Nava's Technical Indicators Show Mixed Signals Amid Strong Long-Term Performance

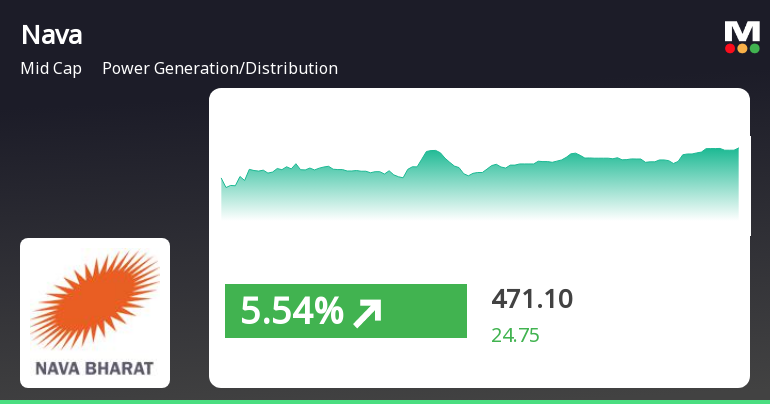

2025-04-03 08:00:53Nava, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 525.05, slightly down from the previous close of 529.35. Over the past year, Nava has demonstrated significant resilience, with a remarkable return of 109.66%, far outpacing the Sensex's 3.67% return during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands are bullish for both weekly and monthly evaluations, suggesting potential volatility in price movements. Meanwhile, the KST presents a bearish signal weekly but turns bullish monthly, indicating fluctuating momentum. Nava's performance over different time frames highlights its strong recovery, particularly...

Read MoreNava Experiences Mixed Technical Trends Amid Strong Performance in Power Sector

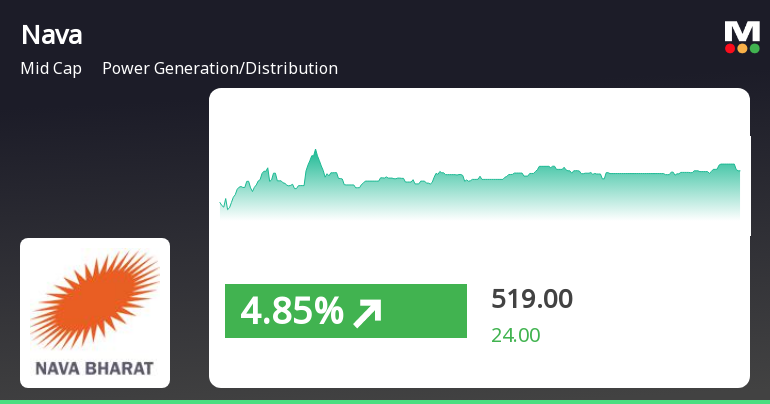

2025-04-02 08:01:50Nava, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 529.35, has shown notable fluctuations, with a 52-week high of 673.35 and a low of 227.23. Today's trading saw a high of 548.40 and a low of 515.00, indicating active market participation. The technical summary reveals a mixed outlook across various indicators. The MACD shows bullish momentum on a weekly basis, while the monthly perspective leans mildly bearish. Bollinger Bands indicate bullish trends in both weekly and monthly evaluations, suggesting some volatility in price movements. The moving averages present a mildly bearish stance on a daily basis, contrasting with the bullish signals from the Dow Theory. In terms of performance, Nava has outperformed the Sensex significantly over various time frames. Over the past ye...

Read MoreNava's Technical Trends Reflect Mixed Signals Amid Strong Long-Term Performance

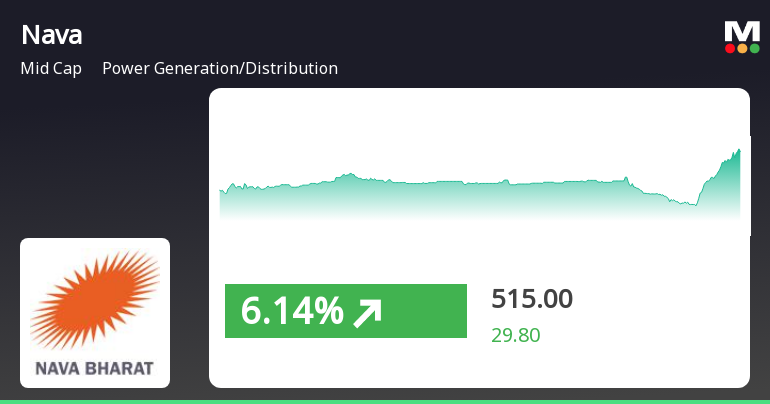

2025-04-01 08:00:33Nava, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 517.20, showing a notable increase from the previous close of 495.00. Over the past year, Nava has demonstrated impressive performance, with a return of 112.08%, significantly outpacing the Sensex's return of 5.11% during the same period. The technical summary indicates a mixed outlook, with bullish signals observed in the MACD and Bollinger Bands on both weekly and monthly charts. However, the daily moving averages present a mildly bearish stance, suggesting some volatility in short-term performance. The KST shows a bearish trend weekly but bullish monthly, indicating fluctuations in momentum. Nava's performance over various time frames highlights its resilience, particularly over three years, where it achieved a stag...

