Nalwa Sons Investments Faces Valuation Shift Amid Mixed Financial Performance and Market Dynamics

2025-04-03 08:03:51Nalwa Sons Investments, a small-cap entity in the Finance/NBFC sector, has experienced a recent evaluation adjustment, reflecting changes in its financial metrics and market standing. The company's valuation grade has shifted, influenced by its performance, including a significant return over the past year despite challenges in net sales and profit.

Read MoreNalwa Sons Investments Shows Mixed Technical Trends Amidst Significant Stock Volatility

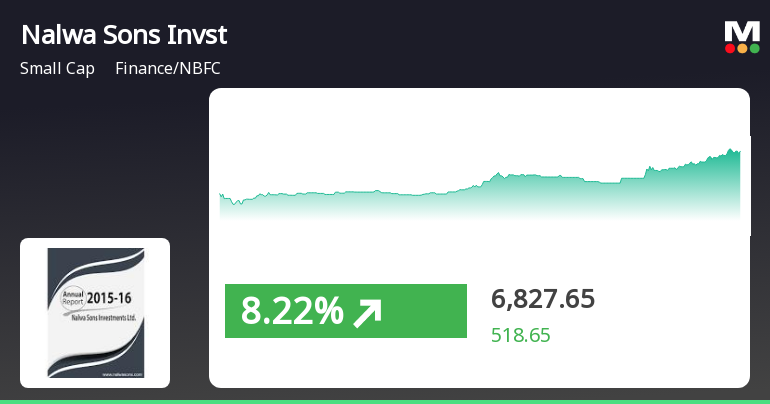

2025-04-03 08:02:46Nalwa Sons Investments, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 6,838.20, showing a notable increase from the previous close of 6,309.00. Over the past year, the stock has reached a high of 9,950.00 and a low of 3,020.25, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the monthly perspective appears bullish. The Bollinger Bands are bullish on both weekly and monthly charts, indicating potential upward momentum. However, the daily moving averages reflect a mildly bearish sentiment, which contrasts with the overall monthly bullish outlook. When comparing the company's performance to the Sensex, Nalwa Sons Investments has demonstrated impressive returns over various periods...

Read MoreNalwa Sons Investments Adjusts Valuation Amidst Competitive NBFC Landscape

2025-04-03 08:00:19Nalwa Sons Investments, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 6,838.20, reflecting a notable increase from the previous close of 6,309.00. Over the past year, Nalwa Sons has demonstrated impressive stock performance, with a return of 98.49%, significantly outpacing the Sensex's 3.67% return during the same period. Key financial metrics for Nalwa Sons include a PE ratio of 47.47 and an EV to EBITDA ratio of 35.09, indicating its market positioning within the industry. The company's return on capital employed (ROCE) is reported at 0.63%, while the return on equity (ROE) is at 0.48%. In comparison to its peers, Nalwa Sons Investments presents a mixed picture. While it holds a fair valuation, competitors like Indus Inf. Trust and Indostar Capital are positioned at a higher valuati...

Read More

Nalwa Sons Investments Shows Strong Performance Amid Broader Market Gains

2025-04-02 15:05:17Nalwa Sons Investments has demonstrated notable performance, gaining 7.7% on April 2, 2025, and achieving consecutive gains over two days. The stock has outperformed its sector and has shown strong returns over the past year, significantly exceeding the broader market's performance.

Read MoreNalwa Sons Investments Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:01:30Nalwa Sons Investments, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 6060.40, slightly down from the previous close of 6121.00. Over the past year, the stock has shown significant resilience, with a return of 80.14%, outperforming the Sensex, which recorded a return of 5.11% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands also reflect bearish tendencies weekly, contrasting with a bullish monthly perspective. Moving averages indicate a mildly bearish trend on a daily basis, while the KST presents a similar bearish outlook weekly but is bullish monthly. In terms of performance, Nalwa Sons Investments has demonstrated remarkable growth over longer p...

