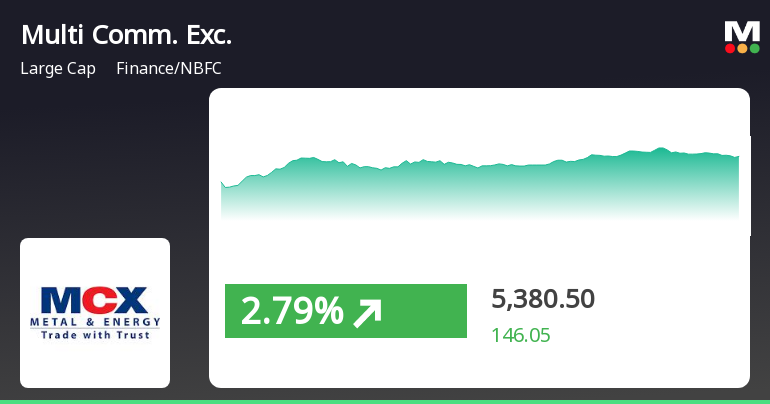

MCX Shows Resilience Amid Mixed Technical Signals and Market Dynamics

2025-04-03 08:04:40Multi Commodity Exchange of India (MCX), a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,380.00, showing a notable increase from the previous close of 5,234.45. Over the past year, MCX has demonstrated a robust performance, with a return of 50.54%, significantly outpacing the Sensex's return of 3.67% during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis while indicating a mildly bearish stance monthly. The Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish perspective monthly. The moving averages also reflect a mildly bearish trend on a daily basis. Despite the mixed technical signals, MCX has shown resilience, particularly over longer time frames, with a remarkable ...

Read More

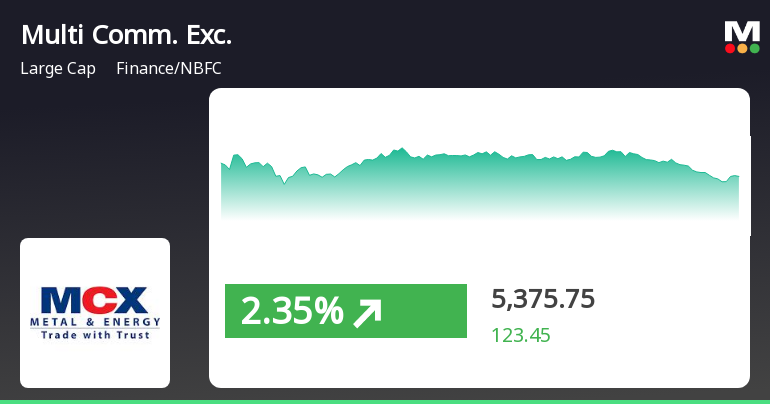

MCX Shows Strong Performance Amid Broader Market Gains and Mixed Trends

2025-04-02 11:05:18Multi Commodity Exchange of India (MCX) has demonstrated notable activity, outperforming its sector and reaching an intraday high. The stock is above several key moving averages, indicating a mixed trend. The broader market is also up, with the Sensex and BSE Mid Cap index showing positive momentum.

Read MoreMCX Faces Technical Trend Shifts Amidst Strong Long-Term Performance Metrics

2025-04-02 08:06:48Multi Commodity Exchange of India (MCX), a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,234.45, showing a slight decline from the previous close of 5,310.80. Over the past year, MCX has demonstrated a robust performance with a return of 46.87%, significantly outpacing the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD and KST are signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a mildly bullish outlook on a monthly basis. The moving averages also reflect a bearish sentiment, suggesting a cautious approach to the stock's performance. Despite the recent evaluation adjustm...

Read MoreMCX Experiences Technical Indicator Shifts Amid Mixed Performance Metrics

2025-04-01 08:02:32Multi Commodity Exchange of India (MCX), a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 5,310.80, slightly above the previous close of 5,252.30, with today's trading range between a high of 5,490.10 and a low of 5,270.00. The technical summary indicates a mixed performance across various metrics. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. Similarly, Bollinger Bands and KST reflect bearish signals weekly but are bullish monthly. The moving averages indicate a bearish stance on a daily basis, while the Dow Theory presents a mildly bullish outlook weekly and mildly bearish monthly. In terms of returns, MCX has demonstrated notable performance over the long term, with a staggering 413.69% increase over five years, ...

