N G Industries Faces Mixed Signals Amid Financial Evaluation Adjustment

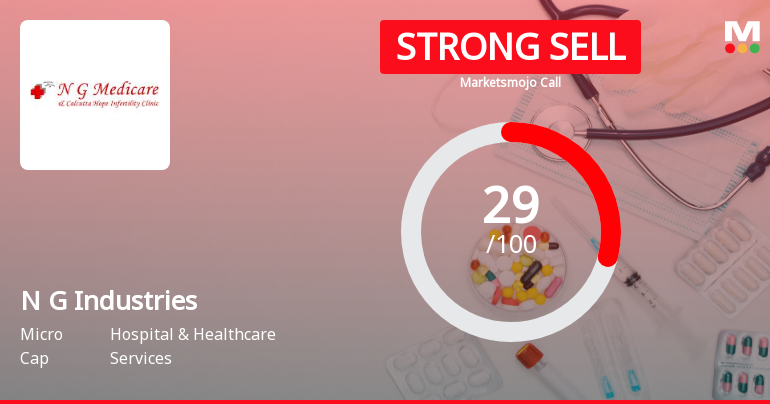

2025-04-02 08:35:44N G Industries, a player in the Hospital & Healthcare Services sector, has experienced a recent evaluation adjustment reflecting changes in its financial metrics. Key indicators like the PE ratio and ROE suggest a strong competitive position, while technical analysis reveals a more cautious market sentiment, highlighting a mix of strengths and challenges.

Read MoreN G Industries Adjusts Valuation Grade, Highlighting Unique Position in Healthcare Sector

2025-04-02 08:02:20N G Industries, a microcap player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings (PE) ratio stands at 4.70, while its price-to-book value is recorded at 1.36. Other key metrics include an EV to EBITDA ratio of 29.76 and a PEG ratio of 0.03, indicating a unique position within the industry. In terms of performance, N G Industries has shown varied returns compared to the Sensex. Over the past year, the company has achieved a return of 1.31%, while the Sensex has returned 2.72%. Notably, over a three-year period, N G Industries has outperformed the Sensex significantly, with a return of 159.79% compared to the index's 28.25%. When compared to its peers, N G Industries demonstrates a competitive edge, particularly in its valuation metrics. While some competitors exhibit higher PE...

Read More

N G Industries Faces Technical Shift Amid Mixed Financial Performance and Long-Term Concerns

2025-03-25 08:23:43N G Industries, a microcap in the Hospital & Healthcare Services sector, has recently seen a change in its evaluation, indicating a shift in its technical outlook. Despite a positive quarterly financial performance, the company faces long-term challenges, including declining operating profits and low returns on capital employed.

Read More

N G Industries Faces Mixed Financial Performance Amid Technical Trend Adjustments

2025-03-20 08:10:09N G Industries, a microcap in the Hospital & Healthcare Services sector, has experienced a recent evaluation adjustment. While it achieved a 6.79% return over the past year, challenges persist with long-term profit growth and debt servicing. Recent quarterly results show improvements, but technical indicators suggest a bearish trend.

Read More

N G Industries Reports Positive Quarterly Results Amid Long-Term Financial Challenges

2025-03-11 08:20:01N G Industries, a microcap in the Hospital & Healthcare Services sector, recently adjusted its evaluation following a positive third-quarter performance, reporting a profit after tax of Rs 6.71 crore. However, long-term growth challenges persist, including a declining CAGR in operating profits and difficulties in debt servicing.

Read More

N G Industries Reports Strong Quarterly Profit Amid Long-Term Growth Concerns

2025-03-03 18:59:01N G Industries, a microcap in the Hospital & Healthcare Services sector, recently reported a strong third-quarter performance for FY24-25, with a profit after tax of Rs 6.71 crore. However, the company faces long-term challenges, including declining operating profits and debt management issues, despite an attractive valuation profile.

Read More

N G Industries Reports Strong Q4 Results Amid Concerns Over Income Sources

2025-02-11 19:34:31N G Industries has announced its financial results for the quarter ending December 2024, revealing a significant increase in Profit After Tax (PAT) to Rs 6.71 crore, the highest in five quarters. The Earnings per Share (EPS) also improved to Rs 20.03, though a large portion of income stems from non-operating sources.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate Under Reg 74(5) of SEBI (DP) Regulation 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Feb-2025 | Source : BSEPublication of Unaudited Financial Results for the quarter and nine months ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

N G Industries Ltd has declared 35% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available