Mindspace Business Parks REIT Adjusts Evaluation Amid Growth and Financial Challenges

2025-04-02 08:39:58Mindspace Business Parks REIT has recently adjusted its evaluation, indicating a shift in technical trends and market sentiment. The company has shown significant annual growth in net sales and operating profit, but faces challenges with a high Debt to EBITDA ratio and modest return on equity. Despite these issues, it has demonstrated resilience and strong institutional support.

Read More

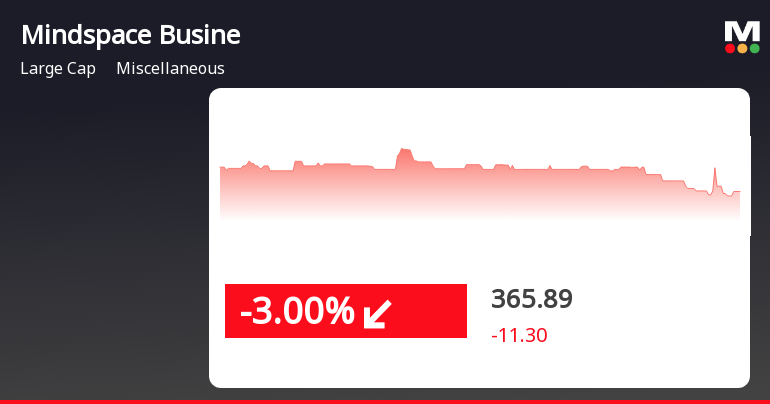

Mindspace Business Parks REIT Faces Decline Amid Broader Market Weakness and Mixed Trends

2025-04-01 14:50:27Mindspace Business Parks REIT saw a decline on April 1, 2025, following two days of gains, with an intraday low of Rs 365.22. While it remains above several moving averages, it is below others. The broader market also faced challenges, with the Sensex experiencing a significant drop.

Read More

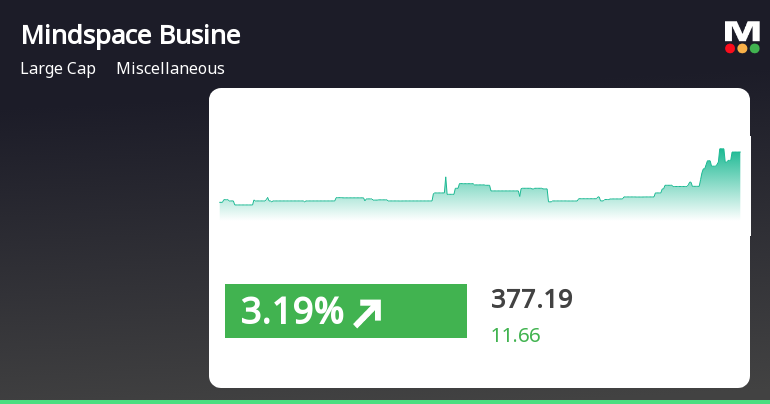

Mindspace Business Parks REIT Shows Resilience Amid Broader Market Challenges

2025-03-28 15:50:26Mindspace Business Parks REIT has demonstrated strong performance, gaining 3.19% and trading close to its 52-week high. It has outperformed its sector and shown resilience amid broader market challenges, with a year-to-date performance of 3.90%, contrasting with the Sensex's decline. The stock reflects a positive trend in price movement.

Read MoreMindspace Business Parks REIT Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:04:02Mindspace Business Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 365.53, showing a slight increase from the previous close of 361.35. Over the past year, Mindspace has recorded a return of 6.22%, closely aligning with the Sensex's return of 6.32%, indicating a competitive performance in the market. In terms of technical indicators, the weekly MACD and KST suggest a mildly bearish sentiment, while the monthly indicators present a more mixed picture, with the Bollinger Bands indicating bullish tendencies. The daily moving averages, however, lean towards a mildly bullish outlook, suggesting some positive momentum in the short term. When comparing the stock's performance to the Sensex, it is noteworthy that while Mindspace has shown modest returns over the past month and year, i...

