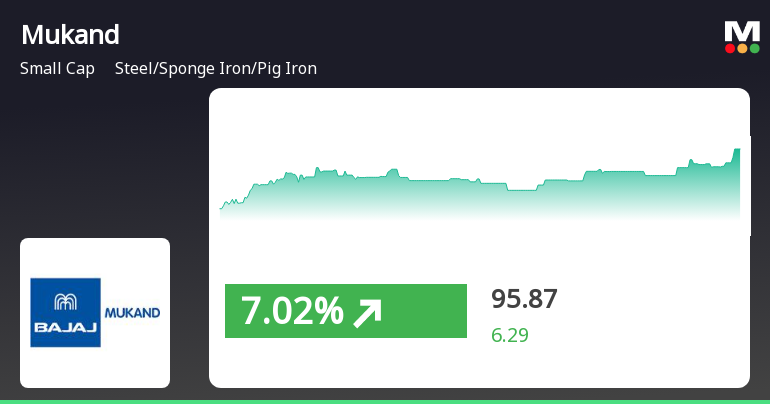

Mukand Ltd's Stock Rebounds Amid Broader Market Decline, Signaling Potential Trend Shift

2025-04-01 15:50:19Mukand Ltd, a small-cap company in the steel industry, has experienced a notable performance today, reversing a five-day decline. Despite a broader market downturn, Mukand's weekly performance has been positive, although it has faced challenges over the past year. Its five-year growth significantly outpaces the market average.

Read More

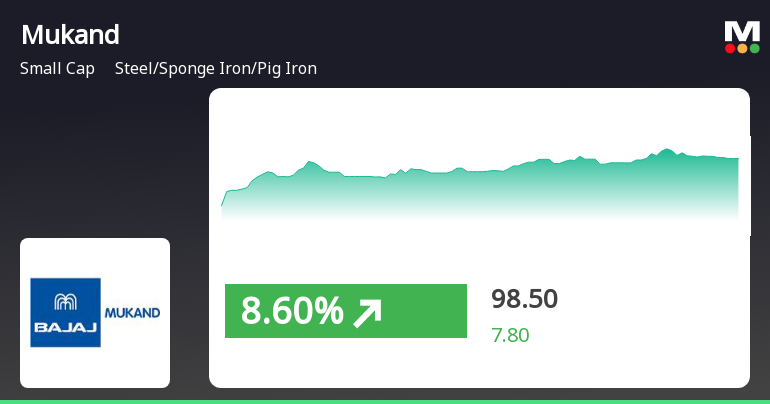

Mukand's Recent Gains Highlight Diverging Trends in Small-Cap Steel Sector Performance

2025-03-19 10:20:21Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has experienced notable trading activity, achieving significant gains today. The stock has outperformed its sector recently, while its longer-term performance reflects a decline. The broader market shows positive movement, particularly in the small-cap segment.

Read More

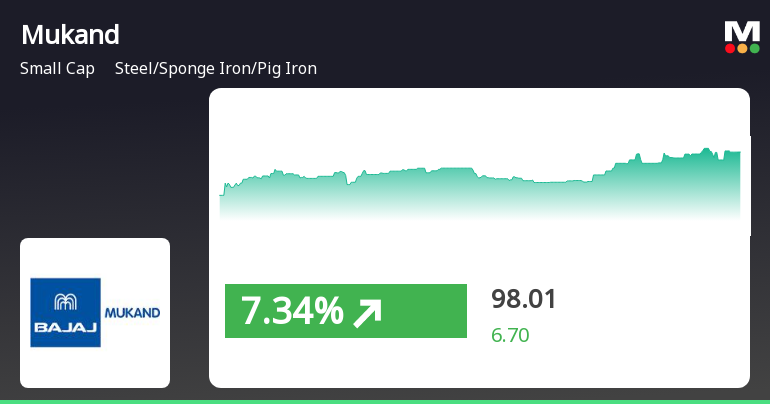

Mukand's Recent Gains Highlight Small-Cap Resilience Amid Broader Market Trends

2025-03-05 15:50:29Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, experienced significant activity on March 5, 2025, with a notable increase in its stock price. Despite recent gains, the stock has declined over the past month and year-to-date, contrasting with the overall market performance.

