Master Trust Stock Surges Amid Small-Cap Sector Resilience and Market Volatility

2025-04-03 12:38:34Master Trust, a small-cap finance and NBFC company, has experienced notable trading activity, with significant intraday volatility and a two-day gain. The stock is currently above several moving averages, while the broader market shows mixed performance, particularly among small-cap stocks. Year-to-date, Master Trust's performance remains negative.

Read MoreMaster Trust Faces Technical Trend Challenges Amidst Long-Term Growth Resilience

2025-04-03 08:02:37Master Trust, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 128.15, showing a notable shift from its previous close of 121.60. Over the past year, Master Trust has experienced a decline of 11.49%, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in the broader market context. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on both timeframes, and moving averages also reflect a mildly bearish stance. The KST aligns with the bearish sentiment on a weekly basis, while both weekly and monthly Dow Theory assessments indicate no clear tre...

Read More

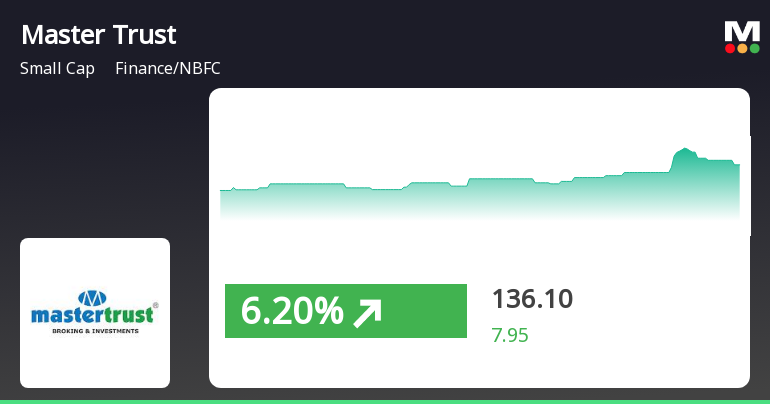

Master Trust Experiences Significant Trading Activity Amid Broader Market Gains

2025-04-02 11:45:20Master Trust, a small-cap finance and NBFC company, experienced notable trading activity on April 2, 2025, with significant intraday volatility. The stock's price is currently above several short-term moving averages, while the broader market, including the Sensex and BSE Mid Cap index, also showed positive trends.

Read MoreMaster Trust Faces Bearish Technical Trends Amidst Volatile Market Conditions

2025-04-02 08:04:08Master Trust, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 121.60, down from a previous close of 125.40, with a notable 52-week range between 103.95 and 207.00. Today's trading saw a high of 128.85 and a low of 121.60. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. The KST aligns with this sentiment, indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. In terms of performance, Master Trust's stock return has shown significant volatility. Over the past year, the stock has declined by 16.58...

Read More

Master Trust Adjusts Evaluation Amid Strong Financial Fundamentals and Market Challenges

2025-03-28 08:04:29Master Trust, a small-cap finance company, has recently adjusted its evaluation, reflecting changes in financial metrics and market position. The revision indicates a shift in sentiment, supported by technical indicators. Despite strong fundamentals and attractive valuation metrics, the company has struggled to outperform broader market indices over the past year.

Read More

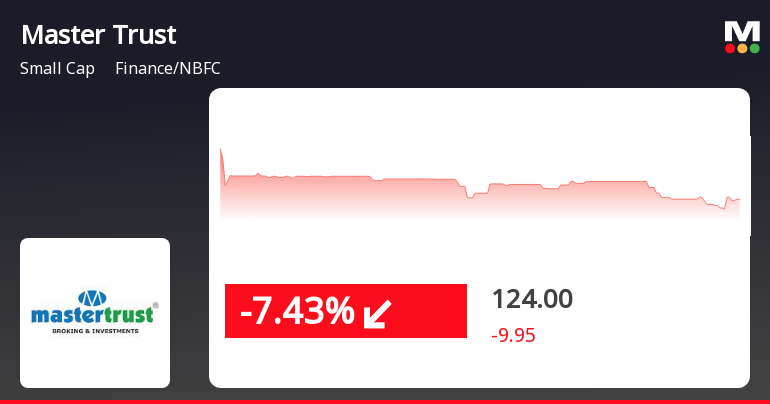

Master Trust Faces Significant Decline Amid Broader Market Resilience and Mixed Signals

2025-03-27 12:15:21Master Trust, a small-cap finance and NBFC company, saw a notable decline of 7.2% on March 27, 2025, following two days of gains. The stock is currently trading above its short-term moving averages but below longer-term ones, indicating mixed performance signals amid broader market resilience.

