Metro Brands Faces Technical Trend Shifts Amid Mixed Market Performance Indicators

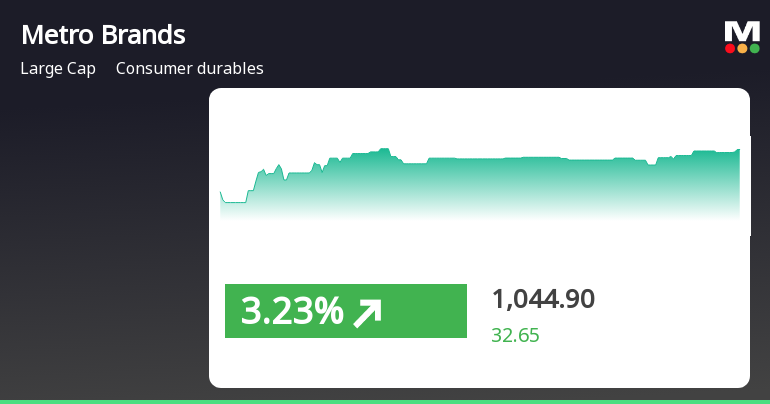

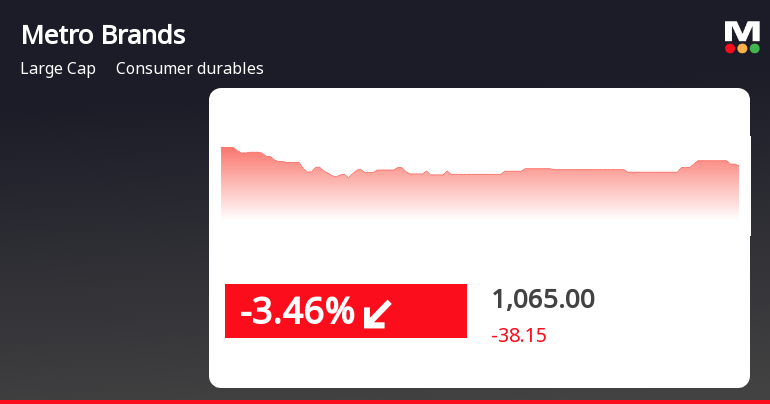

2025-04-03 08:06:28Metro Brands, a prominent player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1060.00, showing a slight increase from the previous close of 1043.30. Over the past year, Metro Brands has experienced a stock return of -3.92%, contrasting with a 3.67% return from the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) does not signal any significant movement on both weekly and monthly charts. Bollinger Bands also reflect a mildly bearish stance on both timeframes. Daily moving averages indicate a bearish trend, while the KST shows a mildly bullish signal on a weekly basis. Despite the recent challenges, Metro Brands has demonstrated...

Read MoreMetro Brands Experiences Technical Trend Shifts Amid Market Volatility

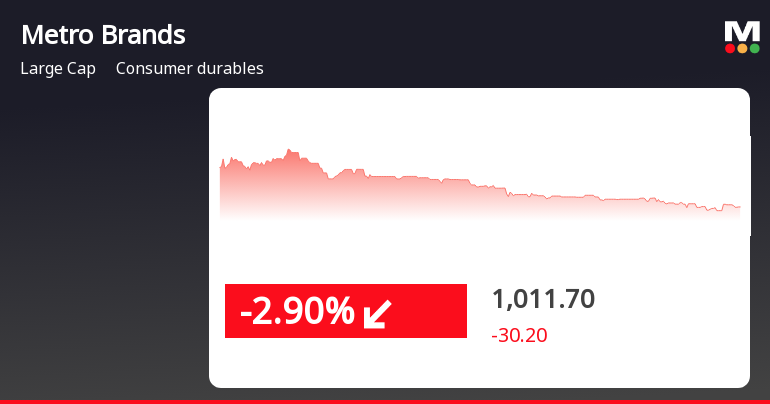

2025-04-02 08:10:03Metro Brands, a prominent player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1043.30, showing a notable shift from its previous close of 1012.25. Over the past year, the stock has experienced a high of 1,430.10 and a low of 890.30, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows a bullish signal on a weekly basis, but no signal is present for the monthly assessment. Bollinger Bands indicate a mildly bearish trend for both weekly and monthly evaluations. Daily moving averages reflect a bearish stance, while the KST shows a mildly bullish trend on a weekly basis. When comparing the stock's performance to the Sensex, Metro Brands has faced challenges, particularly o...

