MRF Adjusts Valuation Grade Amidst Challenging Market Performance and Peer Comparisons

2025-03-28 08:00:22MRF, a prominent player in the Tyres & Allied industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 113,900.00, slightly down from the previous close of 114,100.00. Over the past year, MRF has experienced a stock return of -13.64%, contrasting with a 6.32% return from the Sensex, indicating a challenging performance relative to the broader market. Key financial metrics for MRF include a PE ratio of 27.55 and an EV to EBITDA ratio of 12.34, which provide insight into its valuation compared to peers. Notably, Balkrishna Industries is positioned at a higher valuation level with a PE ratio of 27.87 and an EV to EBITDA of 20.13, while Apollo Tyres shows a more attractive valuation with a PE of 20.13 and an EV to EBITDA of 8.26. MRF's return on capital employed (ROCE) is reported at 14.62%, and its return on equity (ROE) sta...

Read MoreMRF Ltd. Sees Surge in Open Interest Amid Increased Trading Activity

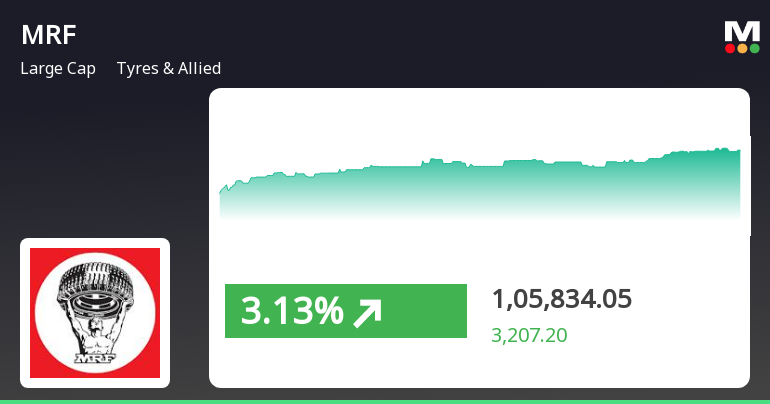

2025-03-26 15:00:22MRF Ltd., a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 22,411 contracts, up from the previous 20,213, marking a change of 2,198 contracts or an increase of 10.87%. The trading volume for the day reached 10,115 contracts, contributing to a futures value of approximately Rs 42,235.35 lakhs and an options value of Rs 1,605,119.73 lakhs, bringing the total value to Rs 42,304.52 lakhs. In terms of performance, MRF has been on a positive trajectory, gaining for the last eight consecutive days with a total return of 9.3% during this period. The stock's current price performance aligns with sector trends, showing a 1D return of 0.39%, compared to the sector's return of 0.17% and the Sensex's decline of 0.61%. MRF's liquidity remains robust, with a delivery volume of 2.88k ...

Read MoreMRF Ltd. Sees Surge in Open Interest, Indicating Increased Trading Activity

2025-03-25 15:00:34MRF Ltd., a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 22,719 contracts, up from the previous 20,589, marking a change of 2,130 contracts or a 10.35% increase. The trading volume for the day reached 15,967 contracts, contributing to a futures value of approximately Rs 50,569.70 lakhs. In terms of performance, MRF has outperformed its sector by 1.06% today, with a 1D return of 0.44%. The stock has shown consistent gains over the past week, accumulating a total return of 9.07%. MRF's current price is above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Additionally, the stock's delivery volume of 2.49k on March 24 has increased by 2.44% compared to the 5-day average, indicating rising investor partic...

Read More

MRF Faces Technical Shift Amid Declining Profits and Rising Interest Expenses

2025-03-21 08:01:56MRF, a key player in the Tyres & Allied industry, has recently experienced a change in its evaluation, reflecting a shift in its technical trend. The company's latest quarterly results show a decline in profit after tax and increased interest expenses, highlighting ongoing challenges despite its strong market position.

Read MoreMRF Stock Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-21 08:01:39MRF, a prominent player in the Tyres & Allied industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 111,074.30, showing a notable increase from the previous close of 110,100.00. Over the past week, MRF has demonstrated a stock return of 6.46%, outperforming the Sensex, which recorded a return of 3.41% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish on a monthly scale. Bollinger Bands and moving averages also reflect a mildly bearish sentiment in the short term. Looking at the company's performance over various time frames, MRF has faced challenges, with a year-to-date return of -14.72%, contrasting with the Sensex's -2.29%. However, the long-term o...

