Metropolis Healthcare Adjusts Valuation Amidst Challenging Performance and Competitive Landscape

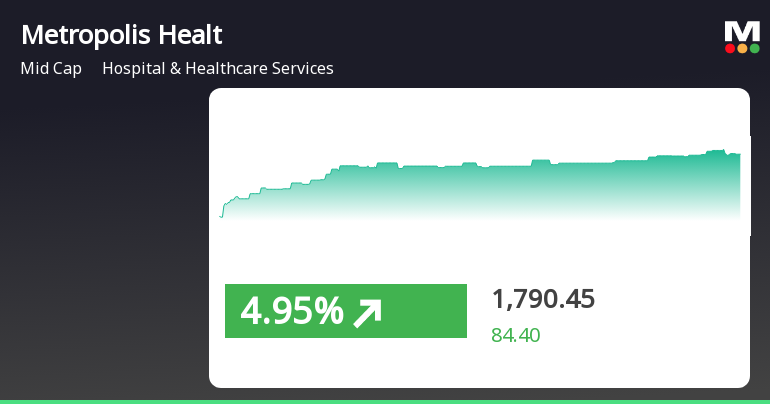

2025-04-02 08:02:56Metropolis Healthcare has recently undergone a valuation adjustment, reflecting its current standing within the Hospital & Healthcare Services industry. The company’s price-to-earnings (PE) ratio stands at 51.38, while its price-to-book value is recorded at 6.61. Other key metrics include an EV to EBIT ratio of 36.53 and an EV to EBITDA ratio of 24.40, indicating its operational efficiency relative to its enterprise value. In terms of return performance, Metropolis Healthcare has faced challenges, with a year-to-date return of -26.08%, contrasting sharply with the Sensex's decline of only -2.71% over the same period. Over a three-year horizon, the company has seen a return of -27.08%, while the Sensex has gained 28.25%. When compared to its peers, Metropolis Healthcare's valuation metrics appear more favorable, particularly against companies like Dr. Agarwal's Healthcare and Rainbow Children's Hospital, ...

Read More

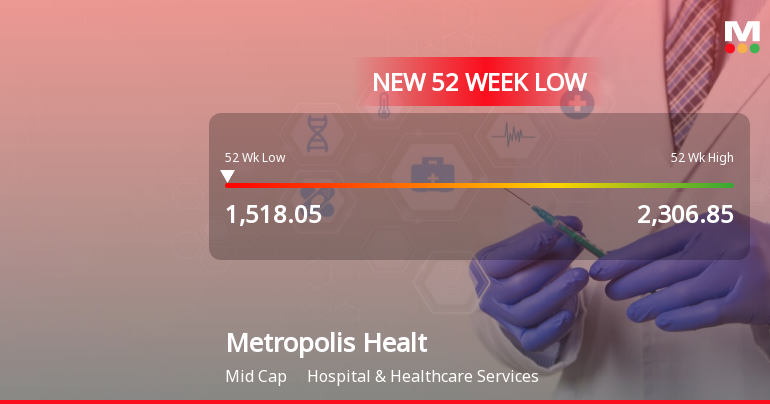

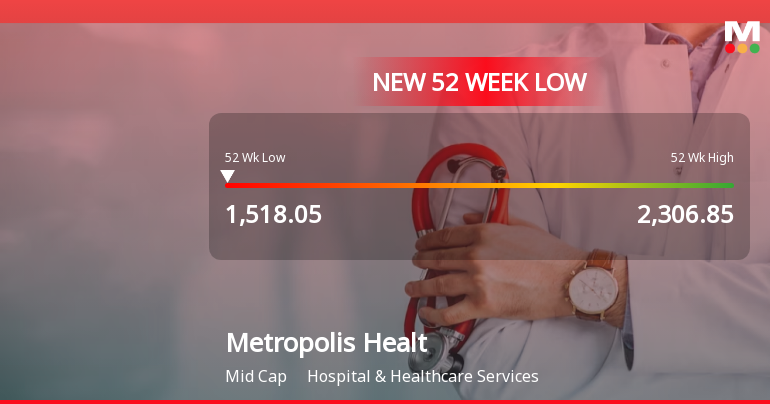

Metropolis Healthcare Hits 52-Week Low Amid Broader Market Decline and Weak Financial Metrics

2025-04-01 12:00:15Metropolis Healthcare has reached a new 52-week low, continuing its recent struggles with a two-day loss and underperformance compared to its sector. The company's financial metrics show slow growth in net sales and operating profit, alongside declining profits and cash reserves, raising concerns about its valuation.

Read More

Metropolis Healthcare Hits 52-Week Low Amid Ongoing Financial Struggles and Sector Underperformance

2025-04-01 12:00:14Metropolis Healthcare has reached a new 52-week low, continuing a two-day decline. The stock is trading below all major moving averages and has underperformed its sector over the past year. Financial metrics indicate slow growth in sales and profits, despite a strong return on capital employed.

