Mukka Proteins Faces Technical Trend Challenges Amid Market Evaluation Revision

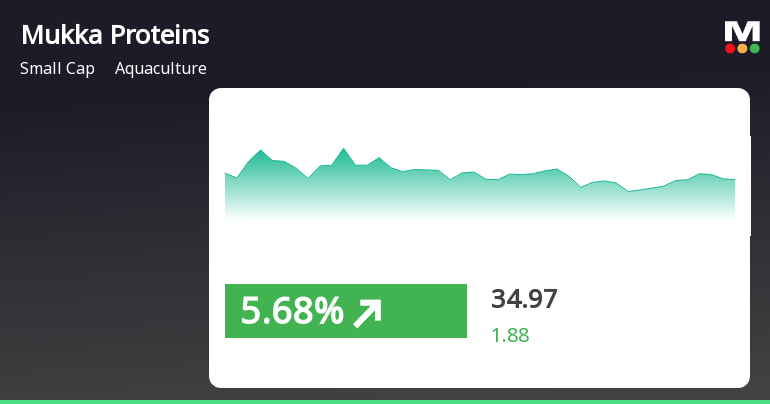

2025-04-02 08:10:47Mukka Proteins, a microcap company in the aquaculture industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 33.29, showing a slight increase from the previous close of 32.70. Over the past year, Mukka Proteins has experienced a decline of 13.37%, contrasting with a 2.72% gain in the Sensex during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly trend is yet to be determined. The Relative Strength Index (RSI) shows bullish momentum on a weekly basis, indicating some positive short-term sentiment. However, the Bollinger Bands suggest a mildly bearish outlook on a weekly timeframe. Daily moving averages also reflect a bearish trend, which may influence investor sentiment. The company's performance over various timeframes reveals a notable disparity when compared to the Sensex. For i...

Read MoreMukka Proteins Faces Mixed Technical Signals Amidst Market Underperformance

2025-04-01 08:03:45Mukka Proteins, a microcap player in the aquaculture industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 32.70, slightly down from the previous close of 32.80. Over the past year, Mukka Proteins has faced challenges, with a notable decline of 10.34% compared to a 5.11% increase in the Sensex, highlighting a significant underperformance relative to the broader market. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages also reflect a bearish trend. The weekly RSI indicates bullish momentum, contrasting with the overall bearish outlook from other indicators. The On-Balance Volume (OBV) shows a mildly bearish trend on a weekly basis but is mildly bullish on a monthly scale, indicating mixed signals in trading volume. The company's performance over various...

Read MoreMukka Proteins Adjusts Valuation Grade Amidst Competitive Aquaculture Landscape

2025-03-26 08:00:54Mukka Proteins, a small-cap player in the aquaculture industry, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 16.82, while its price-to-book value is recorded at 2.52. Additionally, Mukka Proteins shows an EV to EBIT of 16.68 and an EV to EBITDA of 14.27, indicating its operational efficiency relative to its enterprise value. Despite a challenging year, with a year-to-date return of -18.39%, Mukka Proteins has maintained a return on equity (ROE) of 11.02% and a return on capital employed (ROCE) of 7.85%. These figures suggest a stable performance in terms of profitability and capital utilization. In comparison to its peers, Mukka Proteins' valuation metrics highlight a competitive stance within the aquaculture sector. While the broader market, represented by the Sensex, has shown positive returns over var...

Read More

Mukka Proteins Faces Sales Decline Amid Adjusted Market Evaluation and Growth Potential

2025-03-21 08:04:09Mukka Proteins, a small-cap aquaculture company, has recently adjusted its evaluation amid challenges in quarterly performance, including a notable decline in net sales and profit after tax. Despite these difficulties, the company shows long-term growth potential, with historical sales growth and a solid return on capital employed.

Read MoreMukka Proteins Faces Mixed Technical Signals Amidst Challenging Market Conditions

2025-03-21 08:03:30Mukka Proteins, a small-cap player in the aquaculture industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 33.39, slightly down from the previous close of 34.00. Over the past year, Mukka Proteins has experienced a decline of 4.71%, contrasting with a 5.89% gain in the Sensex, highlighting a challenging performance relative to broader market trends. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the daily moving averages also reflect a bearish stance. Conversely, the weekly RSI indicates bullish momentum, suggesting some positive sentiment in the short term. The Bollinger Bands and Dow Theory metrics are leaning towards a mildly bearish outlook, indicating a cautious market sentiment. Mukka Proteins' recent performance has been mixed, with a slight gain of 0.3% over the past week, whil...

Read More

Mukka Proteins Shows Resilience Amid Broader Market Challenges and Mixed Trends

2025-03-06 09:35:32Mukka Proteins, a small-cap aquaculture company, experienced significant activity, outperforming its sector and reaching an intraday high. While its moving averages show mixed trends, the stock's performance contrasts with the broader market, which is facing bearish sentiment despite gains in small-cap stocks.

Read More

Mukka Proteins Reports December 2024 Results Highlighting Growth Amid Sales Challenges

2025-02-17 10:23:30Mukka Proteins has announced its financial results for the quarter ending December 2024, showcasing significant growth in Profit Before Tax and Profit After Tax compared to previous averages. However, the company faces challenges with a notable decline in net sales and rising interest expenses, indicating a mixed financial landscape.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIntimation of Trading Window Closure.

Announcement under Regulation 30 (LODR)-Acquisition

27-Mar-2025 | Source : BSEThe Board of Directors have approved to make a strategic investment in GSM Marine Export.

Announcement under Regulation 30 (LODR)-Acquisition

27-Mar-2025 | Source : BSEThe Board of Directors have approved to make a strategic investment in FABBCO Bio Cycle and Bio Protein Technology Private Limited.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available