Monarch Networth Capital Shows Mixed Technical Trends Amid Strong Long-Term Performance

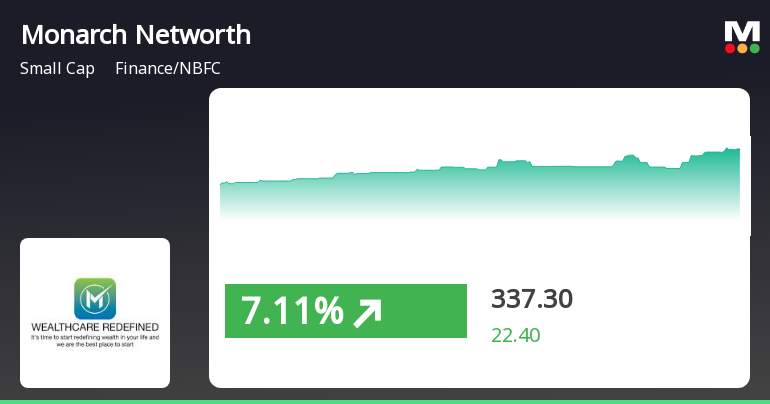

2025-04-02 08:04:53Monarch Networth Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 337.55, showing a notable change from its previous close of 327.65. Over the past year, Monarch has demonstrated a return of 19.34%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, indicating a neutral momentum. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a similar mildly bearish sentimen...

Read MoreMonarch Networth Capital Faces Technical Trend Shifts Amid Mixed Performance Indicators

2025-03-26 08:02:15Monarch Networth Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 334.15, down from a previous close of 346.45, with a notable 52-week high of 501.35 and a low of 226.40. Today's trading saw a high of 350.25 and a low of 330.05. The technical summary indicates a bearish sentiment in several key metrics. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect bearish conditions weekly, contrasting with a bullish monthly perspective. Moving averages and KST metrics further support the bearish stance, with the On-Balance Volume (OBV) showing mildly bullish signals on a weekly basis but mildly bearish on a monthly scale. In terms of performance, Monarch Networth Capital's returns h...

Read MoreMonarch Networth Capital Faces Short-Term Challenges Amid Long-Term Growth Potential

2025-03-25 18:00:12Monarch Networth Capital, a small-cap player in the Finance/NBFC sector, has experienced notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 2,684.00 crore, currently holds a price-to-earnings (P/E) ratio of 16.90, which is below the industry average of 22.14. Over the past year, Monarch Networth Capital has shown a robust performance, gaining 22.97%, significantly outperforming the Sensex, which rose by 7.12%. However, recent trends indicate a decline, with the stock down 3.55% today, contrasting with the Sensex's slight increase of 0.04%. In the short term, the stock has faced challenges, with a 3.81% drop over the past month and a year-to-date decline of 23.56%. Despite these recent setbacks, Monarch Networth Capital has demonstrated impressive long-term growth, boasting a staggering 3707.98% increase over the past five years, compared to the Sensex's 1...

Read MoreMonarch Networth Capital Shows Mixed Technical Trends Amid Strong Long-Term Performance

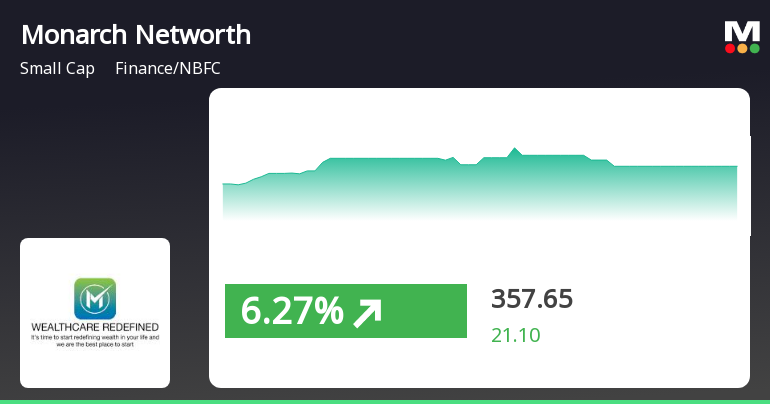

2025-03-25 08:02:33Monarch Networth Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 346.45, showing a slight increase from the previous close of 340.45. Over the past year, Monarch has demonstrated a notable return of 27.50%, significantly outperforming the Sensex, which returned 7.07% in the same period. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The MACD signals a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly evaluations. Bollinger Bands present a mildly bearish outlook weekly but shift to bullish on a monthly basis. Daily moving averages suggest a mildly bullish tren...