Read More

Nava's Strong Performance Highlights Divergence in Power Sector Amid Market Decline

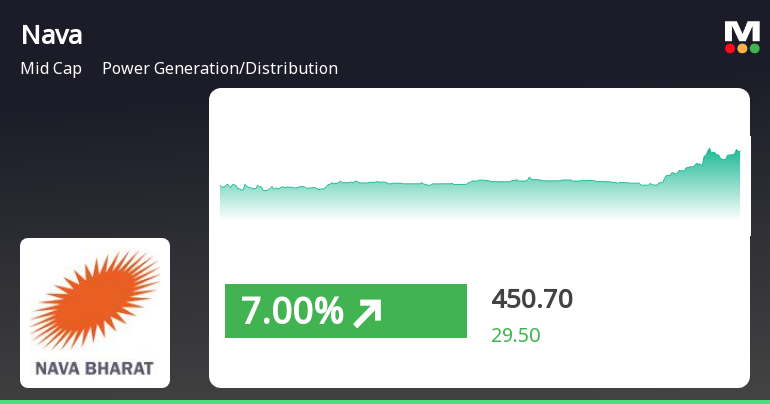

2025-03-28 13:45:20Nava, a midcap power generation and distribution company, has experienced notable stock performance, significantly outperforming the Sensex. Over the past month, it has risen by 29.10%, with a remarkable year-over-year growth of 113.86%, reflecting its strong position in the market.

Read MoreNava's Stock Shows Mixed Technical Trends Amid Strong Long-Term Performance

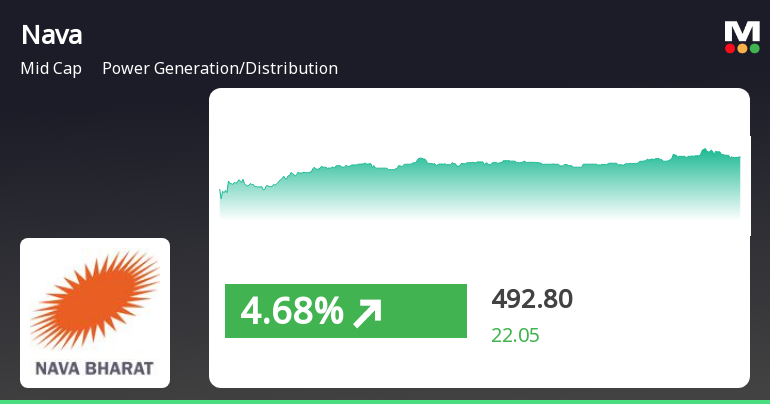

2025-03-28 08:00:32Nava, a midcap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 495.00, showing a notable increase from the previous close of 485.20. Over the past year, Nava has demonstrated impressive performance, with a stock return of 98.00%, significantly outpacing the Sensex's return of 6.32% during the same period. In terms of technical indicators, the weekly MACD suggests a bullish sentiment, while the monthly outlook remains mildly bearish. The Bollinger Bands indicate a bullish trend on both weekly and monthly scales, which may reflect positive market sentiment. However, the daily moving averages present a mildly bearish stance, indicating some volatility in the short term. Nava's performance over various time frames highlights its resilience, particularly over the last three years, wher...

Read More

Nava Stock Shows Strong Performance Amid High Volatility in Power Sector

2025-03-27 15:30:19Nava, a midcap company in the Power Generation and Distribution sector, has demonstrated strong trading activity, outperforming its sector. The stock has shown impressive returns over various time frames, including a significant increase over the past year and three years, highlighting its robust market position.

Read More

Nava's Strong Stock Performance Highlights Resilience Amid Market Decline

2025-03-26 15:00:21Nava, a midcap power generation and distribution company, experienced notable stock performance on March 26, 2025, significantly outperforming the broader market. The stock has shown strong upward trends across various moving averages and impressive growth metrics over different time frames, reflecting its robust market position.

Read More

Nava's Strong Performance Highlights Growing Momentum in Power Sector Stocks

2025-03-20 11:00:23Nava, a midcap power generation and distribution company, has shown strong performance, gaining 5.15% on March 20, 2025, and achieving a total return of 14.92% over four consecutive days. The stock is trading above multiple moving averages, indicating robust upward momentum, while its one-year return significantly outpaces the Sensex.

Read More

Nava Stock Surges Amid Strong Midcap Performance and Market Optimism

2025-03-19 14:00:51Nava, a midcap company in the Power Generation and Distribution sector, has experienced notable gains, outperforming its sector and achieving a total return of 10.86% over three days. The stock has shown high volatility and is currently above several key moving averages, reflecting strong market performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEDisclosure

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Ashok Devineni

Announcement under Regulation 30 (LODR)-Closure of Buy Back

27-Mar-2025 | Source : BSEIntimation of extinguishment of 7200000 equity shares bought back.

Corporate Actions

No Upcoming Board Meetings

Nava Ltd has declared 200% dividend, ex-date: 30 Aug 24

Nava Ltd has announced 1:2 stock split, ex-date: 20 Jan 25

Nava Ltd has announced 1:1 bonus issue, ex-date: 01 Sep 16

No Rights history available