Read More

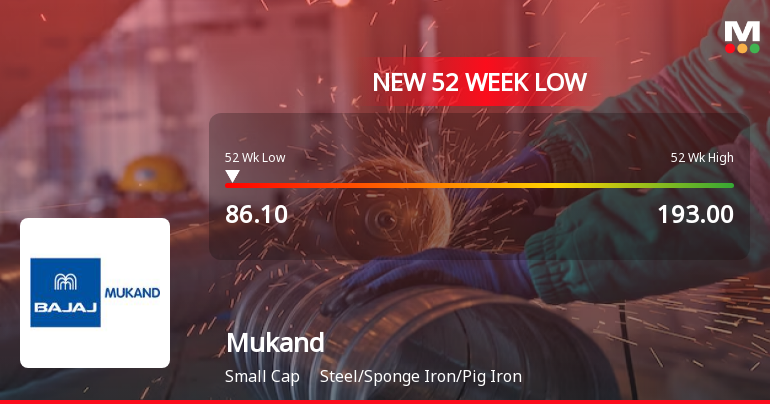

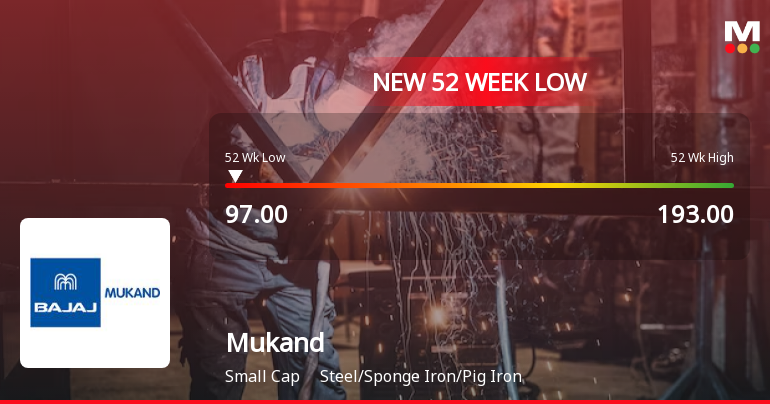

Mukand Faces Continued Volatility Amid Broader Market Challenges and Declining Performance

2025-03-03 10:36:31Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has faced notable volatility, hitting a new 52-week low. The stock has declined for five consecutive days, underperforming its sector and trading below key moving averages, reflecting ongoing challenges in the market and a significant year-over-year drop.

Read More

Mukand Faces Significant Challenges Amid Broader Steel Industry Pressures

2025-02-28 09:38:23Mukand, a small-cap company in the steel industry, has hit a new 52-week low, reflecting significant volatility and a 9.33% decline over four days. The stock is trading below key moving averages and has dropped 43.82% over the past year, contrasting with the Sensex's modest gain.

Read More

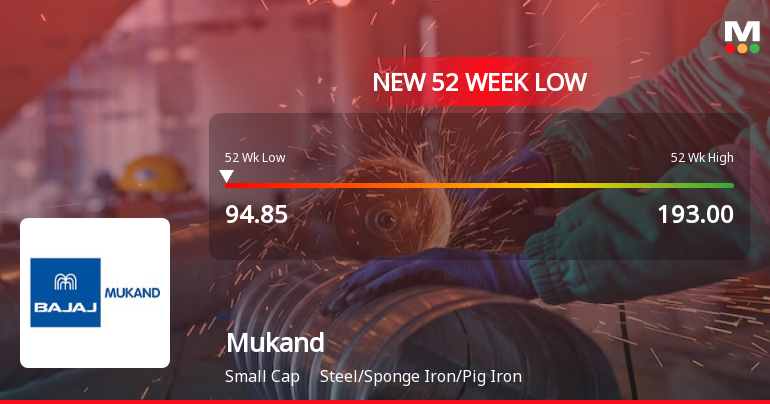

Mukand Faces Persistent Downward Trend Amidst Industry Volatility and Underperformance

2025-02-27 14:05:26Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low, reflecting significant volatility. The stock has underperformed its sector and has seen a consistent decline over the past three days, with a notable drop in its long-term performance compared to the Sensex.

Read More

Mukand Shows Signs of Trend Reversal Amid Ongoing Market Volatility

2025-02-19 11:05:34Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has seen a notable trend reversal after three days of decline, reaching an intraday high. However, its performance over the past year remains weak, with significant losses compared to the broader market, and it continues to trade below key moving averages.