Read More

Mindspace Business Parks REIT Faces Debt Challenges Amidst Stabilizing Stock Trends

2025-03-26 08:12:19Mindspace Business Parks REIT has experienced a change in its evaluation, indicating a shift in technical trends. Key financial metrics highlight a high Debt to EBITDA ratio and modest Return on Equity, alongside significant long-term growth in net sales and operating profit. Institutional holdings remain strong, reflecting investor confidence.

Read MoreMindspace Business Parks REIT Faces Mixed Technical Trends Amid Market Evaluation

2025-03-26 08:04:50Mindspace Business Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 364.00, slightly down from the previous close of 365.00. Over the past year, the stock has reached a high of 384.99 and a low of 331.00, indicating a range of performance that investors have been monitoring closely. The technical summary reveals a mixed picture, with the MACD indicating mildly bearish trends on both weekly and monthly scales. The Relative Strength Index (RSI) shows no significant signals, while Bollinger Bands present a bearish outlook on a weekly basis but a mildly bullish stance monthly. Moving averages suggest a mildly bullish trend on a daily basis, contrasting with the overall technical indicators. In terms of performance, the stock's returns have been modest compared to the Sensex. Over t...

Read MoreMindspace Business Parks REIT Shows Mixed Technical Trends Amid Market Resilience

2025-03-24 08:02:55Mindspace Business Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 369.94, showing a notable increase from the previous close of 360.00. Over the past year, Mindspace has demonstrated a return of 6.96%, slightly outperforming the Sensex, which recorded a return of 5.87% during the same period. In terms of technical indicators, the stock's moving averages signal a bullish trend on a daily basis, while the Bollinger Bands indicate a bullish stance on a monthly scale. However, the MACD and KST metrics present a mixed picture, with weekly readings leaning towards a mildly bearish outlook. The On-Balance Volume (OBV) remains bearish on both weekly and monthly assessments, suggesting some caution in trading volume trends. The company's performance over various time frames reveals a ...

Read MoreMindspace Business Parks REIT Shows Mixed Technical Trends Amid Market Fluctuations

2025-03-19 08:05:01Mindspace Business Parks REIT, a prominent player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 361.73, showing a slight increase from the previous close of 360.50. Over the past year, Mindspace has delivered a return of 4.97%, outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD and KST suggest a mildly bearish trend, while the monthly KST indicates a bullish stance. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly chart and a mildly bullish perspective on the monthly chart. The daily moving averages lean towards a mildly bullish trend, indicating some short-term positive momentum. When comparing the stock's performance to the Sensex, Mindspace has shown resilience, particularly over the last mont...

Read More

Mindspace Business Parks REIT Faces Debt Challenges Amid Strong Growth Metrics

2025-03-18 08:24:01Mindspace Business Parks REIT has recently adjusted its evaluation, reflecting its current market position. The company shows strong annual growth in net sales and operating profit but faces challenges with a high Debt to EBITDA ratio and limited return on equity. Institutional holdings remain stable, indicating some market confidence.

Read MoreReg 23(5)(i): Disclosure of material issue

30-Mar-2025 | Source : BSEMindspace Business Parks REIT has informed the Exchange regarding Disclosure of material issue

Reg 23(5)(i): Disclosure of material issue

30-Mar-2025 | Source : BSEMindspace Business Parks REIT has informed the Exchange regarding Disclosure of material issue

Reg 23(5)(i): Disclosure of material issue

28-Mar-2025 | Source : BSEMindspace Business Parks REIT has informed the Exchange regarding Disclosure of material issue

Corporate Actions

No Upcoming Board Meetings

Mindspace Business Parks REIT has declared 1% dividend, ex-date: 29 Jan 25

No Splits history available

No Bonus history available

No Rights history available