MOIL's Technical Indicators Show Divergence Amidst Strong Long-Term Performance

2025-03-26 08:03:38MOIL, a midcap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 328.05, down from a previous close of 342.15. Over the past year, MOIL has demonstrated a notable return of 15.04%, significantly outperforming the Sensex, which recorded a return of 7.12% during the same period. In terms of technical metrics, the weekly MACD and KST indicators suggest a mildly bullish sentiment, while the monthly counterparts indicate a mildly bearish trend. The Bollinger Bands also reflect a similar divergence between weekly and monthly assessments. The daily moving averages lean towards a mildly bearish outlook, indicating a mixed technical landscape for the stock. When comparing returns, MOIL has shown impressive performance over longer periods, with a remarkable 229.37% return over five years, compared to ...

Read MoreMOIL's Technical Trends Reflect Mixed Sentiment Amid Strong Long-Term Performance

2025-03-25 08:04:21MOIL, a midcap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 342.15, showing a slight increase from the previous close of 339.50. Over the past year, MOIL has demonstrated a robust performance with a return of 19.99%, significantly outpacing the Sensex's return of 7.07% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting potential price stability. However, moving averages on a daily basis reflect a mildly bearish trend, indicating some short-term volatility. The company's performance over various time frames highlights its resilience, with a remarkable 262.06% return over the...

Read More

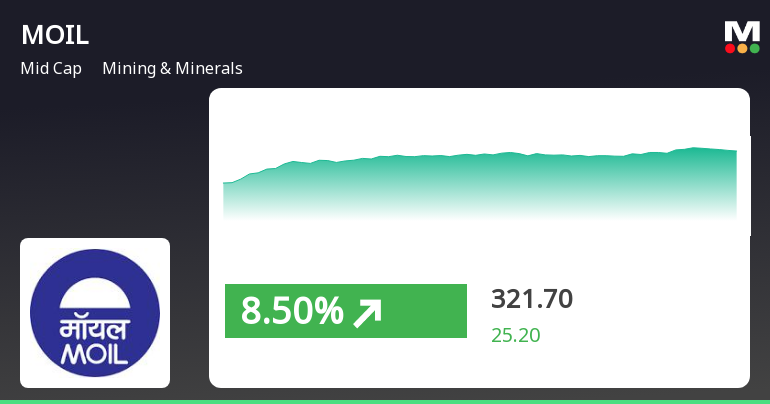

MOIL Ltd. Shows Resilience with Strong Gains Amid Market Fluctuations

2025-03-05 09:35:23MOIL Ltd., a midcap mining company, has experienced notable gains, marking its third consecutive day of increases. The stock has outperformed its sector, with a significant return over the past few days. Despite mixed moving average trends, MOIL's performance reflects resilience in a fluctuating market.

Read More

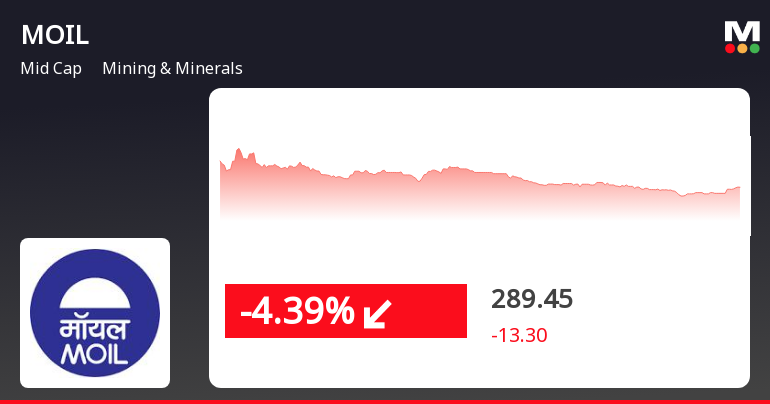

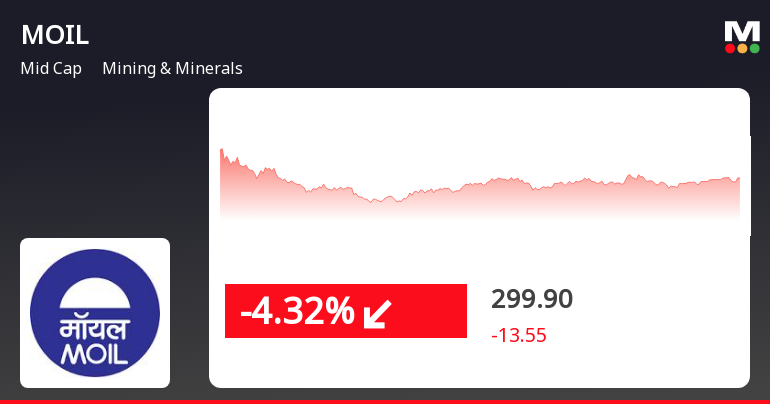

MOIL Ltd. Faces Continued Stock Decline Amid Broader Market Challenges

2025-02-28 13:05:28MOIL Ltd. has seen its stock price decline significantly, falling for five consecutive days and underperforming its sector. The company is trading below key moving averages, indicating a bearish trend. Despite a slight gain over the past month, it faces challenges in the current market environment.