Read More

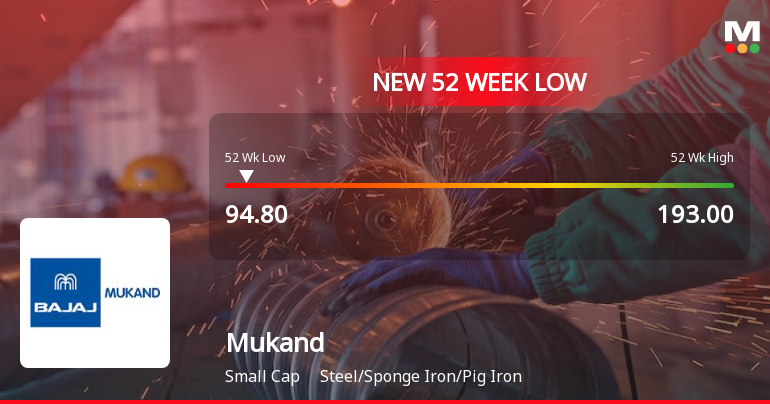

Mukand Faces Significant Volatility Amid Broader Industry Challenges and Declining Performance

2025-02-18 11:55:52Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its industry. The stock has declined nearly 10% over three days and has dropped over 43% in the past year, indicating ongoing market challenges.

Read More

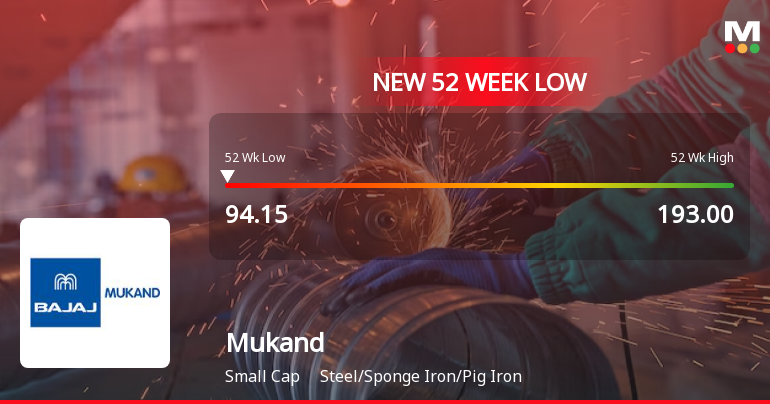

Mukand Stock Hits 52-Week Low Amid Sustained Downward Trend in Steel Sector

2025-02-17 10:06:21Mukand, a small-cap company in the Steel/Sponge Iron/Pig Iron sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges. Over the past year, it has declined notably compared to the Sensex.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith a Certificate issued under Regulation 74(5) of SEBI (DP) Regulations 2018 by KFin Technologies Ltd. the Registrar and Share Transfer Agent of the Company for the quarter ended March 31 2025.

Format of the Annual Disclosure to be made by an entity identified as a LC - Annexure B2

04-Apr-2025 | Source : BSEFormat of the Annual Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Mukand Ltd |

| 2 | CIN NO. | L99999MH1937PLC002726 |

| 3 | Report filed for FY | 2024-2025 |

| Details of the Current block (all figures in Rs crore): | ||

| 4 | 2 - year block period (Specify financial years)* | N.A. |

| 5 | Incremental borrowing done in FY (T)(a) | 0.00 |

| 6 | Mandatory borrowing to be done through debt securities in FY (T) (b) = (25% of a) | 0.00 |

| 7 | Actual borrowing done through debt securities in FY (T)(c) | 0.00 |

| 8 | Shortfall in the borrowing through debt securities if any for FY (T - 1) carried forward to FY (T) (d) | 0 |

| 8 | Quantum of (d) which has been met from (c)(e)* | 0 |

| 9 | Shortfall if any in the mandatory borrowing through debt securities for FY (T) { after adjusting for any shortfall in borrowing for FY(T - 1) which was carried forward to FY(T)}(f) = (b) - [(c) - (e)]{ If the calculated value is zero or negative write nil}* | 0 |

| Details of penalty to be paid if any in respect to previous block (all figures in Rs crore): | |

| 2 - year Block period (Specify financial years) | N.A. |

| Amount of fine to be paid for the block if applicable Fine = 0.2% of {(d) - (e)}# | 0.00 |

| Name of the Company Secretary :- | RAJENDRA D SAWANT |

| Designation :- | Company Secretary and Compliance Officer |

| Name of the Chief Financial Officer :- | DHANESH K GORADIA |

| Designation : - | CHIEF FINANCIAL OFFICER |

Date: 04/04/2025

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

04-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Mukand Ltd |

| 2 | CIN NO. | L99999MH1937PLC002726 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 1553.80 |

| 4 | Highest Credit Rating during the previous FY | BBB+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: rajendrasawant@mukand.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: dhaneshkg@mukand.com

Date: 04/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Corporate Actions

No Upcoming Board Meetings

Mukand Ltd has declared 20% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

Mukand Ltd has announced 1:1 rights issue, ex-date: 10 Feb 14