Read MoreNalwa Sons Investments Exhibits Strong Long-Term Growth Amid Recent Market Fluctuations

2025-03-28 18:00:14Nalwa Sons Investments Ltd, a small-cap player in the Finance/NBFC sector, has shown significant activity in the market today. The company's market capitalization stands at Rs 3,143.00 crore, with a price-to-earnings (P/E) ratio of 42.12, notably higher than the industry average of 8.62. Over the past year, Nalwa Sons Investments has delivered an impressive performance, gaining 80.14%, significantly outpacing the Sensex, which rose by only 5.11%. However, the stock has faced some challenges recently, with a decline of 0.99% today, compared to a slight drop of 0.25% in the Sensex. In the short term, the stock has experienced a 5.26% decrease over the past week, while it has shown a robust 26.87% increase over the last month. Year-to-date, the stock is down 21.83%, contrasting with the Sensex's minor decline of 0.93%. Long-term performance remains strong, with a remarkable 285.60% increase over three ye...

Read MoreNalwa Sons Investments Adjusts Valuation Grade, Highlighting Competitive Positioning in Finance Sector

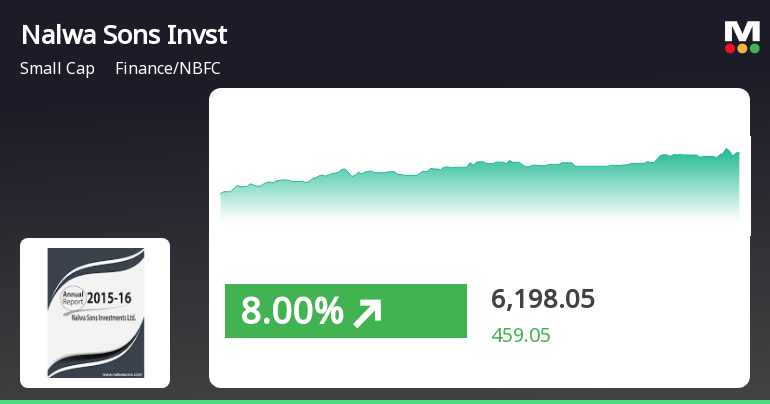

2025-03-27 08:00:22Nalwa Sons Investments, a small-cap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's current price stands at 6,152.00, with a notable 52-week range between 3,020.25 and 9,950.00. Key financial metrics reveal a PE ratio of 42.71 and an EV to EBITDA ratio of 31.54, indicating a robust valuation framework. The company's return on capital employed (ROCE) is recorded at 0.63%, while the return on equity (ROE) is at 0.48%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Nalwa Sons Investments presents a relatively attractive valuation profile. For instance, MAS Financial Services also holds an attractive valuation but with a significantly lower PE ratio of 15.57. Meanwhile, Indus Inf. Trust and Indostar Capital are positioned at a higher valuation tier, refle...

Read MoreNalwa Sons Investments Adjusts Valuation Amidst Competitive Finance Sector Landscape

2025-03-20 08:00:23Nalwa Sons Investments, a small-cap player in the Finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 6,265.55, reflecting a notable increase from the previous close of 5,739.00. Over the past year, Nalwa Sons has demonstrated a strong performance, with a return of 92.95%, significantly outpacing the Sensex's return of 4.77% during the same period. Key financial metrics reveal a PE ratio of 43.49 and an EV to EBITDA ratio of 32.13, indicating the company's market positioning. The price to book value is notably low at 0.19, which may suggest potential undervaluation relative to its assets. However, the company's return on capital employed (ROCE) and return on equity (ROE) are relatively modest at 0.63% and 0.48%, respectively. In comparison to its peers, Nalwa Sons Investments shows a higher PE ratio than several competitors, such as MAS Financial Servi...

Read More

Nalwa Sons Investments Shows Strong Performance Amid Broader Market Trends

2025-03-19 11:50:18Nalwa Sons Investments has experienced notable gains, outperforming its sector and achieving a total return of nearly 20% over the past four days. The stock has consistently surpassed its shorter-term moving averages, while also demonstrating impressive long-term growth, with significant increases over one, three, and five years.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

18-Mar-2025 | Source : BSEDisclosure under regulation 30 of the SEBI(Listing Obligations and Disclosure Requirements) Regulations 2015

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015.

18-Mar-2025 | Source : BSEDisclosure under Regulation 30 of the Securities and Exchange Board of India(Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available