Morepen Laboratories Sees Surge in Trading Volume and Investor Participation

2025-03-19 10:00:11Morepen Laboratories Ltd, a small-cap player in the Pharmaceuticals & Drugs industry, has emerged as one of the most active stocks today, with a total traded volume of 30,628,625 shares and a traded value of approximately Rs 1,468.95 crore. The stock opened at Rs 43.97 and reached a day high of Rs 50.50, closing at Rs 48.28, reflecting a 1.92% increase for the day. Over the past two days, Morepen Laboratories has shown a notable upward trend, gaining 16.25% in returns. The stock has outperformed its sector by 3.11%, indicating strong relative performance. Additionally, the delivery volume on March 18 reached 58.42 lakh shares, marking a significant increase of 254.73% compared to the five-day average delivery volume, suggesting rising investor participation. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages....

Read MoreMorepen Laboratories Sees Surge in Trading Volume Amid Market Sentiment Shift

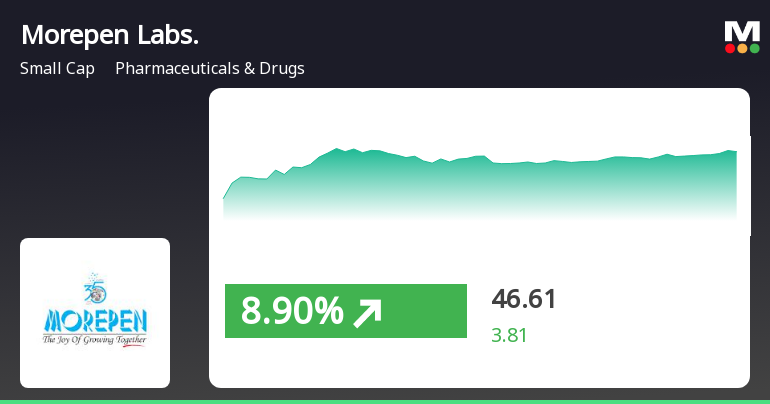

2025-03-18 11:00:05Morepen Laboratories Ltd, a small-cap player in the Pharmaceuticals & Drugs industry, has emerged as one of the most active equities by volume today. The stock, trading under the symbol MOREPENLAB, saw a total traded volume of 5,993,086 shares, with a total traded value of approximately Rs 27.44 crore. Opening at Rs 43.97, Morepen Laboratories experienced a notable gain of 2.64% at the start of the trading session. The stock reached an intraday high of Rs 47.75, reflecting an increase of 11.46% during the day. This performance marks a significant trend reversal, as the stock has gained after five consecutive days of decline. In terms of performance metrics, Morepen Laboratories outperformed its sector by 8.97%, with a one-day return of 10.41%. The stock's liquidity remains robust, with a delivery volume of 193,200 shares on March 17, which is up 27.57% compared to the five-day average. Overall, Morepe...

Read More

Morepen Laboratories Shows Potential Trend Reversal Amid Broader Market Gains

2025-03-18 09:35:22Morepen Laboratories experienced notable activity, gaining 9.35% after a series of declines. The stock outperformed its sector and opened positively, reflecting resilience despite recent volatility. While it remains below several key moving averages, its long-term performance shows significant growth over the past five years.

Read MoreMorepen Laboratories Faces Year-to-Date Challenges Amid Broader Market Trends

2025-02-20 11:57:09Morepen Laboratories, a small-cap player in the Pharmaceuticals & Drugs sector, has shown notable activity today with a 1.68% increase in its stock price, contrasting with a slight decline in the Sensex, which fell by 0.29%. Despite this daily uptick, the company's performance over the past month has been challenging, with a decline of 25.63%, significantly underperforming the Sensex's drop of 1.76%. The company's market capitalization stands at Rs 2,863.00 crore, and it currently has a price-to-earnings (P/E) ratio of 22.57, which is below the industry average of 36.44. Over the past year, Morepen Laboratories has experienced a decline of 2.60%, while the Sensex has gained 3.64%. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows bullish tendencies. Moving averages indicate a bearish trend on a daily basis. Overall, Morepen Laboratories has faced a challenging yea...

Read More

Morepen Laboratories Faces Continued Stock Decline Amid Sector Weakness in February 2025

2025-02-14 14:16:02Morepen Laboratories has faced a notable decline in its stock price, dropping significantly today and continuing a downward trend over the past week. The stock is currently trading below multiple moving averages, indicating a bearish performance, and has underperformed compared to both its sector and the broader market.

Read More

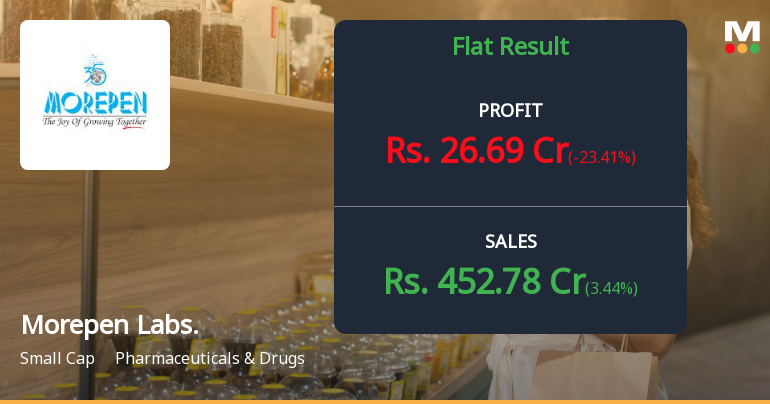

Morepen Laboratories Faces Financial Challenges Amidst Flat Quarterly Performance

2025-02-11 18:00:32Morepen Laboratories has recently experienced a change in evaluation amid flat financial performance for the quarter ending December 2024. The company reported a decline in profit after tax and operating profit metrics, while maintaining a low debt-to-equity ratio. Valuation metrics suggest an attractive position relative to historical averages.

Read More

Morepen Laboratories Reports Mixed Financial Results Amid Operational Challenges for Q4 2024

2025-02-06 17:23:54Morepen Laboratories recently released its financial results for the quarter ending December 2024, showcasing a strong Debtors Turnover Ratio but facing challenges with declining Profit Before Tax and Profit After Tax. The company also reported lower Operating Profit and Earnings per Share, indicating a complex financial situation.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEPlease find enclosed press release titled Morepen secured Loratadine approval for export to China.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEPlease find enclosed press release titled Morepen secured Loratadine approval for export to China.

Announcement under Regulation 30 (LODR)-Acquisition

31-Mar-2025 | Source : BSEAcquisition of Common Stock by Morepen Bio Inc. a Wholly owned subsidiary

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available