Read More

Monarch Networth Capital Shows Strong Rebound Amid Broader Small-Cap Market Gains

2025-03-18 13:15:20Monarch Networth Capital has experienced a significant uptick in its stock performance, reversing a three-day decline and reaching an intraday high. While it currently exceeds its 5-day moving average, it remains below longer-term averages. The broader market also shows positive movement, particularly among small-cap stocks.

Read MoreMonarch Networth Capital Shows Signs of Recovery Amidst Market Volatility

2025-03-05 09:50:08Monarch Networth Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has shown significant activity today, opening with a gain of 5.72%. This uptick marks a notable trend reversal after three consecutive days of decline. The stock reached an intraday high of Rs 343.6, outperforming its sector by 3.64% during the trading session. Despite today's positive movement, Monarch Networth Capital is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a challenging position in the market. Over the past month, the stock has experienced a decline of 23.22%, contrasting with the Sensex's decrease of 6.01%. In terms of day-to-day performance, Monarch Networth Capital Ltd recorded a 1-day increase of 3.37%, significantly outperforming the Sensex, which rose by only 0.79%. These metrics highlight the stock's current volatility and it...

Read More

Monarch Networth Capital Adjusts Evaluation Amid Declining Net Sales and Strong Fundamentals

2025-03-03 18:40:37Monarch Networth Capital, a small-cap finance and NBFC player, recently experienced an evaluation adjustment amid stable performance indicators. In Q3 FY24-25, the company reported net sales of Rs 76.65 crore, reflecting a decline. Despite this, it maintains strong long-term fundamentals and has consistently outperformed the BSE 500 index.

Read MoreMonarch Networth Capital Faces Significant Volatility Amid Challenging Market Conditions

2025-02-28 09:55:06Monarch Networth Capital, a small-cap player in the finance and non-banking financial company (NBFC) sector, has experienced significant volatility today. The stock opened with a notable loss of 5.05%, reflecting a challenging market environment. Throughout the trading session, Monarch Networth Capital underperformed its sector, showing a decline of 0.98% compared to its peers. The stock reached an intraday low of Rs 330, marking a 5.05% drop from the previous close. In terms of performance metrics, Monarch Networth Capital has seen a one-day decline of 3.02%, while the benchmark Sensex fell by 1.18% during the same period. Over the past month, the stock has faced a more pronounced downturn, with a decrease of 15.78%, contrasting sharply with the Sensex's decline of just 2.86%. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a ...

Read More

Monarch Networth Capital Shows Volatility Amid Broader Market Trends and Declines

2025-02-19 09:45:20Monarch Networth Capital, a small-cap finance and NBFC player, experienced notable trading activity, gaining 7.68% on February 19, 2025. Despite today's performance, the stock remains below key moving averages and has declined 18.83% over the past month, reflecting its volatility in the current market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEThe certificate under Regulation 74(5) of SEBI (Depository and Participants) Regulation 2018 is hereby submitted.

Closure of Trading Window

28-Mar-2025 | Source : BSEPlease find attached intimation of closure of trading window

Announcement under Regulation 30 (LODR)-Change in RTA

05-Mar-2025 | Source : BSEThe intimation regarding execution of Tripartite Agreement on March 03 2025 with New RTA and Old RTA is hereby submitted.

Corporate Actions

No Upcoming Board Meetings

Monarch Networth Capital Ltd has declared 10% dividend, ex-date: 02 Aug 24

No Splits history available

Monarch Networth Capital Ltd has announced 1:1 bonus issue, ex-date: 13 Sep 24

No Rights history available