Naperol Investments Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-25 08:04:11Naperol Investments, a microcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1042.20, showing a notable increase from the previous close of 870.00. Over the past year, Naperol has experienced a stock return of 20.95%, outperforming the Sensex, which recorded a return of 7.07% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while being mildly bullish on a monthly scale. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and moving averages suggest a mildly bearish trend, while the KST presents a contrasting bullish signal on a monthly basis. In terms of performance, Naperol's stock has demonstrated resilience over various time frames, particularly in the...

Read MoreNaperol Investments Adjusts Valuation Grade Amid Mixed Financial Metrics in Chemicals Sector

2025-03-25 08:00:40Naperol Investments, a microcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics. The company's price-to-earnings ratio stands at 16.91, while its price-to-book value is notably low at 0.66. Other key indicators include an EV to EBIT ratio of 12.79 and an EV to EBITDA ratio of 8.90, suggesting a competitive positioning within its sector. Despite a challenging year-to-date performance, where the stock has returned -13.15%, Naperol has shown resilience over longer periods, with a one-year return of 20.95%. In comparison to its peers, Naperol's valuation metrics present a mixed picture. For instance, while it maintains a lower EV to EBITDA ratio than some competitors, its price-to-earnings ratio is significantly lower than that of Shivalik Rasayan, which is categorized differently. Overall, Naperol's recent evaluation revision highli...

Read MoreNaperol Investments Ltd Experiences Surge Amid Strong Buying Activity and Market Rebound

2025-03-24 10:20:12Naperol Investments Ltd is witnessing significant buying activity, with the stock surging by 19.79% today, notably outperforming the Sensex, which rose by only 0.88%. This marks a strong rebound after two consecutive days of decline, indicating a potential trend reversal. The stock opened with a gap up of 3.45% and reached an intraday high of Rs 1040, reflecting a 19.54% increase from the previous close. Over the past week, Naperol Investments has gained 24.40%, compared to the Sensex's 4.60% rise, and its one-month performance shows a 24.81% increase against the Sensex's 4.20%. However, the stock has faced challenges over longer periods, with a three-year decline of 38.68% relative to the Sensex's 34.70% gain. The current buying pressure may be attributed to various factors, including market sentiment and potential developments within the chemicals industry. The stock's volatility today was notable, with...

Read More

Naperol Investments Faces Significant Volatility Amid Declining Financial Performance

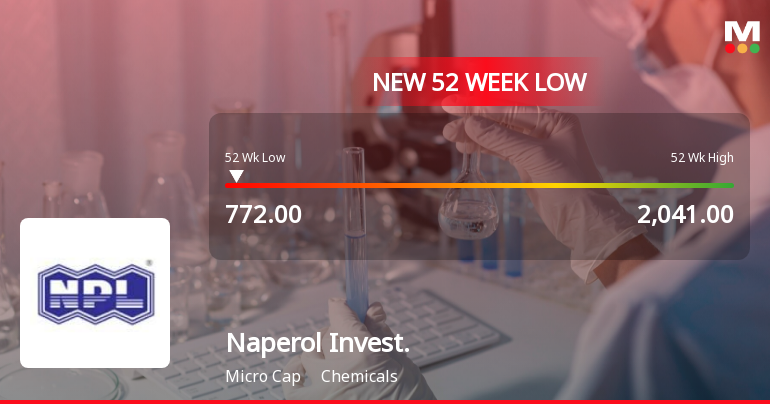

2025-03-05 09:50:33Naperol Investments, a microcap in the chemicals sector, has hit a new 52-week low, reflecting significant volatility. The company has faced a 19.51% decline over the past year, with net sales and operating profit sharply decreasing. Its low return on equity and bearish technical indicators raise concerns about its financial health.

Read More

Naperol Investments Faces Significant Financial Challenges Amidst Market Volatility

2025-03-05 09:50:31Naperol Investments, a microcap in the chemicals sector, has reached a new 52-week low, reflecting significant volatility. The stock has underperformed its sector and experienced a notable decline over the past year. Financial metrics indicate a concerning trend, with substantial decreases in net sales and operating profit.

Read More

Naperol Investments Faces Significant Volatility Amid Declining Financial Metrics and Sector Underperformance

2025-03-05 09:50:31Naperol Investments, a microcap in the chemicals sector, has reached a new 52-week low, underperforming its industry. The stock has declined significantly over the past year, with troubling financial metrics including a sharp drop in net sales and operating profit. Despite a low debt-to-equity ratio, its valuation appears high relative to peers.

Read More

Naperol Investments Faces Significant Volatility Amid Declining Financial Metrics and Market Performance

2025-03-05 09:50:29Naperol Investments, a microcap in the chemicals sector, has reached a new 52-week low, underperforming its industry. The stock has declined significantly over the past year, with troubling financial metrics including a sharp drop in net sales and operating profit, alongside a low return on equity.

Read More

Naperol Investments Faces Market Challenges Amid Signs of Potential Trend Reversal

2025-03-03 10:07:48Naperol Investments, a microcap in the chemicals sector, reached a new 52-week low today but has shown signs of a potential trend reversal after four days of decline. Despite outperforming its sector recently, the stock has faced a challenging year, down 21.13% compared to the Sensex.

Read More

Naperol Investments Hits 52-Week Low Amid Broader Market Trends and Sector Resilience

2025-02-28 10:06:09Naperol Investments, a microcap in the chemicals sector, has reached a new 52-week low of Rs. 797, reflecting a 20.24% decline over the past year. Despite recent struggles, the stock has shown some resilience today, outperforming its sector, though it remains below key moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the qurter ended March 31 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEThis is to inform that the Trading Window in respect of the Companys Securities will remain closed for Designated Persons & their immediate relatives with effect from April 01 2025 till 48 hours after the declaration of Audited Financial Results of the Company for the quarter and year ending March 31 2025.

Board Meeting Outcome for Declaration Of Interim Dividend For FY 2024-25

21-Mar-2025 | Source : BSEWe wish to inform the Exchange that the Board of Directors at its meeting held today i.e. March 21 2025 have considered and declared interim dividend for the financial year 2024-25 of Rs. 9.00/- per equity share i.e. 90% of face value of Rs.10/- per equity share. Further the Board of Directors have fixed Thursday March 27 2025 as the Record Date to determine the eligibility of shareholders to receive the aforesaid interim dividend.

Corporate Actions

No Upcoming Board Meetings

Naperol Investments Ltd has declared 90% dividend, ex-date: 27 Mar 25

Naperol Investments Ltd has announced 10:100 stock split, ex-date: 26 May 06

Naperol Investments Ltd has announced 3:2 bonus issue, ex-date: 26 May 06

No Rights history available