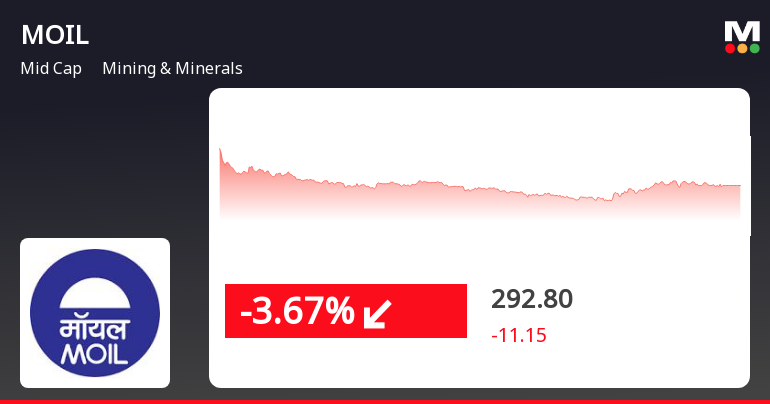

Read MoreMOIL Faces Technical Trend Shifts Amid Market Volatility and Bearish Indicators

2025-02-28 08:00:54MOIL, a midcap player in the Mining & Minerals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 302.75, down from a previous close of 311.70. Over the past year, MOIL has experienced a high of 588.35 and a low of 259.50, indicating significant volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly evaluations. Moving averages indicate a bearish trend on a daily basis, while the KST presents a mildly bullish outlook weekly but shifts to mildly bearish monthly. In terms of performance, MOIL's returns have varied significantly compared to the Sensex. Over the past week, the stock has returned -7.13%, contrasting with the Sensex's ...

Read More

MOIL Ltd. Faces Ongoing Volatility Amid Declining Stock Performance in February 2025

2025-02-14 13:45:40MOIL Ltd., a midcap in the Mining & Minerals sector, has seen a notable decline in its stock performance, losing 5.03% today and 6.38% over the past two days. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing volatility in the industry.

Read More

MOIL Reports December Quarter Results Amidst Declining Profitability and Improved Liquidity

2025-02-12 09:48:29MOIL has announced its financial results for the quarter ending December 2024, highlighting a significant increase in cash and cash equivalents, reaching Rs 1,007.34 crore. However, the company reported declines in both Profit Before Tax and Profit After Tax, with concerns regarding the sustainability of income from non-operating activities.

Read More

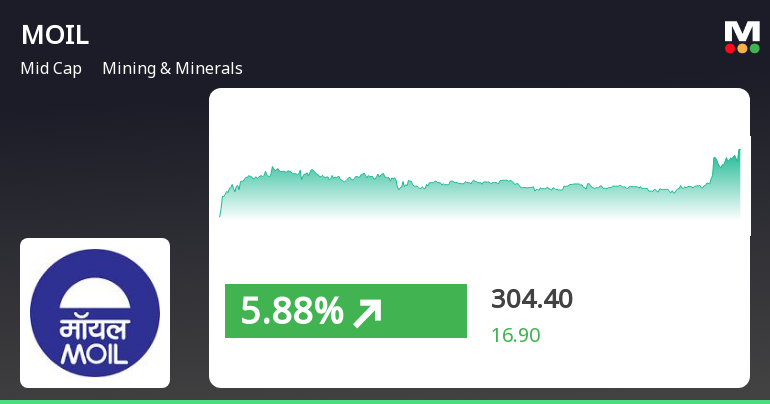

MOIL Shows Signs of Trend Reversal Amidst Broader Market Declines

2025-01-29 15:20:19MOIL, a midcap Mining & Minerals company, experienced a notable uptick on January 29, 2025, after eight days of decline. The stock opened higher and reached an intraday peak, although it remains below key moving averages. In comparison, MOIL outperformed the Sensex in one-day performance but has declined over the past month.

Read More

MOIL Ltd. Faces Continued Stock Decline Amid Broader Market Volatility

2025-01-27 10:05:19MOIL Ltd., a midcap mining company, has faced a notable decline in its stock price, marking the seventh consecutive day of losses and a cumulative drop of 17%. The stock is trading below key moving averages and has underperformed relative to its sector and the broader market over the past month.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

02-Apr-2025 | Source : BSESubmission of Press Release titled MOIL delivers best financial year performance in FY25 surpassing all previous records.

Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015- Cautionary Letters/E-Mails.

01-Apr-2025 | Source : BSESubmission of intimation regarding Cautionary letters/E-mails received from Stock Exchanges.

Fixation Of Price Of Different Grades Of Manganese Ore

01-Apr-2025 | Source : BSEIntimation of fixation of price of different grades of Manganese Ore

Corporate Actions

No Upcoming Board Meetings

MOIL Ltd. has declared 40% dividend, ex-date: 14 Feb 25

No Splits history available

MOIL Ltd. has announced 1:1 bonus issue, ex-date: 27 Sep 17

No Rights history available