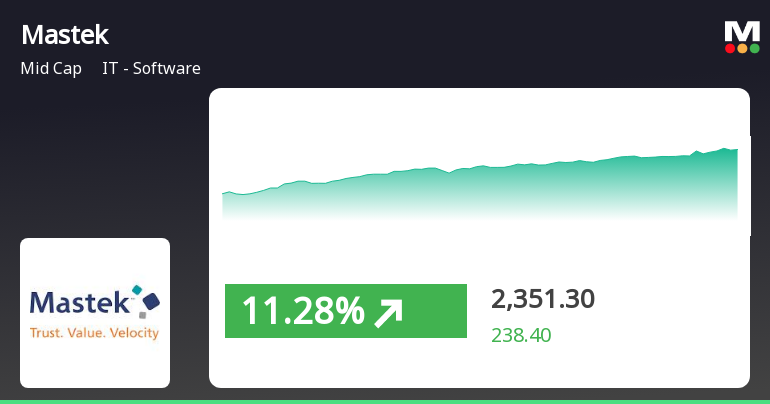

2025-03-18 12:00:04Mastek Ltd, a mid-cap player in the IT software industry, has emerged as one of the most active equities today, with a total traded volume of 1,942,192 shares and a total traded value of approximately Rs 4,558.50 million. The stock opened at Rs 2,120.05 and reached an intraday high of Rs 2,418.05, reflecting a significant gain of 14.43% during the trading session. After experiencing five consecutive days of decline, Mastek has shown a trend reversal, outperforming its sector by 12.53%. The stock's performance today is notable, with a 1D return of 13.78%, compared to a sector return of 1.14% and a Sensex return of 1.16%. The stock has traded within a wide range of Rs 301.80, indicating volatility. Additionally, the weighted average price suggests that more volume was traded closer to the lower price point. Mastek's delivery volume on March 17 increased by 10.97% against the five-day average, indicating r...

Read More

Mastek Shows Signs of Recovery Amid Broader Market Fluctuations

2025-03-18 09:45:27Mastek, a midcap IT software company, experienced a notable uptick on March 18, 2025, following a five-day decline. The stock opened higher and reached an intraday peak, outperforming its sector. Despite this recovery, it remains below key moving averages, reflecting ongoing market challenges.

Read More

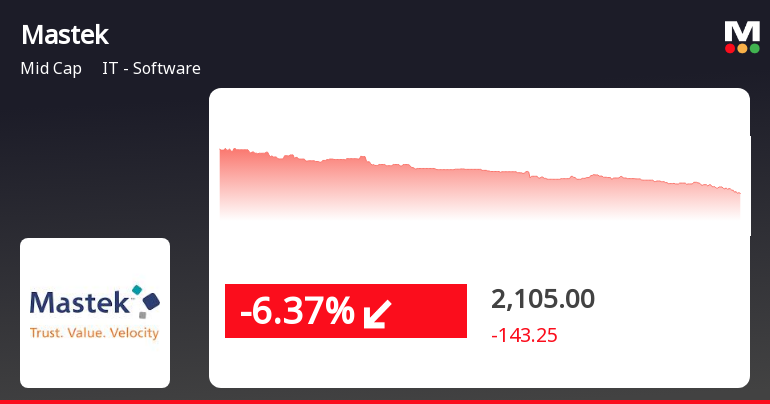

Mastek Faces Continued Decline Amid Broader Market Gains and High Volatility

2025-03-17 15:20:22Mastek, a midcap IT software company, has faced a notable decline, trading close to its 52-week low. The stock has dropped significantly over the past week and is currently below key moving averages, highlighting a bearish trend. This performance contrasts sharply with the broader market's upward movement.

Read MoreMastek Faces Mixed Technical Indicators Amidst Market Volatility and Performance Challenges

2025-03-11 08:03:47Mastek, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2398.30, slightly down from its previous close of 2410.00. Over the past year, Mastek has experienced a notable decline of 15.48%, contrasting with a negligible change in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on a weekly basis. The moving averages also reflect a bearish trend, while the On-Balance Volume shows a bullish stance on a monthly scale. This mixed technical landscape suggests a complex market environment for Mastek. In terms of performance, Mastek's stock return over the past week stands at an impressive 11.08%, significantly outperforming the Sensex, which returned only 1.41%. However, the longer-term view reveals ch...

