Meghna Infracon Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-04-02 08:00:49Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 819.95, slightly down from the previous close of 828.90. Over the past year, Meghna Infracon has demonstrated remarkable performance, with a return of 240.94%, significantly outpacing the Sensex's return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly MACD also indicates a bullish trend. However, the Relative Strength Index (RSI) shows bearish signals on both weekly and monthly charts. The Bollinger Bands reflect a mildly bullish stance on both timeframes, suggesting some positive momentum. Daily moving averages are bullish, indicating a favorable short-term outlook. The company's performance over various timeframes is noteworthy, particularly its staggering...

Read More

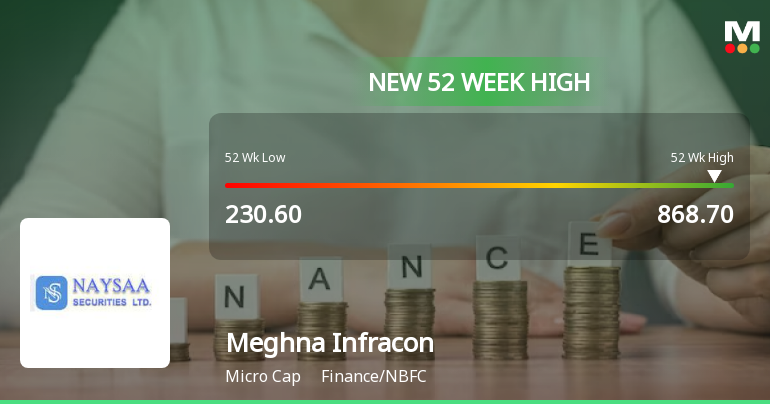

Meghna Infracon Achieves 52-Week High Amid Strong Market Activity and Small-Cap Gains

2025-03-20 09:35:14Meghna Infracon Infrastructure's stock reached a new 52-week high of Rs. 868.7, reflecting strong market activity after a two-day gain. The company has shown impressive growth over the past year, significantly outperforming the Sensex, while small-cap stocks lead the broader market.

Read More

Meghna Infracon Stock Reaches All-Time High, Signaling Strong Market Momentum

2025-03-20 09:30:58Meghna Infracon Infrastructure's stock reached an all-time high of Rs. 868.7 on March 20, 2025, despite a slight pullback after two days of gains. The company has shown strong performance over the past week and year, significantly outperforming the Sensex in various time frames.

Read MoreMeghna Infracon Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-19 08:00:22Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock is currently priced at 818.00, showing a notable increase from the previous close of 772.50. Over the past year, Meghna Infracon has demonstrated impressive performance, with a return of 249.42%, significantly outpacing the Sensex's return of 3.51% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling a bullish trend, while the monthly MACD also reflects a positive outlook. However, the monthly RSI indicates a bearish signal, suggesting mixed signals in momentum. The daily moving averages are bullish, indicating a favorable short-term trend. Meghna Infracon's performance over various time frames highlights its resilience, particularly with a staggering 7336.36% return over three years c...

