Mindteck (India) Ltd Experiences Significant Stock Surge Amid Market Activity Shift

2025-03-18 13:00:05Mindteck (India) Ltd, a microcap player in the IT software industry, has made headlines today as its stock hit the upper circuit limit, reflecting a significant upward movement. The stock reached an intraday high of Rs 192.27, marking a notable change of Rs 32.04 or 20% from the previous close. This surge comes after a period of five consecutive days of decline, indicating a potential trend reversal. The stock opened with a gain of 2.35% and traded within a wide range of Rs 29.81 throughout the day, showcasing robust market activity. Total traded volume reached approximately 2.41 lakh shares, contributing to a turnover of Rs 4.40 crore. Notably, the stock outperformed its sector by 17.28%, highlighting its strong performance relative to peers. Despite the recent volatility, Mindteck's stock is currently trading above its 5-day moving averages, although it remains below the longer-term averages. The delive...

Read MoreMindteck Adjusts Valuation Grade Amid Strong Performance and Competitive Edge in IT Sector

2025-03-10 08:00:16Mindteck (India), a microcap player in the IT software sector, has recently undergone a valuation adjustment. The company's current price stands at 209.15, reflecting a notable increase from the previous close of 199.90. Over the past year, Mindteck has demonstrated a stock return of 26.79%, significantly outperforming the Sensex, which recorded a mere 0.29% return during the same period. Key financial metrics for Mindteck include a price-to-earnings (PE) ratio of 22.39 and an EV to EBITDA ratio of 15.82. The company's return on capital employed (ROCE) is reported at 24.40%, while the return on equity (ROE) stands at 11.88%. These figures indicate a solid operational performance relative to its peers. In comparison to other companies in the sector, Mindteck's valuation metrics suggest a more favorable position against several competitors, which are categorized as expensive or very expensive. This context ...

Read More

Mindteck Reports Steady Q4 Performance with Highest Operating Profit in Five Quarters

2025-02-05 17:33:15Mindteck (India) has announced its financial results for the quarter ending December 2024, showcasing a stable performance. The company achieved its highest operating profit and profit after tax in five quarters, alongside a notable increase in earnings per share and cash reserves, indicating improved liquidity and operational efficiency.

Read More

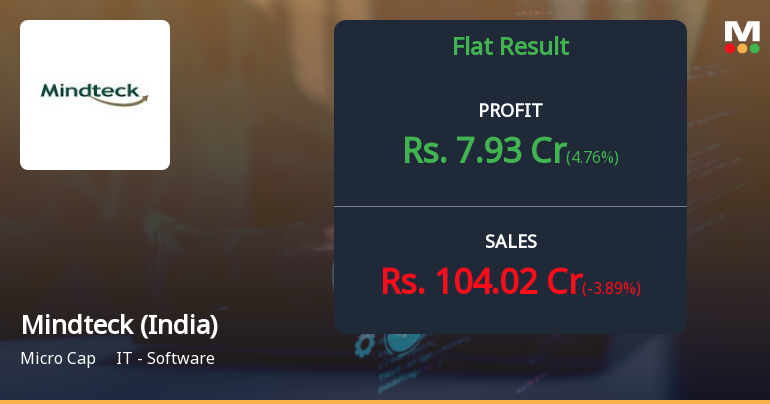

Mindteck Reports Flat Q3 Performance Amidst Strong Long-Term Growth Indicators

2025-01-28 18:44:07Mindteck (India), a microcap IT software firm, has experienced a recent evaluation adjustment amid flat financial performance for the quarter ending September 2024. Despite this, the company shows a low Debt to Equity ratio and strong long-term growth, with significant increases in operating profit and profits over the past year.

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

04-Apr-2025 | Source : BSEAllotment of ESOPs

Announcement under Regulation 30 (LODR)-Change in Management

03-Apr-2025 | Source : BSEAppointment of Senior Management Personnel

Board Meeting Intimation for Intimation Of Board Meeting Under Regulation 29 Of SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015 And Closure Of Trading Window

26-Mar-2025 | Source : BSEMindteck (India) Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 23/05/2025 inter alia to consider and approve Financial Results Dividend if any and other business matters

Corporate Actions

23 May 2025

Mindteck (India) Ltd has declared 10% dividend, ex-date: 02 Aug 24

No Splits history available

Mindteck (India) Ltd has announced 1:4 bonus issue, ex-date: 20 Sep 24

No Rights history available