Read MoreMCX Demonstrates Strong Long-Term Growth Amid Short-Term Fluctuations in Market Performance

2025-03-28 18:00:20Multi Commodity Exchange of India Ltd (MCX), a prominent player in the Finance/NBFC sector, has shown significant activity today, reflecting its large-cap status with a market capitalization of Rs 27,471.00 crore. The stock's price-to-earnings (P/E) ratio stands at 52.85, notably higher than the industry average of 28.58, indicating a premium valuation relative to its peers. Over the past year, MCX has delivered an impressive performance, gaining 58.60%, significantly outpacing the Sensex, which has risen by just 5.11% during the same period. In the short term, the stock has experienced a daily increase of 1.11%, contrasting with a slight decline in the Sensex of 0.25%. However, the one-week performance shows a decrease of 2.57%, while the stock has gained 6.33% over the past month, compared to the Sensex's 5.76% rise. Long-term performance metrics are also noteworthy, with MCX achieving a remarkable 271....

Read MoreSurge in Open Interest Signals Increased Trading Activity for MCX Stock

2025-03-28 15:00:27Multi Commodity Exchange of India Ltd (MCX) has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 40,039 contracts, up from the previous 35,740, marking a change of 4,299 contracts or a 12.03% increase. The trading volume for the day reached 65,369 contracts, with a futures value of approximately Rs 57.17 crore. In terms of price performance, MCX has outperformed its sector by 1.53%, with the stock gaining 3.88% over the last two days. Today, it reached an intraday high of Rs 5,491, reflecting a 4.67% increase. While the stock is currently above its 5-day and 20-day moving averages, it remains below the 50-day, 100-day, and 200-day moving averages. Despite this positive momentum, there has been a decline in investor participation, with delivery volume dropping by 26.67% compared to the 5-day average. The stock's liquidity ...

Read MoreSurge in Open Interest Signals Increased Trading Activity for MCX Stock

2025-03-28 14:00:25Multi Commodity Exchange of India Ltd (MCX) has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 40,123 contracts, marking a rise of 4,383 contracts or 12.26% from the previous open interest of 35,740. The trading volume for the day reached 60,317 contracts, contributing to a total futures value of approximately Rs 51,792.47 lakhs and an options value of Rs 29,076.26 crore. In terms of price performance, MCX has outperformed its sector by 0.96% and has shown a consecutive gain over the last two days, with a total return of 3.12% during this period. The stock touched an intraday high of Rs 5,491, reflecting a 4.67% increase. While the stock is currently trading above its 20-day moving averages, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages. Despite a decline in delivery volume, which fell by 26.6...

Read MoreMCX has emerged as one of the most active stock calls today amid heightened options trading.

2025-03-28 11:00:07Multi Commodity Exchange of India Ltd (MCX) has emerged as one of the most active stocks today, particularly in the options market. The company, operating within the Finance/NBFC sector, has seen significant trading activity with 6,327 call contracts traded for an expiry date set for April 24, 2025, at a strike price of Rs 5,500. This activity has generated a turnover of approximately Rs 1,420.73 lakhs, while the open interest stands at 973 contracts, indicating a robust interest in this option. In terms of performance, MCX has outperformed its sector by 3.37%, marking a consecutive gain over the last two days with a total return of 6.06%. The stock reached an intraday high of Rs 5,491, reflecting a 4.67% increase for the day. Currently, the underlying value of MCX is Rs 5,449, which is higher than its 5-day, 20-day, 50-day, and 200-day moving averages, although it remains below the 100-day moving average....

Read More

MCX Outperforms Sector Amid Broader Market Fluctuations and Positive Yearly Growth

2025-03-28 10:05:19Multi Commodity Exchange of India (MCX) has demonstrated strong performance, gaining 4.5% on March 28, 2025, and outperforming its sector. The stock has shown a cumulative return of 5.95% over two days and has increased 62.57% over the past year, significantly exceeding the Sensex's growth.

Read MoreSettlement Order Passed On Subsidiary Company

01-Apr-2025 | Source : BSESettlement Order passed on Subsidiary Company

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Mar-2025 | Source : BSEIntimation of schedule of Analyst / Investor Meeting

Corporate Actions

No Upcoming Board Meetings

Multi Commodity Exchange of India Ltd has declared 76% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available