Nahar Industrial Enterprises Adjusts Valuation Grade Amid Competitive Textile Market Dynamics

2025-04-02 08:01:25Nahar Industrial Enterprises has recently undergone a valuation adjustment, reflecting its current standing in the textile industry. The company's price-to-earnings ratio is reported at 17.20, while its price-to-book value stands at 0.41. Key metrics such as the EV to EBIT ratio are at 34.43, and the EV to EBITDA ratio is noted at 11.82. The PEG ratio is particularly low at 0.09, indicating a potentially favorable growth outlook relative to its earnings. In comparison to its peers, Nahar Industrial Enterprises shows a competitive edge with its valuation metrics. For instance, Mafatlal Industries also holds a strong position with a PE ratio of 7.85, while Indo Rama Synthetic is currently facing challenges as it is loss-making. Other competitors like R&B Denims and Faze Three exhibit higher valuation ratios, suggesting that Nahar may be positioned favorably within the market. Despite recent fluctuations in ...

Read More

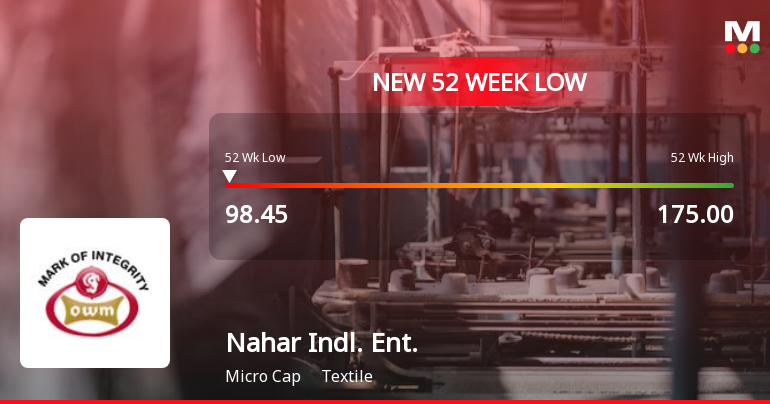

Nahar Industrial Enterprises Faces Declining Performance Amid Weak Fundamentals and Market Trends

2025-03-28 12:06:49Nahar Industrial Enterprises, a microcap textile firm, has reached a new 52-week low, continuing a four-day decline. The company has reported a significant annual return drop and weak long-term fundamentals, including low sales growth and profitability. Despite trading at a discount to peers, technical indicators suggest a bearish trend.

Read More

Nahar Industrial Enterprises Faces Continued Volatility Amid Weak Financial Fundamentals

2025-03-27 13:06:58Nahar Industrial Enterprises, a microcap textile firm, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and benchmark indices over the past year, with declining net sales and a low return on equity, indicating ongoing financial challenges and a bearish technical trend.

Read More

Nahar Industrial Enterprises Faces Significant Volatility Amidst Persistent Downward Trend

2025-03-03 10:36:11Nahar Industrial Enterprises, a microcap in the textile sector, has hit a new 52-week low of Rs. 93.1 amid significant volatility. The stock has underperformed its sector and experienced a 13.48% decline over the past five days, with a year-over-year drop of 31.11%.

Read More

Nahar Industrial Enterprises Hits New Low Amid Ongoing Downward Trend in Textile Sector

2025-02-28 10:05:51Nahar Industrial Enterprises, a microcap textile firm, reached a new 52-week low today, continuing a four-day decline. Despite this, it outperformed its sector slightly. Over the past year, the stock has dropped significantly, contrasting with the Sensex's modest gain, while technical indicators suggest a bearish trend.

Read More

Nahar Industrial Enterprises Faces Key Challenges Amidst Market Fluctuations and Sector Resilience

2025-02-19 10:55:16Nahar Industrial Enterprises, a microcap in the textile sector, is nearing its 52-week low, trading just above it. The stock showed some recovery today, outperforming its sector slightly, but remains below key moving averages. Over the past year, it has declined significantly compared to the broader market.

Read More

Nahar Industrial Enterprises Faces Persistent Bearish Sentiment Amid Sector Volatility

2025-02-18 13:05:36Nahar Industrial Enterprises, a microcap in the textile sector, has hit a new 52-week low, continuing a downward trend with an 11.84% decline over three days. The stock is trading below multiple moving averages and has decreased by 26.24% over the past year, contrasting with the Sensex's gains.

Read More

Nahar Industrial Enterprises Hits New Low Amid Ongoing Textile Sector Challenges

2025-02-17 10:05:58Nahar Industrial Enterprises, a microcap in the textile sector, reached a new 52-week low today, continuing a downward trend with a 5.16% decline over two days. The stock has struggled over the past year, down 21.52%, while the broader Sensex has gained 4.06%.

Read More

Nahar Industrial Enterprises Reports Mixed Financial Results Amid Rising Costs and Declining Profitability in February 2025

2025-02-15 12:43:24Nahar Industrial Enterprises has reported its financial results for the quarter ending December 2024, revealing a mixed performance. While net sales reached Rs 429.66 crore, the profit before tax declined significantly, and interest expenses rose, indicating challenges in profitability and increased borrowing costs. Non-operating income also surged, raising sustainability concerns.

Read MoreAnnouncement under Regulation 30 (LODR)-Acquisition

08-Apr-2025 | Source : BSEINTIMATION FOR INCORPORATION OF WHOLLY OWNED SUSBIDIARY

Closure of Trading Window

27-Mar-2025 | Source : BSECLOSURE OF TRADING WINDOW

Announcement under Regulation 30 (LODR)-Credit Rating

12-Mar-2025 | Source : BSEReview of Credit Rating

Corporate Actions

No Upcoming Board Meetings

Nahar Industrial Enterprises Ltd has declared 10% dividend, ex-date: 07 Sep 17

No Splits history available

No Bonus history available

No Rights history available