Read MoreMastek's Technical Indicators Signal Mixed Trends Amidst Market Fluctuations

2025-03-10 08:01:32Mastek, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2410.00, showing a slight increase from the previous close of 2383.80. Over the past year, Mastek has experienced a 15.07% decline, contrasting with a modest gain of 0.29% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and KST also reflect a mildly bearish trend on a monthly basis, while the On-Balance Volume (OBV) suggests bullish sentiment in both weekly and monthly assessments. In terms of returns, Mastek has outperformed the Sensex over the past w...

Read More

Mastek Hits 52-Week Low Amidst Mixed Signals in IT Sector Performance

2025-03-04 10:23:30Mastek, an IT software midcap, reached a new 52-week low today after two days of losses but later showed signs of recovery. Despite a significant one-year decline, the company maintains strong financial metrics, including a high Return on Capital Employed and low debt, though it trades below key moving averages.

Read More

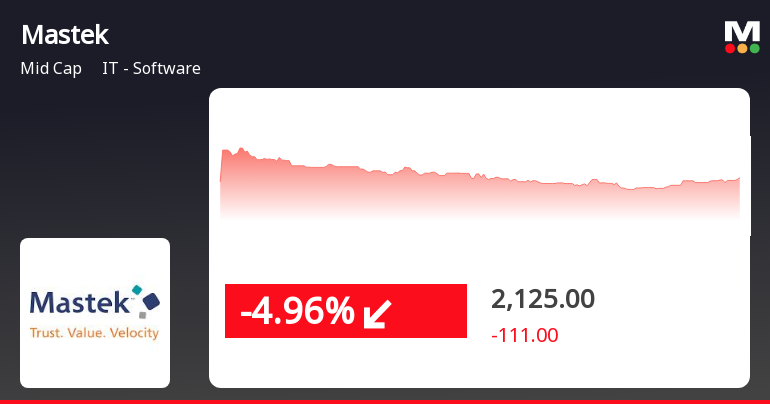

Mastek Faces Significant Volatility Amid Broader Market Pressures and Declining Performance

2025-03-03 11:05:25Mastek, a midcap IT software company, faced notable volatility today, with shares hitting a new 52-week low. The stock has declined consecutively over two days, underperforming the sector and trading below key moving averages, reflecting broader market challenges and a significant drop over the past month.

Read MoreMastek Faces Increased Scrutiny Amid Significant Stock Volatility and Decline

2025-03-03 10:00:11Mastek, a midcap player in the IT software industry, has experienced significant volatility today, opening with a loss of 5.45%. The stock reached a new 52-week low of Rs. 2114.05, reflecting a challenging trading environment. Over the past two days, Mastek has seen a cumulative decline of 9.23%, indicating a consecutive fall that has raised concerns among market observers. In terms of performance metrics, Mastek underperformed its sector by 4.46% today, with a one-day performance decline of 3.52%, compared to the Sensex's modest drop of 0.32%. Over the past month, Mastek's performance has been particularly weak, with a decrease of 16.26%, while the Sensex has fallen by 5.47% during the same period. Additionally, Mastek is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, which may indicate a bearish trend in the stock's performance. As the market continues to react ...

Read MoreUpdate on board meeting

09-Apr-2025 | Source : BSEMastek Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 18/04/2025 inter alia to consider and approve Intimation of Board Meeting to consider recommending a Final Dividend for the financial year ended March 31 2025

Board Meeting Intimation for Board Meeting For Approval Of Audited Financial Results For The Financial Year Ended March 31 2025

07-Apr-2025 | Source : BSEMastek Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 18/04/2025 inter alia to consider and approve Board Meeting for Approval of Audited Financial Results for the financial year ended March 31 2025

Announcement under Regulation 30 (LODR)-Press Release / Media Release

04-Apr-2025 | Source : BSEPress Release titled Mastek continues its commitment to Sustainability and Social Impact through Philanthropy and CSR Initiatives

Corporate Actions

No Upcoming Board Meetings

Mastek Ltd has declared 140% dividend, ex-date: 24 Jan 25

No Splits history available

Mastek Ltd has announced 1:1 bonus issue, ex-date: 27 Mar 06

No Rights history available