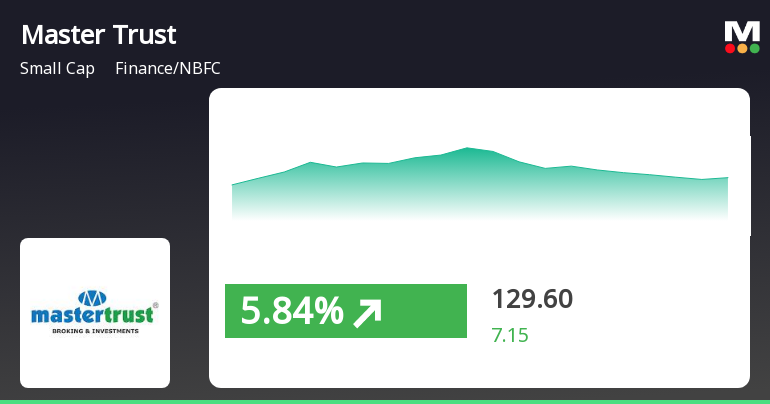

Read MoreMaster Trust Experiences Technical Trend Shifts Amidst Market Volatility and Growth Potential

2025-03-27 08:01:22Master Trust, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 133.95, showing a notable increase from the previous close of 122.45. Over the past week, Master Trust has experienced a significant return of 22.05%, outperforming the Sensex, which returned 2.44% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment on a daily basis. Looking at the company's performance over various time frames, Master Trust has shown remark...

Read MoreMaster Trust Adjusts Valuation Grade Amid Strong Performance and Competitive Metrics

2025-03-27 08:00:19Master Trust, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 133.95, reflecting a notable increase from the previous close of 122.45. Over the past week, Master Trust has demonstrated a strong performance with a stock return of 22.05%, significantly outpacing the Sensex's return of 2.44%. Key financial metrics for Master Trust include a price-to-earnings (PE) ratio of 10.40 and an EV to EBITDA ratio of 0.63, indicating a competitive position within its industry. The company's return on equity (ROE) is reported at 22.97%, showcasing its efficiency in generating profits from shareholders' equity. However, it is important to note that the company has negative capital employed, which may raise questions about its financial structure. In comparison to its peers, Master Trust's valuation metr...

Read More

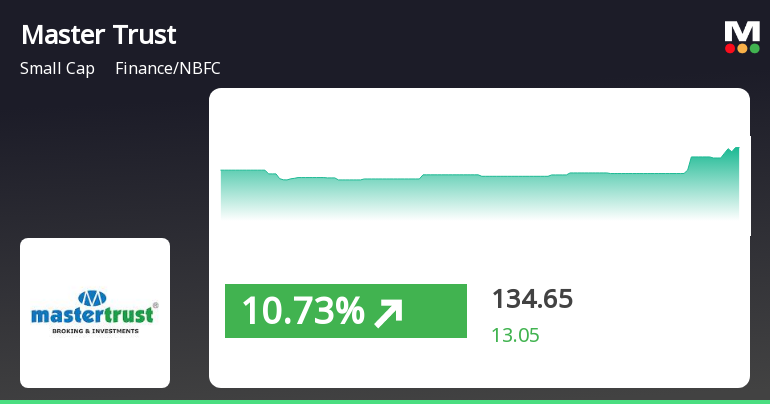

Master Trust Experiences Notable Stock Surge Amid High Market Volatility

2025-03-26 09:30:20Master Trust, a small-cap finance and NBFC player, experienced notable trading activity, gaining 7.51% on March 26, 2025. The stock showed high volatility and is currently above several short-term moving averages. Despite recent modest gains, its long-term performance over three, five, and ten years remains impressive.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31.03.2025.

Declaration Under Regulation 31(4) Of The SEBI(SAST) Regulations 2011

04-Apr-2025 | Source : BSEAnnual Declaration under Regulation 31(4) of the SEBI(SAST) Regulations 2011 from the Promoters of the company for the financial year ended 31.03.2025.

Closure of Trading Window

26-Mar-2025 | Source : BSETrading Window will be closed for all designated persons including Promoters Directors connected persons the insiders and their immediate relatives from the end of the quarter i.e. start of business hours on April 1 2025 till the end of 48 hours after the publication of Audited Financial Results for the quarter and financial year ended 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Master Trust Ltd has declared 10% dividend, ex-date: 21 Sep 18

Master Trust Ltd has announced 1:5 stock split, ex-date: 30 Oct 24

No Bonus history available

No Rights history available