Read More

Metro Brands Shows Resilience Amid Broader Market Decline and Sector Challenges

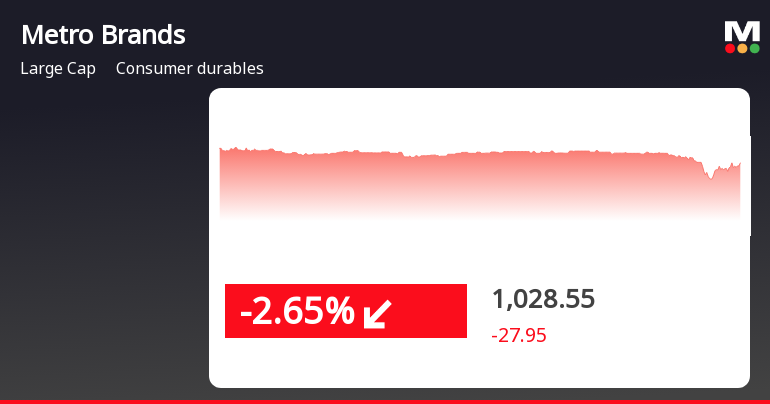

2025-04-01 12:35:29Metro Brands rebounded on April 1, 2025, after five days of decline, outperforming the broader sector despite a challenging market. While the stock has faced recent struggles, its three-year growth significantly exceeds that of the Sensex, highlighting its resilience in the consumer durables industry.

Read More

Metro Brands Faces Continued Stock Decline Amid Broader Market Gains

2025-03-28 14:20:26Metro Brands has faced a significant decline, with the stock down for five consecutive days and a total drop of 6.52%. It has underperformed against the broader sector and is trading below key moving averages. Over the past year, the stock has decreased by 11.81%.

Read More

Metro Brands Faces Challenges Amid Broader Market Resilience and Declining Stock Performance

2025-03-27 15:20:35Metro Brands' shares fell significantly today, reaching a new 52-week low and marking a consistent decline over the past four days. The stock has underperformed compared to the broader market, trading below key moving averages, while the Sensex has shown resilience and gained over the past three weeks.

Read More

Metro Brands Experiences Trend Reversal Amid Broader Market Gains and Mid-Cap Strength

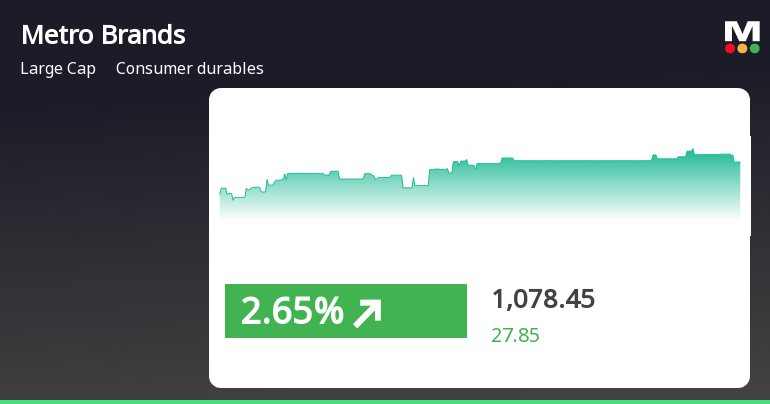

2025-03-19 15:05:28Metro Brands experienced a notable uptick today, reversing a two-day decline and reaching an intraday high. While the stock is above its 5-day moving average, it remains below longer-term averages. In the broader market, mid-cap stocks are performing well, with the Sensex also showing positive movement.

Read More

Metro Brands Faces Significant Challenges Amid Broader Market Decline

2025-03-11 09:50:26Metro Brands has faced a significant decline, with a notable drop in stock value and consecutive losses over the past week. The stock is trading below key moving averages, reflecting a bearish trend. This performance occurs amid broader market challenges, as the Sensex also shows signs of weakness.

Read MoreMetro Brands Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-11 08:05:38Metro Brands, a prominent player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1103.15, down from a previous close of 1121.15, with a notable 52-week high of 1430.10 and a low of 992.65. Today's trading saw a high of 1118.80 and a low of 1090.00, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly evaluations. Moving averages indicate a bearish trend on a daily basis, and the Dow Theory aligns with a mildly bearish outlook for both weekly and monthly assessments. In terms of performance, Metro Brands has faced challenges compared to the Sensex. Over the past week, the stock has r...

Read MoreMetro Brands Faces Technical Trend Shifts Amidst Market Evaluation Revision

2025-03-10 08:02:07Metro Brands, a prominent player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1121.15, slightly down from the previous close of 1139.10. Over the past year, Metro Brands has experienced a stock return of -1.02%, contrasting with a modest gain of 0.29% in the Sensex during the same period. In terms of technical indicators, the weekly MACD suggests a bearish outlook, while the monthly perspective leans towards a mildly bearish stance. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, although it shows no signal on a monthly scale. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly evaluations. Despite recent fluctuations, Metro Brands has demonstrated resilience over a three-year period, boasting a remarkable return of 116.48%, significantly outpe...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading window with effect from 1st April 2025 till 48 hours after declaration of Financial Results.

Announcement under Regulation 30 (LODR)-Credit Rating

26-Mar-2025 | Source : BSECredit Rating Re-affirmation Disclosure.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

17-Mar-2025 | Source : BSEAllotment of 45144 equity shares under the Metro Stock Option Plan (ESOP 2008)

Corporate Actions

No Upcoming Board Meetings

Metro Brands Ltd has declared 60% dividend, ex-date: 07 Mar 25

No Splits history available

No Bonus history available

No Rights history available