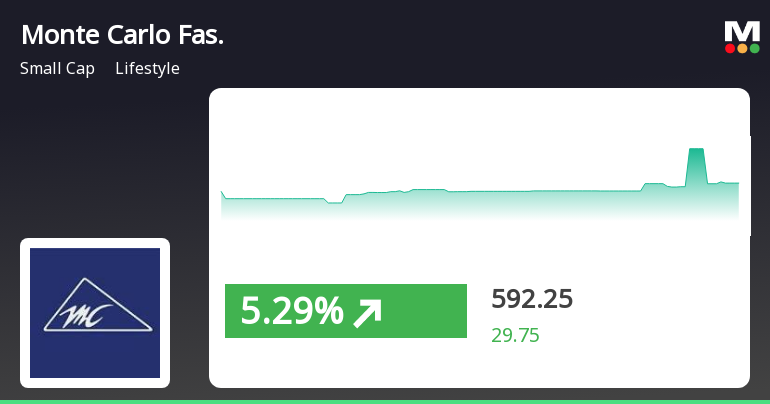

Monte Carlo Fashions Shows Strong Performance Amid Broader Market Volatility

2025-03-06 11:35:23Monte Carlo Fashions has experienced notable stock activity, outperforming its sector and achieving consecutive gains over two days. The stock opened strongly and reached a significant intraday high. In the broader market, the Sensex has seen a slight decline, while small-cap stocks are performing well.

Read More

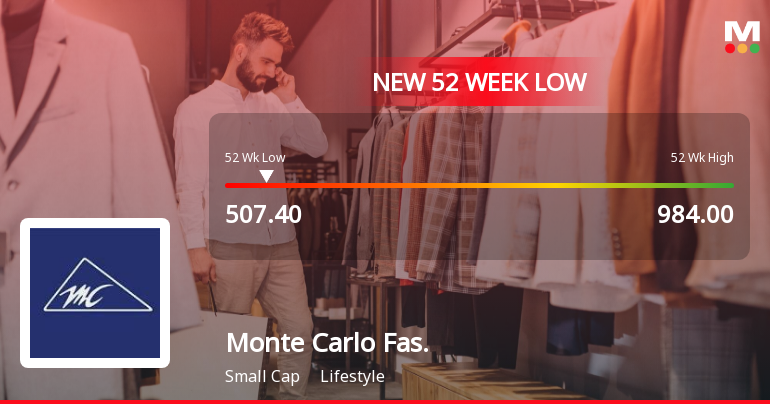

Monte Carlo Fashions Faces Volatility Amid Weak Fundamentals and High Dividend Yield

2025-03-04 10:22:03Monte Carlo Fashions has faced significant volatility, reaching a new 52-week low and underperforming compared to the Sensex over the past year. The stock shows intraday fluctuations and is trading below key moving averages. Long-term fundamentals appear weak, but it offers a high dividend yield that may appeal to income-focused investors.

Read More

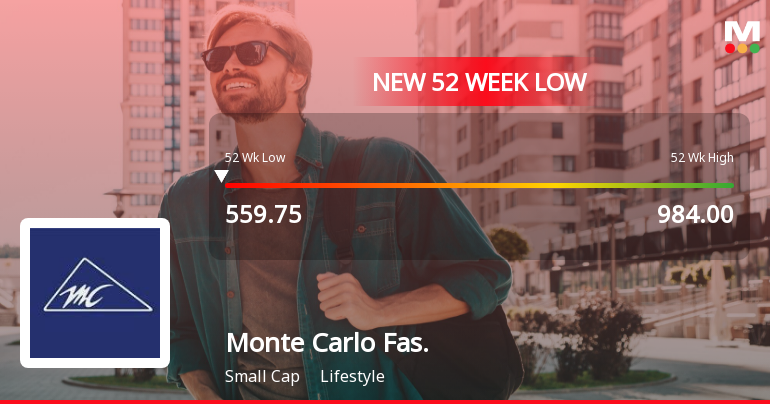

Monte Carlo Fashions Hits 52-Week Low Amid Ongoing Market Challenges

2025-03-03 09:37:17Monte Carlo Fashions has reached a new 52-week low, reflecting ongoing challenges in its market position. Despite a brief recovery during the day, the stock remains below key moving averages. The company offers a high dividend yield, which may attract specific investors amid its fluctuating performance.

Read More

Monte Carlo Fashions Faces Volatility Amidst Broader Market Trends and Dividend Yield Stability

2025-02-28 14:35:21Monte Carlo Fashions has reached a new 52-week low, experiencing a notable decline over the past five days. Despite this downturn, the company has outperformed its sector. It is trading below several moving averages and has seen a year-over-year performance drop, although it offers a high dividend yield.

