Max Heights Infrastructure Faces Severe Decline Amid High Debt and Low Profitability Concerns

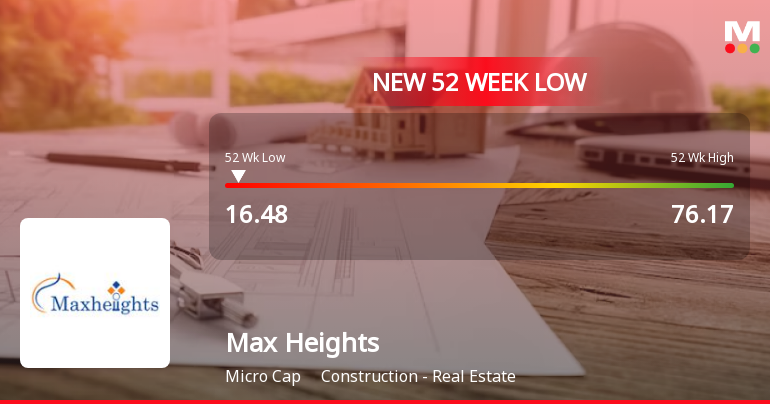

2025-04-03 09:35:40Max Heights Infrastructure has faced notable volatility, reaching a new 52-week low and experiencing a significant decline over the past year. The company struggles with high debt levels and low profitability, as indicated by its debt-to-equity ratio and return on equity, alongside a concerning trend in operating profit.

Read More

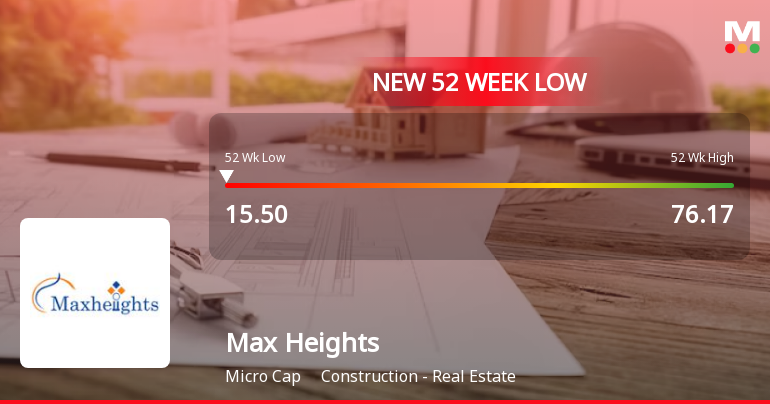

Max Heights Infrastructure Faces Continued Decline Amidst Broader Market Volatility

2025-03-28 10:05:30Max Heights Infrastructure, a microcap in construction and real estate, has hit a new 52-week low, continuing a downward trend with significant losses over the past year. The company struggles with high debt and low profitability, despite a recent profit increase, indicating ongoing challenges in its financial outlook.

Read MoreMax Heights Infrastructure Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-27 13:30:03Max Heights Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has recorded consecutive losses over the past two days, with a total decline of 9.36%. Today, the stock fell by 4.99%, underperforming the Sensex, which gained 0.45%. In the past week, Max Heights has seen a decline of 11.23%, while the Sensex rose by 1.69%. Over the past month, the stock has plummeted by 20.08%, contrasting sharply with the Sensex's increase of 4.05%. Year-to-date, Max Heights has dropped 46.36%, compared to the Sensex's slight decline of 0.64%. The stock has reached a new 52-week low of Rs. 16.26 today and is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. The ongoing selling pressure may be attributed to broader market trends and specific challenges within the construction and real estate sector, impacting investor sent...

Read More

Max Heights Infrastructure Hits 52-Week Low Amid Ongoing Financial Struggles

2025-03-27 12:05:28Max Heights Infrastructure has reached a new 52-week low, reflecting a significant decline in stock performance. The company has underperformed its sector and is trading below key moving averages. Financial challenges include a high debt-to-equity ratio and low profitability, despite a recent profit increase.

Read MoreMax Heights Infrastructure Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-26 12:30:04Max Heights Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive days of losses, with a notable decline of 4.96% in just one day, starkly contrasting with the Sensex's minor drop of 0.42%. Over the past week, Max Heights has lost 2.12%, while the Sensex gained 2.97%. The stock's performance over the past month reveals a steep decline of 17.55%, compared to a 4.14% increase in the Sensex. This trend continues over longer periods, with a staggering 71.96% drop over the past year, while the Sensex has risen by 7.20%. Year-to-date, Max Heights is down 43.54%, against a slight decline of 0.57% for the Sensex. Several factors may be contributing to this selling pressure, including broader market trends and company-specific challenges. The stock's price summary indicates it is currently above its 5-day moving aver...

Read More

Max Heights Infrastructure Faces Challenges Amid Broader Market Gains and Weak Fundamentals

2025-03-25 14:35:13Max Heights Infrastructure, a microcap in construction and real estate, reached a new 52-week low today, despite outperforming its sector. The company has seen a significant annual stock decline and faces challenges with high debt and low profitability, raising concerns about its long-term fundamentals.

Read MoreMax Heights Infrastructure Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-21 15:30:03Max Heights Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive days of losses, with a notable decline of 4.99% in just one day. Over the past week, the stock has dropped 8.45%, and its performance over the last month reveals a staggering 17.82% decrease. In comparison to the Sensex, which has gained 0.77% today, Max Heights Infrastructure's performance has been markedly poor. Over the past year, the stock has plummeted by 71.10%, while the Sensex has risen by 5.91%. Year-to-date, the stock is down 42.58%, contrasting sharply with the Sensex's decline of only 1.54%. The stock's performance relative to the Sensex highlights a troubling trend, as it has underperformed the index across various time frames, including a 41.22% drop over the last three months. Additionally, Max Heights is trading below its 5-da...

Read More

Max Heights Infrastructure Faces Persistent Challenges Amidst Broader Market Volatility

2025-03-19 10:05:16Max Heights Infrastructure has faced notable volatility, reaching a new 52-week low and experiencing a three-day losing streak. The stock has significantly underperformed the sector, with a substantial year-over-year decline. Concerns about its financial health persist, including a high debt-to-equity ratio and decreasing operating profit.

Read MoreMax Heights Infrastructure Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-19 09:35:05Max Heights Infrastructure Ltd is currently facing significant selling pressure, with the stock showing only sellers today. This trend has resulted in consecutive days of losses, highlighting a challenging market environment for the microcap company. Over the past week, Max Heights has declined by 7.18%, while the Sensex has gained 1.84%. The disparity continues over a month, with the stock down 19.95% compared to a slight decline of 0.72% in the Sensex. In a broader context, Max Heights has experienced a staggering 71.65% drop over the past year, contrasting sharply with the Sensex's positive performance of 4.70%. Year-to-date, the stock is down 41.79%, while the Sensex has only slipped by 3.51%. The three-year performance shows a decline of 2.33%, significantly underperforming the Sensex, which has risen by 30.29%. Today, Max Heights hit a new 52-week low of Rs. 17.58 and is trading below its 5-day, 20-...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSESubmission of Compliance Certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Naveen Narang

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Mansi Narang

Corporate Actions

No Upcoming Board Meetings

No Splits history available

No Bonus history available

No Rights history available