Moneyboxx Finance Faces Technical Challenges Amidst Long-Term Resilience in Market Dynamics

2025-03-19 08:01:12Moneyboxx Finance, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 197.50, showing a slight increase from the previous close of 197.00. Over the past year, Moneyboxx Finance has experienced a 19.12% decline, contrasting with a 3.51% gain in the Sensex, highlighting the challenges faced by the company in a competitive landscape. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting a cautious market environment. Despite these challenges, Moneyboxx Finance has shown resilience over longer periods, with a re...

Read More

Moneyboxx Finance Hits New Low Amid Ongoing Sector Underperformance and Volatility

2025-02-24 10:40:18Moneyboxx Finance has hit a new 52-week low, experiencing significant volatility after two days of gains. The stock is trading below all major moving averages, indicating a bearish trend. Over the past year, it has declined notably, contrasting with the overall performance of the Sensex.

Read More

Moneyboxx Finance Faces Significant Stock Volatility Amidst Sector Underperformance

2025-02-18 15:05:16Moneyboxx Finance has faced significant volatility, hitting a new 52-week low of Rs. 174 and underperforming its sector. The stock has declined 12.19% over three days and 33.46% over the past year, while trading below key moving averages, signaling a sustained downward trend.

Read More

Moneyboxx Finance Faces Significant Volatility Amidst Sector Underperformance in October 2023

2025-02-14 14:05:34Moneyboxx Finance has seen notable volatility, hitting a new 52-week low after a brief period of gains. The stock has underperformed its sector over the past year, with a significant decline contrasting with broader market gains. It is currently trading below key moving averages, indicating a bearish trend.

Read More

Moneyboxx Finance Faces Sustained Downward Trend Amid Sector Underperformance

2025-02-12 10:05:55Moneyboxx Finance, a microcap in the NBFC sector, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has seen consecutive weekly losses and is trading below key moving averages, reflecting ongoing challenges in its market performance over the past year.

Read More

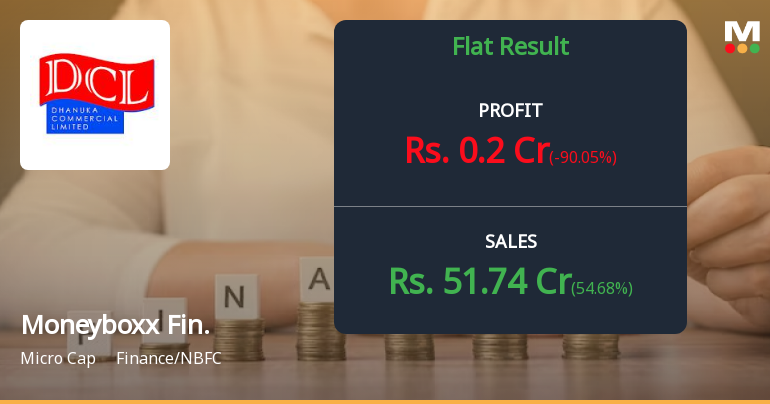

Moneyboxx Finance Reports Mixed Q3 Results Amid Strong Sales Growth and Declining Profits

2025-02-11 10:32:46Moneyboxx Finance's financial results for the quarter ending December 2024 show a mixed performance. While net sales grew significantly year-on-year, cash reserves reached a six-period high, and the debt-equity ratio improved, profits before and after tax declined sharply, indicating challenges in profitability.

Read More

Moneyboxx Finance Hits 52-Week Low Amidst Sector Underperformance and Volatility

2025-01-30 11:35:14Moneyboxx Finance has faced significant volatility, reaching a new 52-week low today. The stock has underperformed its sector and has seen a consecutive decline over the past two days. Its performance over the past year has been challenging, contrasting sharply with broader market gains.

Read More

Moneyboxx Finance Faces Sustained Weakness Amidst Sector Underperformance and Volatility

2025-01-28 11:35:15Moneyboxx Finance has faced significant volatility, hitting a new 52-week low and experiencing a downward trend for six consecutive days, resulting in a total loss of 10.1%. The company's stock performance has declined by over 20% in the past year, contrasting with broader market gains.

Read More

Moneyboxx Finance Faces Significant Volatility Amidst Broader Sector Declines

2025-01-27 14:35:14Moneyboxx Finance, a microcap in the NBFC sector, has reached a new 52-week low amid significant volatility, underperforming its sector. The stock has declined consecutively over the past five days and is trading below multiple moving averages, reflecting ongoing challenges in the market.

Read MoreUpdate On-Collection Efficiency Of Moneyboxx Finance Limited

08-Apr-2025 | Source : BSEPlease find enclosed herewith the update on collection efficiency of Moneyboxx Finance Ltd.

Announcement under Regulation 30 (LODR)-Change in Management

08-Apr-2025 | Source : BSEPlease find enclosed herewith intimation with respect to the above captioned subject. Please refer the attachment for details.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

07-Apr-2025 | Source : BSEPlease find enclosed herewith the intimation with respect to Allotment of ESOPs

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Moneyboxx Finance Ltd has announced 1:10 bonus issue, ex-date: 21 Nov 19

No Rights history available