Read More

Metropolis Healthcare Hits 52-Week Low Amid Sustained Downward Trend in Stock Performance

2025-03-03 09:37:48Metropolis Healthcare has reached a new 52-week low, reflecting a consistent decline over the past four days. The stock has underperformed its sector and is trading below key moving averages. Over the past year, it has recorded a notable decline, contrasting with the overall market performance.

Read MoreMetropolis Healthcare Faces Bearish Technical Trends Amid Market Challenges

2025-02-27 08:01:28Metropolis Healthcare, a midcap player in the Hospital & Healthcare Services industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,662.65, down from a previous close of 1,682.90. Over the past year, Metropolis has experienced a stock return of -4.77%, contrasting with a 2.00% return from the Sensex, indicating a relative underperformance. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a bearish stance, particularly on a monthly basis. Moving averages indicate a bearish trend, and the KST presents a mixed picture with a bearish weekly signal but a bullish monthly outlook. In terms of price movement, the stock has seen a 52-week high of 2,306.85 and a low of 1,555.55, with today'...

Read More

Metropolis Healthcare Experiences Trend Reversal Amid Broader Market Challenges

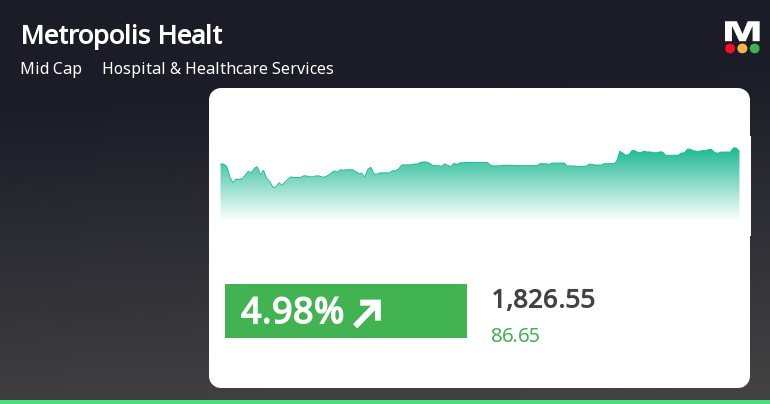

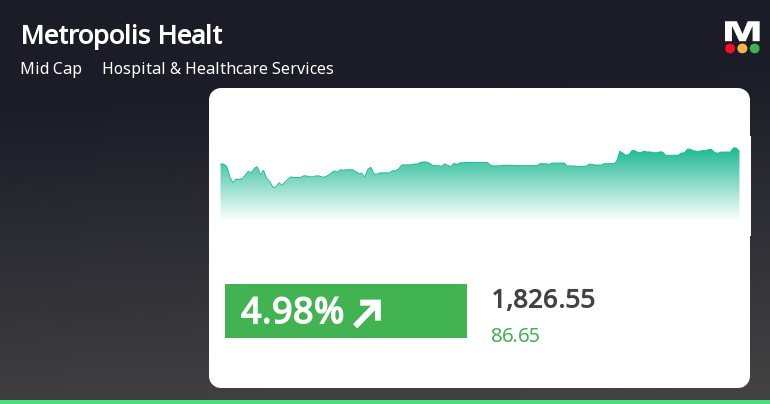

2025-02-05 12:05:23Metropolis Healthcare experienced a significant uptick in its stock performance, reversing a four-day decline. The stock outperformed its sector and the broader market, although it has faced challenges over the past month. Current moving averages indicate mixed trends in the short to long term.

Read More

Metropolis Healthcare Experiences Trend Reversal Amid Broader Market Challenges

2025-02-05 12:05:23Metropolis Healthcare experienced a significant uptick in its stock performance, reversing a four-day decline. The stock outperformed its sector and the broader market, although it has faced challenges over the past month. Current moving averages indicate mixed trends in the short to long term.

Read More

Metropolis Healthcare Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-02-04 21:03:31Metropolis Healthcare's financial results for Q3 FY24-25 indicate a flat performance, with a notable decline in its evaluation score. The company maintains a low debt-equity ratio of 0.16 times and a strong debtor turnover ratio of 9.58 times, but faces challenges with decreased profit before and after tax and reduced cash reserves.

Read More

Metropolis Healthcare Shows Short-Term Recovery Amid Long-Term Trading Challenges

2025-01-29 15:20:29Metropolis Healthcare saw a significant rebound on January 29, 2025, after three days of decline, outperforming its sector. However, it remains below key moving averages and has faced a 13.17% decline over the past month, contrasting with a smaller drop in the broader Sensex index.

Read MoreBusiness Update For Q4FY25

05-Apr-2025 | Source : BSEBusiness update for Q4FY25

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

29-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Dr Duru Sushil Shah & PACs

Corporate Actions

No Upcoming Board Meetings

Metropolis Healthcare Ltd has declared 200% dividend, ex-date: 17 Nov 23

No Splits history available

No Bonus history available

No Rights history available