Natco Pharma Outperforms Sector Amid Broader Market Decline and Long-Term Challenges

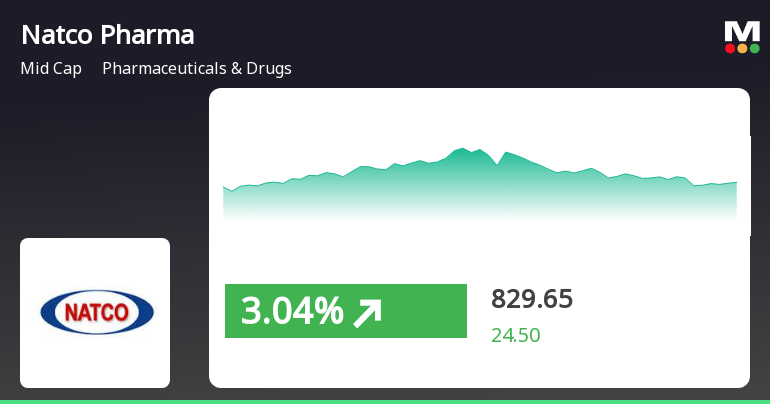

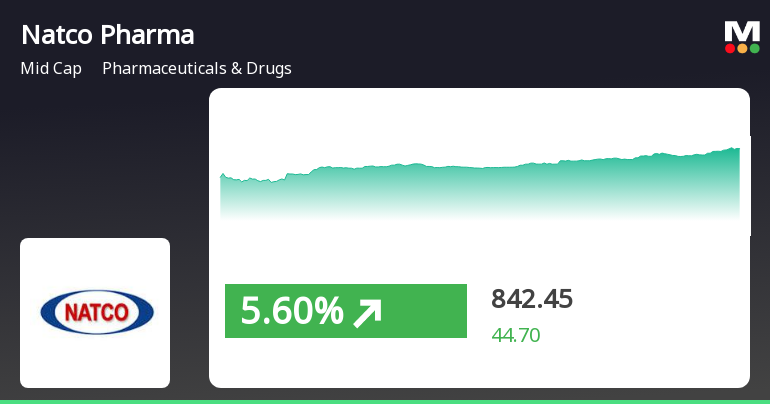

2025-04-03 09:45:22Natco Pharma experienced notable activity on April 3, 2025, with a significant intraday gain. The stock outperformed the Pharmaceuticals & Drugs sector and showed a positive trend over the past week, despite a decline over the past year and year-to-date performance.

Read MoreNatco Pharma Faces Technical Trend Shifts Amid Ongoing Market Volatility

2025-04-03 08:00:25Natco Pharma, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 805.15, slightly down from the previous close of 806.45. Over the past year, Natco Pharma has faced challenges, with a return of -19.32%, contrasting with a positive return of 3.67% for the Sensex during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but no signal is present for the monthly evaluation. Bollinger Bands and KST also reflect a mildly bearish trend on both weekly and monthly scales. Despite these technical indicators, Natco Pharma has shown resilience over longer periods, with a notable return of 61.79% over the past five years, although...

Read More

Natco Pharma Faces Financial Challenges Amidst Strong Management Efficiency and Growth Potential

2025-04-02 08:13:24Natco Pharma has recently experienced a change in evaluation, highlighting a shift in its financial outlook. The company reported flat performance for the quarter ending December 2024, with key metrics showing challenges, including a decline in profit after tax and net sales. Despite these issues, Natco maintains strong management efficiency and healthy long-term growth.

Read MoreNatco Pharma Faces Technical Challenges Amidst Market Dynamics and Performance Pressures

2025-03-26 08:00:19Natco Pharma, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 824.65, slightly down from the previous close of 830.10. Over the past year, Natco Pharma has faced challenges, with a return of -13.31%, contrasting with a 7.12% gain in the Sensex during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands signal bearish trends, while the monthly indicators show a mildly bearish stance. The daily moving averages also reflect a bearish sentiment. Notably, the stock's performance has been under pressure, with a year-to-date return of -40.54%, while the Sensex has remained relatively stable with a minor decline of -0.16%. Despite these challenges, Natco Pharma has shown resilience over longer periods, with a 5-year return of 77.84%, although this still...

Read More

Natco Pharma Adjusts Evaluation Score Amid Mixed Technical Indicators and Performance Trends

2025-03-25 08:10:50Natco Pharma has recently experienced a change in its evaluation score, influenced by technical indicators and market trends. While the sentiment shows a shift, the company continues to demonstrate strong management efficiency and long-term growth, despite recent declines in net sales and profit after tax.

Read MoreNatco Pharma Faces Mixed Technical Trends Amidst Market Performance Challenges

2025-03-25 08:00:25Natco Pharma, a midcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 830.10, showing a slight increase from the previous close of 829.35. Over the past year, Natco Pharma has experienced a decline of 12.74%, contrasting with a 7.07% gain in the Sensex, highlighting the challenges faced by the company in comparison to broader market trends. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive signal on a monthly basis. Bollinger Bands and KST also reflect a mildly bearish trend, suggesting caution in the stock's performance. In terms of returns, Natco Pharma has shown a notabl...

Read More

Natco Pharma Hits 52-Week Low Amid Ongoing Market Challenges and Declining Performance

2025-02-28 10:05:13Natco Pharma has reached a new 52-week low, continuing a downward trend with a 5.77% decline over the past three days. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in the competitive pharmaceutical market. Over the past year, it has declined significantly.

Read More

Natco Pharma Shows Resilience Amid Significant Stock Volatility and Market Challenges

2025-02-24 12:30:17Natco Pharma's stock showed notable activity on February 24, 2025, rising significantly despite a challenging month marked by a substantial decline. The stock reached a new 52-week low but also achieved an intraday high, reflecting its volatility and performance relative to the broader market and its sector.

Read More

Natco Pharma Hits 52-Week Low Amid Sustained Downward Trend in Pharmaceuticals

2025-02-24 09:35:13Natco Pharma has reached a new 52-week low, reflecting ongoing challenges for the midcap pharmaceutical company. It has underperformed its sector and is trading below key moving averages, indicating a sustained downward trend. Over the past year, the company's performance has declined significantly compared to the broader market.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Natco Pharma Ltd |

| 2 | CIN NO. | L24230TG1981PLC003201 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | AA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | ICRA LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | NSE |

Designation: COMPANY SECRETARY AND COMPLIANCE OFFICER

EmailId: venkatramesh.ch@natcopharma.co.in

Designation: CHIEF FINANCIAL OFFICER

EmailId: svvn@natcopharma.co.in

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

08-Apr-2025 | Source : BSELegal Update regarding RISDIPLAM launch in India

Announcement under Regulation 30 (LODR)-Change in Management

03-Apr-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Natco Pharma Ltd. has declared 75% dividend, ex-date: 18 Feb 25

Natco Pharma Ltd. has announced 2:10 stock split, ex-date: 26 Nov 15

No Bonus history available

No Rights history available