Read More

MRF Ltd. Shows Signs of Potential Trend Reversal Amid Ongoing Market Challenges

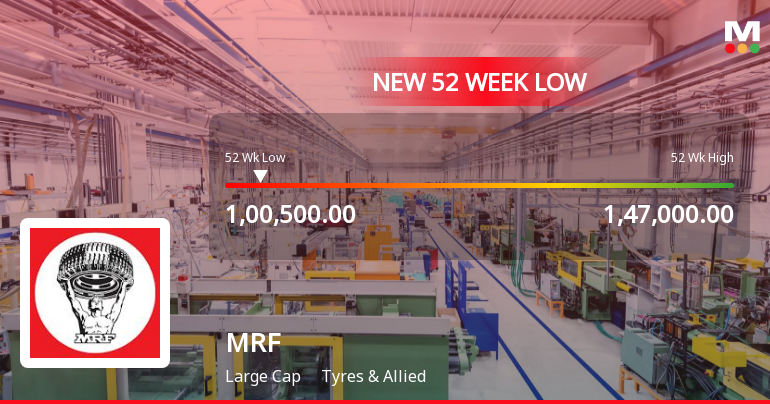

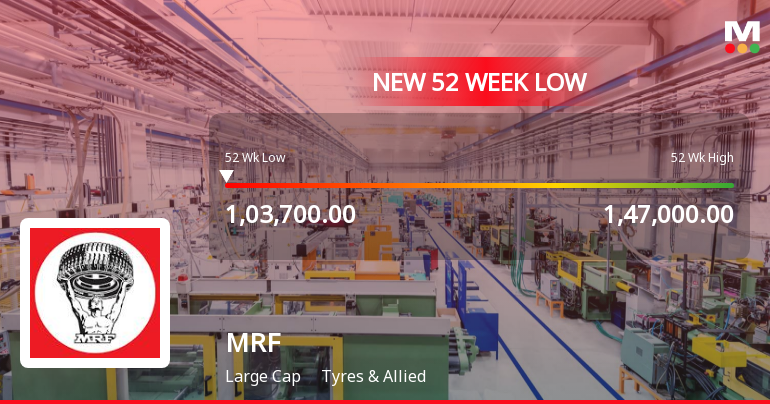

2025-03-05 15:50:27MRF Ltd. experienced notable stock activity on March 5, 2025, recovering from a 52-week low earlier in the day. Despite today's gains, the stock remains below key moving averages and has faced recent declines. Over the past three years, MRF has outperformed the Sensex significantly.

Read More

MRF Ltd. Hits 52-Week Low Amid Declining Profit and Rising Interest Expenses

2025-03-05 09:44:58MRF Ltd., a key player in the Tyres & Allied industry, has reached a new 52-week low, reflecting a challenging year with a 28.70% decline in stock value. The company reported a 35.2% drop in profit after tax for the December quarter, while maintaining a low debt-to-equity ratio and significant market capitalization.

Read More

MRF Ltd. Faces Financial Challenges Amidst Stock Decline and Sector Underperformance

2025-03-05 09:44:55MRF Ltd., a key player in the Tyres & Allied industry, has reached a new 52-week low amid concerns over its financial performance, including a significant drop in PAT and rising interest expenses. Despite these challenges, the company maintains a low debt-to-equity ratio and a strong market presence.

Read More

MRF Ltd. Hits 52-Week Low Amid Broader Market Decline and Poor Performance

2025-03-04 11:37:31MRF Ltd., a key player in the Tyres & Allied industry, has reached a new 52-week low amid a broader market decline. Over the past year, the company's stock has dropped significantly, underperforming the market. Despite recent financial challenges, MRF maintains a low debt-to-equity ratio and a notable market share.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation of trading window closure

Annual Debenture Interest Payment Intimation

24-Feb-2025 | Source : BSEDetails attached

Code Of Practices And Procedures For Fair Disclosure Of Unpublished Price Sensitive Information

07-Feb-2025 | Source : BSEAmended Code attached

Corporate Actions

No Upcoming Board Meetings

MRF Ltd. has declared 30% dividend, ex-date: 14 Feb 25

No Splits history available

No Bonus history available

No Rights history available