Mercury Laboratories Adjusts Valuation Amid Competitive Pharmaceutical Landscape

2025-03-24 08:00:13Mercury Laboratories, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 26.74 and an EV to EBITDA ratio of 14.21, indicating its current market positioning. The price to book value stands at 2.04, while the dividend yield is recorded at 0.40%. Additionally, Mercury Laboratories has a return on capital employed (ROCE) of 9.23% and a return on equity (ROE) of 7.62%. In comparison to its peers, Mercury Laboratories presents a mixed picture. For instance, Kopran is noted for its attractive valuation with a lower PE ratio of 19.63, while Shree Ganesh Remedies and Wanbury are positioned at higher valuation levels. Anuh Pharma stands out with a very attractive valuation, showcasing a PE ratio of 15.8. Meanwhile, Valiant Organics and Bharat Parenterals are categorized as risky, reflecting their financial chal...

Read MoreMercury Laboratories Adjusts Valuation Amid Competitive Pharmaceutical Market Dynamics

2025-03-17 08:00:12Mercury Laboratories, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 25.28 and a price-to-book value of 1.93, indicating a solid market position. Its enterprise value to EBITDA stands at 13.45, while the enterprise value to sales is recorded at 1.41. The company also shows a return on capital employed (ROCE) of 9.23% and a return on equity (ROE) of 7.62%. In comparison to its peers, Mercury Laboratories presents a competitive valuation profile. For instance, Shree Ganesh Remedies is noted for its higher PE ratio of 29.04, while Anuh Pharma boasts a lower PE at 15.28, reflecting a more attractive valuation. Other competitors like Kopran and NGL Fine Chemicals also maintain attractive valuations, but with varying metrics that highlight the diverse financial landscapes within the industry....

Read MoreMercury Laboratories Adjusts Valuation Amid Competitive Pharmaceutical Landscape Dynamics

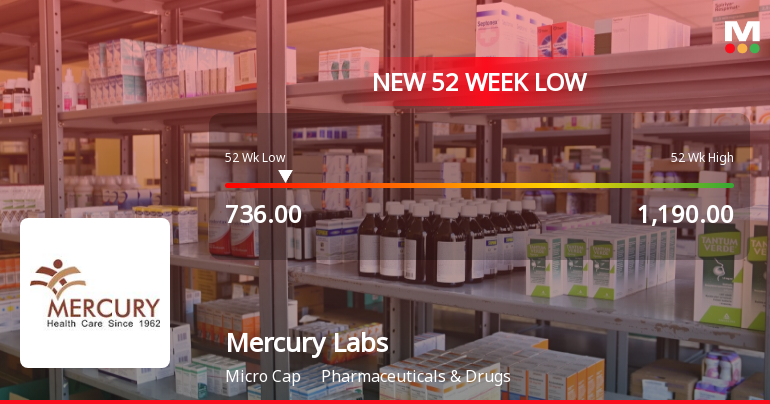

2025-03-07 08:00:40Mercury Laboratories, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company currently reports a PE ratio of 26.65 and an EV to EBITDA of 14.16, reflecting its financial standing in the market. With a dividend yield of 0.40% and a return on capital employed (ROCE) of 9.23%, Mercury Labs showcases a moderate performance profile. In comparison to its peers, Mercury Labs presents a competitive landscape. For instance, Shree Ganesh Remedies is positioned at a higher valuation level with a PE ratio of 31.55, while Kopran and Anuh Pharma exhibit more attractive metrics with lower PE ratios of 17.18 and 16.24, respectively. Notably, Mercury Labs has shown resilience with a 3-year return of 77.54%, significantly outperforming the Sensex's 36.82% over the same period. The company's stock price has fluctuated between a 52-week high of 1,190.00 and a low o...

Read More

Mercury Laboratories Hits 52-Week Low Amid Broader Market Decline and Small-Cap Gains

2025-03-04 09:55:30Mercury Laboratories has reached a new 52-week low, reflecting ongoing challenges in its performance, including a notable decline in profit after tax. The company's stock has consistently underperformed against various moving averages, while the broader market shows mixed trends, particularly among small-cap stocks.

Read MoreMercury Laboratories Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-02-25 10:28:01Mercury Laboratories, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 884.90, maintaining its previous close, with a 52-week range between 760.00 and 1,190.00. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish stance. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish monthly. Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious outlook in the short term. When examining the company's performance relative to the Sensex, Mercury Laboratories has shown notable resilience over various time frames. Over the past week, the stock returned 9.52%, contrasting sharply with the Sensex's decline of 1.74%. However, ...

Read More

Mercury Laboratories Reports Mixed Financial Results Amid Sales Growth and Liquidity Concerns

2025-02-13 10:33:10Mercury Laboratories has reported its financial results for the quarter ending December 2024, showing flat performance overall. The company achieved its highest quarterly net sales in five quarters at Rs 19.57 crore, but faced challenges with a significant decline in Profit After Tax and reduced cash reserves.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Reg 74(5) SEBI (DP) Regulation for the quarter ended on March 31 2025 is attached

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation regarding closure of trading window is attached

Announcement under Regulation 30 (LODR)-Change in Management

24-Feb-2025 | Source : BSEIntimation of Resignation of HR manager is attached here

Corporate Actions

No Upcoming Board Meetings

Mercury Laboratories Ltd has declared 35% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available