Navneet Education Faces Technical Trend Shifts Amid Market Fluctuations

2025-03-19 08:04:03Navneet Education, a small-cap player in the printing and publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 134.65, slightly down from the previous close of 135.85. Over the past year, Navneet Education has experienced a decline of 6.66%, contrasting with a 3.51% gain in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also indicate a mildly bearish stance weekly, with a bearish outlook monthly. The stock's performance has been mixed, with the KST showing a mildly bullish trend weekly but mildly bearish monthly. Notably, Navneet Education's return over three years stands at 53.89%, significantly outperforming the Sensex's 30.14% return in the same timeframe. However, the stock h...

Read MoreNavneet Education Faces Technical Trend Adjustments Amidst Challenging Market Conditions

2025-03-18 08:03:27Navneet Education, a small-cap player in the printing and publishing industry, has recently undergone a technical trend adjustment. The company's current price stands at 135.85, reflecting a slight increase from the previous close of 134.20. Over the past year, Navneet Education has experienced a 3.93% decline, contrasting with a 2.10% gain in the Sensex, highlighting a challenging market environment for the company. In terms of technical indicators, the MACD suggests a bearish outlook on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also indicate a bearish trend for the month, with moving averages signaling bearish conditions on a daily basis. Notably, the KST shows a mildly bullish trend weekly but shifts to mildly bearish on a monthly scale. Despite these technical signals, Navneet Education has demonstrated resilience in its returns over longer periods. For inst...

Read MoreNavneet Education Experiences Mixed Technical Trends Amid Market Dynamics and Stock Performance

2025-03-12 08:02:31Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 138.25, showing a notable increase from the previous close of 129.90. Over the past week, Navneet Education has demonstrated a stock return of 2.41%, outperforming the Sensex, which returned 1.52% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and moving averages reflect a bearish sentiment on a daily basis, with the KST showing a mildly bullish trend weekly but bearish monthly. In terms of returns, Navneet Education...

Read More

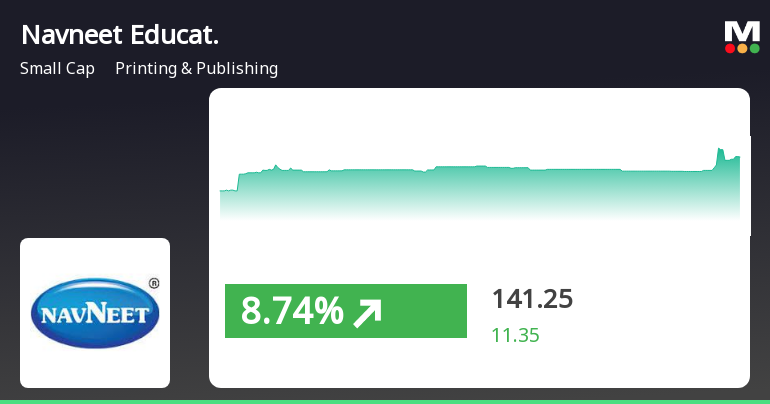

Navneet Education Shows Resilience with Significant Stock Rebound Amid Market Decline

2025-03-11 13:20:23Navneet Education, a small-cap company in the Printing & Publishing sector, experienced a notable rebound today, reversing two days of decline. The stock reached an intraday high and demonstrated significant volatility, outperforming the broader market. Its price remains above several moving averages, indicating positive technical momentum.

Read MoreNavneet Education Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-03 08:01:17Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 138.00, slightly down from the previous close of 139.70. Over the past year, Navneet Education has experienced a decline of 6.66%, contrasting with a modest gain of 1.24% in the Sensex during the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands reflect a mildly bearish stance on a weekly basis and a bearish outlook monthly. Daily moving averages also suggest a bearish trend, while the KST presents a mildly bullish signal weekly but shifts to mildly bearish monthly. Despite the recent challenges, Navneet Education has shown re...

Read MoreNavneet Education Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-02 08:01:16Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 138.00, slightly down from the previous close of 139.70. Over the past year, Navneet Education has experienced a decline of 6.66%, contrasting with a modest gain of 1.24% in the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a bearish stance, particularly on the monthly chart. Moving averages signal a bearish trend on a daily basis, suggesting a cautious market environment. Despite the recent challenges, Navneet Education has demonstrated resilience over longer periods, with a notable 66.97% return over three years, significantly...

Read MoreNavneet Education Faces Technical Trend Shifts Amid Mixed Market Signals

2025-03-01 08:01:14Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 138.00, slightly down from the previous close of 139.70. Over the past year, Navneet Education has experienced a decline of 6.66%, contrasting with a modest gain of 1.24% in the Sensex during the same period. The technical summary indicates a bearish sentiment in the weekly MACD and a mildly bearish outlook on the monthly scale. The Bollinger Bands also reflect a bearish trend, while the daily moving averages align with this sentiment. The KST shows a mildly bullish position on a weekly basis but shifts to a mildly bearish stance monthly, indicating mixed signals in the short term. In terms of stock performance, Navneet Education has shown resilience over longer periods, with a notable 66.97% return over three ye...

Read MoreNavneet Education Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-02-28 08:01:19Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 139.70, showing a notable increase from the previous close of 133.25. Over the past year, Navneet Education has experienced a decline of 8.03%, contrasting with a 2.08% gain in the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands indicate a sideways trend weekly, but a bearish stance monthly. Moving averages reflect a mildly bearish sentiment on a daily basis, while the KST presents a mixed picture with a mildly bullish weekly trend and a mildly bearish monthly tre...

Read MoreNavneet Education Adjusts Valuation Amidst Competitive Industry Landscape and Market Challenges

2025-02-28 08:00:19Navneet Education, a small-cap player in the Printing & Publishing industry, has recently undergone a valuation adjustment. The company's current price stands at 139.70, reflecting a notable increase from the previous close of 133.25. Over the past year, Navneet has experienced a decline of 8.03%, contrasting with a 2.08% gain in the Sensex, indicating a challenging market environment for the company. Key financial metrics for Navneet include a PE ratio of 18.01 and a price-to-book value of 1.74. The company's EV to EBITDA ratio is recorded at 9.17, while the EV to sales ratio stands at 1.68. Additionally, Navneet boasts a dividend yield of 2.95% and a return on capital employed (ROCE) of 14.76%. When compared to its peers, Navneet's valuation metrics reveal a competitive landscape. MPS, for instance, has a significantly higher PE ratio of 32.05, while D B Corp and Jagran Prakashan present attractive val...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEThe trading window for dealing in shares of the Company by the designated persons will remain closed from 1St April 2025.

Intimation For Change In The Domain Name And Generic E-Mail ID Of The Registrar And Share Transfer Agent (RTA) Of The Company

15-Feb-2025 | Source : BSEWe wish to inform you that the Domain Name and Generic E-mail ID of the RTA has been updated as part of its rebranding.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

12-Feb-2025 | Source : BSEDisclosure of Transcript of Earning call for the quarter and nine months ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Navneet Education Ltd has declared 75% dividend, ex-date: 19 Nov 24

Navneet Education Ltd has announced 2:10 stock split, ex-date: 27 Sep 06

Navneet Education Ltd has announced 3:2 bonus issue, ex-date: 08 Sep 09

No Rights history available