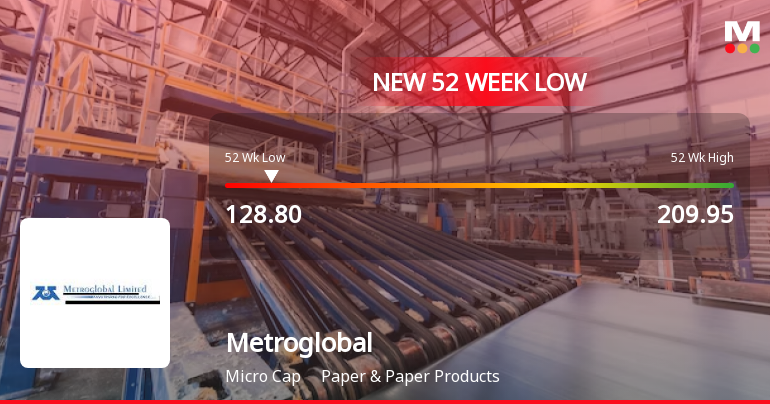

Metroglobal Faces Profitability Challenges Amidst Stagnant Growth and Low ROE

2025-03-18 11:07:53Metroglobal, a microcap in the Paper & Paper Products sector, has reached a 52-week low amid limited volatility. The company reports a low return on equity of 3.73% and stagnant sales growth. Recent quarterly profits fell sharply, while its stock has underperformed the broader market over the past year.

Read MoreMetroglobal Adjusts Valuation Grade Amid Competitive Paper Industry Landscape

2025-03-18 08:00:46Metroglobal, a microcap player in the Paper & Paper Products industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 7.47, while its price-to-book value is notably low at 0.39. Additionally, Metroglobal's enterprise value to EBITDA ratio is recorded at 11.97, indicating its operational efficiency relative to its valuation. In terms of profitability, the company has a return on equity (ROE) of 5.71% and a return on capital employed (ROCE) of 3.06%. The dividend yield is also noteworthy at 2.04%, providing a return to shareholders. When compared to its peers, Metroglobal's valuation metrics present a competitive landscape. For instance, while it maintains an attractive valuation, other companies in the sector, such as Pudumjee Paper and Kuantum Papers, also show strong performance indicators....

Read More

Metroglobal Hits 52-Week Low Amidst Increased Market Volatility and Underperformance

2025-02-28 12:05:23Metroglobal, a microcap in the Paper & Paper Products sector, reached a new 52-week low today, reflecting a significant decline over the past four days. The stock has shown high volatility and is trading below all major moving averages, indicating ongoing challenges in the market.

Read More

Metroglobal Faces Market Challenges Amidst Declining Stock Performance and Bearish Trends

2025-02-13 09:37:37Metroglobal, a microcap in the Paper & Paper Products sector, showed notable trading activity today, opening higher but ultimately closing lower than its sector. The stock is near its 52-week low and has faced a year-long decline, contrasting with broader market gains, while trading below key moving averages.

Read More

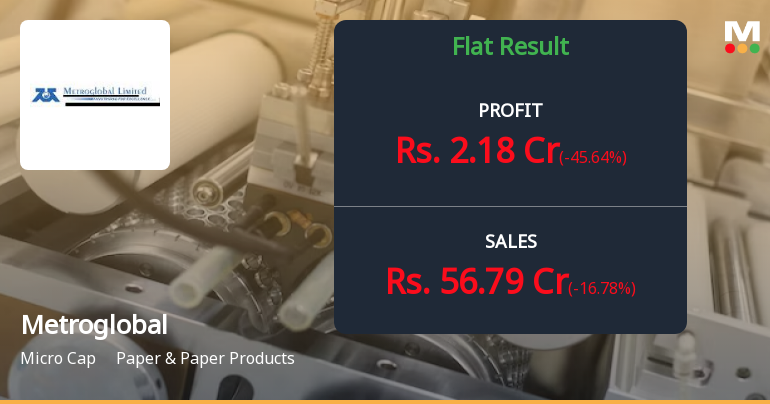

Metroglobal Reports December 2024 Results, Signaling Financial Challenges Ahead

2025-02-12 20:06:14Metroglobal has announced its financial results for the quarter ending December 2024, revealing a decline in Profit After Tax, net sales, and Earnings per Share. The company's cash and cash equivalents have also decreased, reflecting challenges in its financial performance and prompting a reevaluation of its financial standing.

Read More

Metroglobal Reports Strong Q2 FY24-25 Performance Amid Management Efficiency Concerns

2025-01-27 19:01:11Metroglobal, a microcap in the Paper & Paper Products sector, recently adjusted its evaluation following a strong second quarter in FY24-25, reporting significant cash flow and sales growth. However, challenges in management efficiency and long-term growth trends raise concerns about profitability and stock performance despite increased profits.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Disclosure Under Regulation 31(4) Of The SEBI (Substantial Acquisition Of Shares And Takeovers) Regulation 2011

01-Apr-2025 | Source : BSESubmission of Annual Disclosure under Regulation 31(4) of the SEBI (Substantial Acquisition of Shares and Takeovers) Regulation 2011 for the Financial Year Ended March 31 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Metroglobal Ltd. has declared 20% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available