Mayur Uniquoters Adjusts Valuation Grade Amid Competitive Footwear Market Dynamics

2025-04-03 08:00:42Mayur Uniquoters, a small-cap player in the footwear industry, has recently undergone a valuation adjustment. The company's current price stands at 484.80, slightly up from the previous close of 480.25. Over the past year, Mayur Uniquoters has experienced a stock return of 1.54%, which lags behind the Sensex's return of 3.67% during the same period. However, the company has shown resilience over a longer timeframe, with a notable 223.52% return over the past five years, outperforming the Sensex's 171.07%. Key financial metrics for Mayur Uniquoters include a PE ratio of 15.22 and an EV to EBITDA ratio of 10.89, indicating its market positioning relative to its earnings potential. The company also boasts a PEG ratio of 0.66, suggesting a favorable growth outlook compared to its valuation. Additionally, the latest return on capital employed (ROCE) stands at 19.68%, while the return on equity (ROE) is at 15.49...

Read MoreMayur Uniquoters Adjusts Valuation Grade Amid Competitive Financial Metrics in Footwear Sector

2025-03-10 08:00:41Mayur Uniquoters, a small-cap player in the footwear industry, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently has a price-to-earnings (P/E) ratio of 15.10 and a price-to-book value of 2.39. Its enterprise value to EBITDA stands at 10.80, while the enterprise value to EBIT is recorded at 12.87. Additionally, the PEG ratio is noted at 0.65, indicating a favorable growth outlook relative to its earnings. In terms of returns, Mayur Uniquoters has shown a stock return of 2.92% over the past week, outperforming the Sensex, which returned 1.55% in the same period. However, the company has faced challenges in the longer term, with a year-to-date return of -20.96%, compared to the Sensex's -4.87%. Over a three-year horizon, Mayur has delivered a return of 35.09%, although this lags behind the Sensex's 40.67% return. When compared to its pe...

Read More

Mayur Uniquoters Hits 52-Week Low Amid Broader Footwear Sector Decline

2025-03-03 10:36:35Mayur Uniquoters, a small-cap footwear company, reached a new 52-week low of Rs. 450, continuing a downward trend with a 6.92% decline over three days. Despite outperforming its sector slightly, the stock remains below key moving averages and has dropped 12.48% over the past year.

Read MoreMayur Uniquoters Adjusts Valuation Grade Amid Competitive Market Positioning

2025-03-03 08:00:09Mayur Uniquoters, a small-cap player in the footwear industry, has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position. The company's price-to-earnings ratio stands at 14.67, while its price-to-book value is recorded at 2.33. Additionally, the enterprise value to EBITDA ratio is noted at 10.46, and the PEG ratio is an impressive 0.63, indicating a favorable growth outlook relative to its earnings. In terms of profitability, Mayur Uniquoters showcases a return on capital employed (ROCE) of 19.68% and a return on equity (ROE) of 15.49%, highlighting its effective use of capital and shareholder equity. The dividend yield is modest at 0.64%, reflecting a balanced approach to returning value to shareholders. When compared to its peers, Mayur Uniquoters demonstrates competitive valuation metrics, particularly in the context of its enterprise value ra...

Read MoreMayur Uniquoters Experiences Valuation Grade Change Amidst Competitive Financial Metrics

2025-02-25 10:23:26Mayur Uniquoters, a small-cap player in the footwear industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 485.45, slightly up from the previous close of 481.90. Over the past year, Mayur Uniquoters has experienced a stock return of -6.72%, contrasting with a positive return of 2.06% from the Sensex. Key financial metrics indicate a PE ratio of 15.13 and a PEG ratio of 0.65, suggesting a favorable valuation relative to its earnings growth. The company also boasts a robust return on capital employed (ROCE) of 19.68% and a return on equity (ROE) of 15.49%, highlighting its efficiency in generating profits from its capital. In comparison to its peers, Mayur Uniquoters demonstrates competitive metrics, particularly in EV to EBITDA at 10.82 and EV to Sales at 2.28. These figures suggest that while the company faces challenges in th...

Read More

Mayur Uniquoters Shows Strong Short-Term Gains Amid Sector Volatility

2025-02-21 09:35:21Mayur Uniquoters, a small-cap footwear company, experienced notable gains on February 21, 2025, outperforming its sector. The stock opened strongly and has shown consecutive gains over two days. Despite recent volatility and a monthly decline, it remains a significant player in the footwear market.

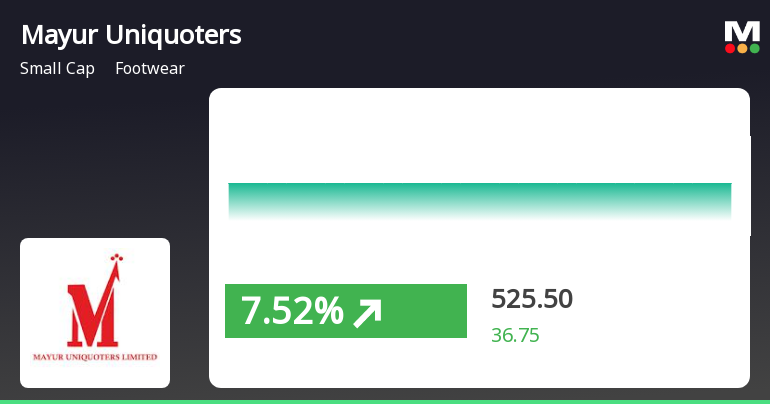

Read MoreMayur Uniquoters Shows Strong Short-Term Gains Amid Mixed Market Signals

2025-02-21 09:35:10Mayur Uniquoters Ltd, a small-cap player in the footwear industry, has shown significant activity today, opening with a gain of 7.52%. The stock's performance has outpaced its sector by 0.63%, reflecting a positive trend amid broader market conditions. Over the past two days, Mayur Uniquoters has achieved a cumulative return of 7.73%, indicating a sustained upward momentum. Today, the stock reached an intraday high of Rs 525.5, maintaining this price level throughout the trading session. In terms of moving averages, the stock is currently positioned higher than its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages, suggesting mixed signals in its short to medium-term performance. While the footwear sector has seen a gain of 6.75%, Mayur Uniquoters' one-month performance reflects a decline of 7.16%, contrasting with the Sensex's slight drop of 0.24% over the sa...

Read More

Mayur Uniquoters Reports Flat Q3 FY24-25 Results Amid Profitability Challenges

2025-01-31 20:31:43Mayur Uniquoters has announced its financial results for Q3 FY24-25, showing a flat performance with a revised evaluation score. The Profit After Tax (PAT) for the quarter is reported at Rs 30.57 crore, marking a decline from the previous average. Stakeholders may need to monitor these developments closely.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation for closure of trading window.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

03-Feb-2025 | Source : BSEAudio recording of Earnings Call on the Results for the Quarter and Nine-Months ended on December 31 2024.

Corporate Actions

No Upcoming Board Meetings

Mayur Uniquoters Ltd has declared 60% dividend, ex-date: 23 Aug 24

Mayur Uniquoters Ltd has announced 5:10 stock split, ex-date: 25 Sep 13

Mayur Uniquoters Ltd has announced 1:1 bonus issue, ex-date: 28 Mar 14

No Rights history available