Read MoreMeghna Infracon Shows Mixed Technical Trends Amid Market Volatility

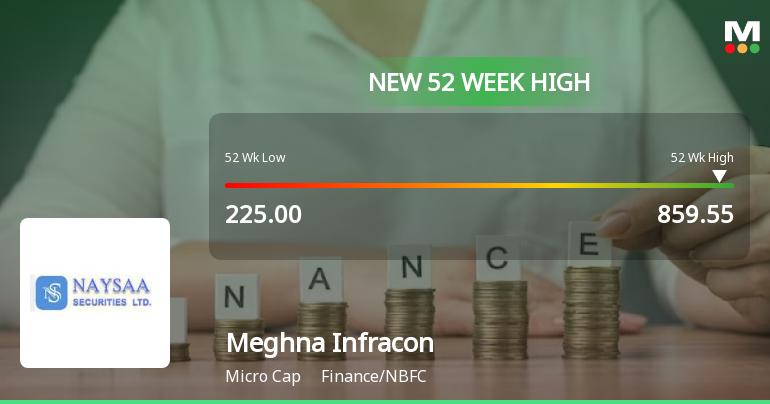

2025-03-18 08:00:19Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision that reflects its current market dynamics. The stock is currently priced at 772.50, down from a previous close of 800.00, with a notable 52-week high of 859.55 and a low of 230.60. Today's trading saw a high of 804.95 and a low of 769.95, indicating some volatility. In terms of technical indicators, the MACD shows a mixed picture with a mildly bearish stance on the weekly chart and a bullish outlook on the monthly chart. The Bollinger Bands suggest a mildly bullish trend on both weekly and monthly bases, while the moving averages indicate a bullish trend on a daily basis. The KST reflects a mildly bearish trend weekly but is bullish monthly, and the Dow Theory shows no clear trend at this time. When comparing the company's performance to the Sensex, Meghna Infracon has demonstrated significant retu...

Read MoreMeghna Infracon Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-11 08:00:23Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock is currently priced at 775.00, showing a notable contrast from its previous close of 802.60. Over the past year, Meghna Infracon has demonstrated impressive performance, with a remarkable return of 207.54%, significantly outpacing the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the company exhibits a mixed picture. The Moving Averages signal a bullish trend on a daily basis, while the MACD shows a mildly bearish stance on a weekly basis but turns bullish on a monthly scale. The Bollinger Bands also reflect a mildly bullish trend over both weekly and monthly periods. Meghna Infracon's performance over various time frames highlights its resilience, particularly over the last three and five years, where it...

Read MoreMeghna Infracon Shows Mixed Technical Trends Amidst Significant Stock Performance Gains

2025-03-10 08:00:15Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 802.60, down from a previous close of 820.85, with a 52-week high of 859.55 and a low of 225.00. Today's trading saw a high of 822.90 and a low of 792.30, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bullish momentum on both weekly and monthly charts, while the RSI shows no signal on a weekly basis but is bearish monthly. Bollinger Bands reflect a mildly bullish stance on both timeframes, and moving averages suggest bullish trends daily. However, the KST presents a mildly bearish outlook weekly, with no definitive trends noted in the Dow Theory. In terms of performance, Meghna Infracon has shown significant returns compared to the Sensex. Over the past year, the stock has surged...

Read MoreMeghna Infracon Shows Strong Technical Trends Amidst Market Dynamics Shift

2025-03-07 08:00:47Meghna Infracon, a microcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 820.85, showing a slight increase from the previous close of 809.95. Over the past year, Meghna Infracon has demonstrated remarkable performance, with a return of 225.09%, significantly outpacing the Sensex, which recorded a mere 0.34% during the same period. The technical summary indicates a generally positive outlook, with bullish signals observed in both weekly and monthly MACD and Bollinger Bands. However, the RSI presents a mixed picture, showing no signal on a weekly basis while indicating bearish momentum monthly. The moving averages also reflect bullish sentiment, suggesting a favorable trend in the stock's performance. In terms of returns, Meghna Infracon has excelled over various time frames, including a staggering 5...

Read More

Meghna Infracon Reaches 52-Week High Amidst High Trading Volatility

2025-02-27 12:05:12Meghna Infracon Infrastructure's stock reached a new 52-week high of Rs. 859.55, reflecting a significant annual increase. Despite a gap down at the start of trading and high volatility, the stock remains above key moving averages, indicating a strong long-term performance trend.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed the certificate received from Big Share Services Pvt Ltd under Reg74(5) of SEBI(Depositories and Participants) Regulations2018 for the Quarter ended March 312025.

Closure of Trading Window

01-Apr-2025 | Source : BSEIntimation of Closure of Trading Window

Integrated Filing (Financial)

15-Feb-2025 | Source : BSEIntegrated filing (Financial) for the Quarter ended December 312024

Corporate Actions

No Upcoming Board Meetings

Meghna Infracon Infrastructure Ltd has declared 1% dividend, ex-date: 13 Sep 24

No Splits history available

Meghna Infracon Infrastructure Ltd has announced 15:10 bonus issue, ex-date: 30 Dec 22

No Rights history available