Read MoreMonte Carlo Fashions Faces Market Challenges Amidst Long-Term Growth Resilience

2025-02-21 10:29:41Monte Carlo Fashions, a small-cap player in the lifestyle industry, has experienced notable fluctuations in its stock performance today. The company currently holds a market capitalization of Rs 1,314.10 crore, with a price-to-earnings (P/E) ratio of 17.96, significantly lower than the industry average of 154.22. Over the past year, Monte Carlo Fashions has seen a decline of 4.27%, contrasting with the Sensex, which has gained 3.76%. On a daily basis, the stock has dipped by 0.79%, while the Sensex fell by 0.50%. In the past week, however, Monte Carlo Fashions has shown a positive trend, rising by 2.23% compared to the Sensex's decline of 0.77%. Despite a challenging year-to-date performance of -21.25%, the company has demonstrated resilience over a longer horizon, with a 5-year growth of 166.72%, outpacing the Sensex's 83.03% increase. Technical indicators suggest a bearish sentiment in the short term, w...

Read More

Monte Carlo Fashions Faces Financial Struggles Amid Declining Profits and High Debt Levels

2025-02-20 18:10:46Monte Carlo Fashions has recently experienced a change in evaluation following a detailed review of its financial performance and market standing. The company reported stagnant results for Q3 FY24-25, with declining operating profits and challenges in managing debt, reflected in its high Debt to EBITDA ratio and low Return on Capital Employed.

Read More

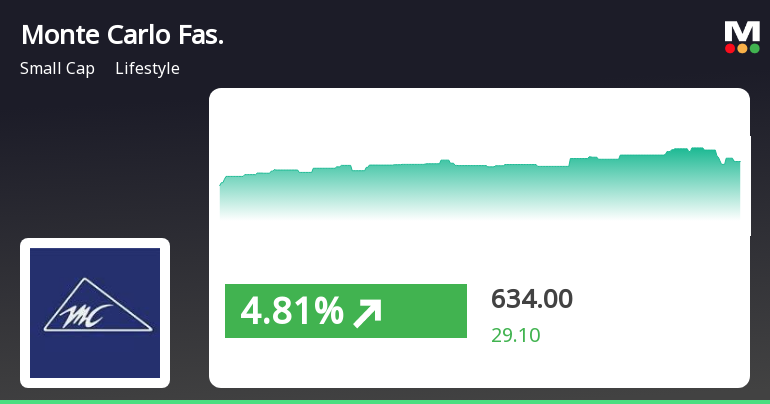

Monte Carlo Fashions Shows Strong Trading Momentum Amid Positive Lifestyle Sector Trends

2025-02-19 14:50:21Monte Carlo Fashions has experienced notable trading activity, achieving a significant gain on February 19, 2025, and outperforming its sector. The stock reached an intraday high, showing strong momentum, while the broader lifestyle sector also saw positive movement. The company offers a high dividend yield, attracting income-focused investors.

Read More

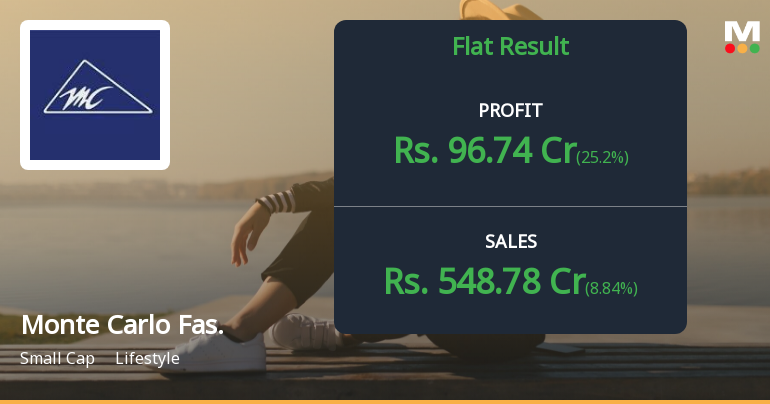

Monte Carlo Fashions Reports Flat Q3 FY24-25 Results Amid Positive Sales Trends

2025-02-11 21:36:59Monte Carlo Fashions has reported its Q3 FY24-25 financial results, highlighting record net sales and operating profit for the past five quarters. While profit before tax and profit after tax also reached new highs, the company faces rising interest expenses and a higher debt-equity ratio, indicating potential liquidity challenges.

Read More

Monte Carlo Fashions Faces Financial Challenges Amid Six Quarters of Declining Performance

2025-02-10 18:56:19Monte Carlo Fashions has recently experienced an evaluation adjustment reflecting its challenging financial situation, marked by six consecutive quarters of negative results. Key performance indicators have declined, and the company faces difficulties in generating returns on capital, contributing to cautious market sentiment and limited investment interest from domestic mutual funds.

Read MoreDisclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Parshav Investment & Trading Company Ltd

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Parshav Investment & Trading Company Ltd & Other

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Girnar Investment Ltd & Others

Corporate Actions

No Upcoming Board Meetings

Monte Carlo Fashions Ltd has declared 200% dividend, ex-date: 13 Sep 24

No Splits history available

No Bonus history available

No Rights history available