NBCC Stock Shows Mixed Technical Trends Amid Market Volatility and Outperformance

2025-04-03 08:04:34NBCC (India), a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 82.88, showing a slight increase from the previous close of 81.62. Over the past year, NBCC has experienced a 52-week high of 138.44 and a low of 70.82, indicating significant volatility. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook appears mildly bearish. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and moving averages also reflect a mildly bearish trend, highlighting the mixed signals in the market. When comparing the company's performance to the Sensex, NBCC has shown notable returns over various periods. In the last week, the stock returned 2.2...

Read MoreNBCC (India) Ltd Sees Surge in Trading Activity Amid Sector Outperformance

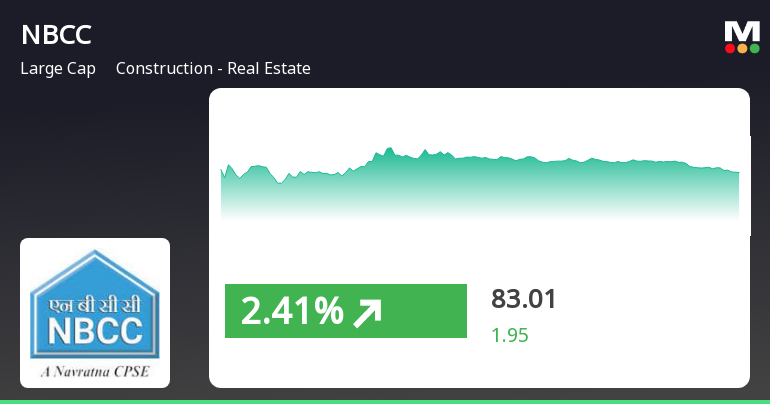

2025-03-27 11:00:07NBCC (India) Ltd, a prominent player in the construction and real estate sector, has emerged as one of the most active equities today, with a total traded volume of 11,709,462 shares and a total traded value of approximately Rs 97.36 crores. The stock opened at Rs 82.35 and reached a day’s high of Rs 84.69, reflecting a notable intraday gain of 4.47%. As of the latest update, the last traded price stands at Rs 84.11. Today’s performance indicates that NBCC has outperformed its sector by 2.89%, marking a trend reversal after two consecutive days of decline. The stock's performance is also noteworthy as it has surpassed its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Investor participation has seen a rise, with a delivery volume of 56.01 lakhs on March 26, which is an increase of 8.17% compared to the 5-day average. The liquidity of the stock...

Read More

NBCC (India) Shows Short-Term Gains Amid Mixed Long-Term Performance Trends

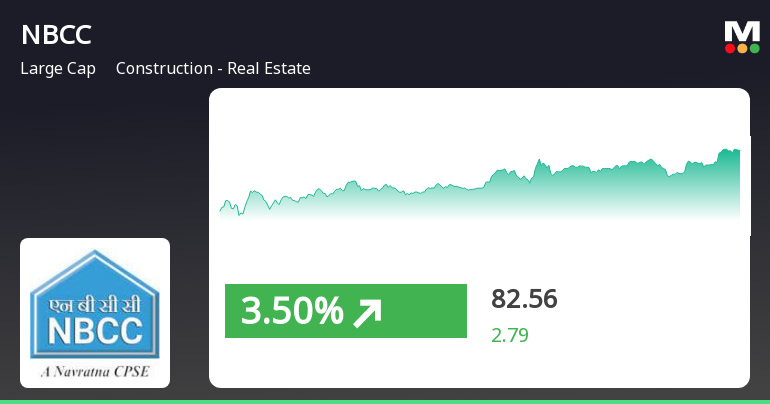

2025-03-27 10:05:24NBCC (India) has experienced a notable uptick, reversing a two-day decline and reaching an intraday high. The stock has outperformed its sector today, although its moving averages present a mixed picture. Meanwhile, the broader market, represented by the Sensex, has shown resilience with recent gains.

Read MoreNBCC (India) Faces Mixed Technical Trends Amidst Market Evaluation Revision

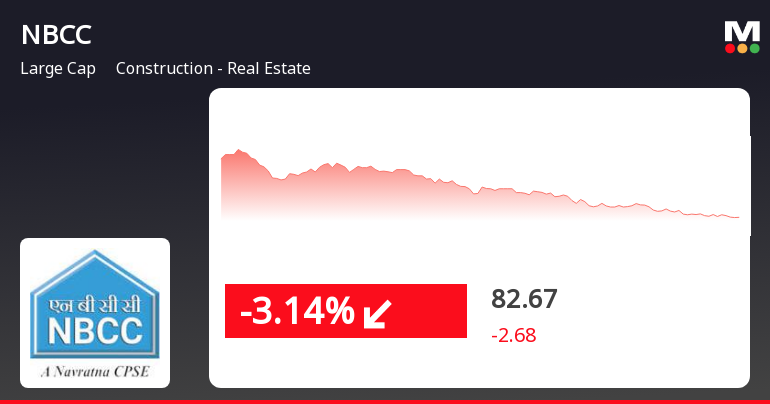

2025-03-26 08:03:24NBCC (India), a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 83.18, down from a previous close of 85.35, with a 52-week high of 138.44 and a low of 70.82. Today's trading saw a high of 85.99 and a low of 82.04. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents no signal on a weekly basis but is bullish monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting caution in the short term. In terms of returns, NBCC has shown resilience compared to the Sensex. Over the past week, the stock returned 4.27%, outperforming the Sensex's 3.61%. In the last month, it achieved a return of 5.7...

Read More

NBCC Stock Faces Short-Term Challenges Amid Broader Market Resilience

2025-03-25 11:15:22NBCC (India) saw a decline on March 25, 2025, after two days of gains, underperforming its sector. The stock is above its short-term moving averages but below longer-term ones. Despite recent challenges, it has shown notable growth over three years, significantly outpacing the Sensex's performance.

Read MoreNBCC (India) Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:01:46NBCC (India), a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 83.73, showing a slight increase from the previous close of 82.96. Over the past year, NBCC has demonstrated a return of 10.51%, outperforming the Sensex, which recorded a return of 5.87% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish on a monthly scale. Additionally, Bollinger Bands reflect a mildly bearish trend weekly, with a sideways movement monthly. The daily moving averages are bearish, while the KST shows a bearish trend weekly and mildly bearish monthly. Notably, NBCC has shown significant long-term performance, with a rema...

Read MoreNBCC Faces Mixed Technical Trends Amid Strong Long-Term Performance Resilience

2025-03-21 08:02:08NBCC (India), a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 82.96, slightly down from the previous close of 83.31. Over the past year, NBCC has demonstrated a notable return of 14.95%, significantly outperforming the Sensex, which recorded a return of 5.89% in the same period. In terms of technical indicators, the weekly MACD is indicating a bearish trend, while the monthly MACD shows a mildly bearish stance. The Relative Strength Index (RSI) presents no signal on a weekly basis but is bullish on a monthly scale. Bollinger Bands and moving averages also reflect a bearish sentiment in the short term. Despite these technical trends, NBCC has shown resilience over longer periods, with a remarkable 637.23% return over the last five years compared to the Sensex's 15...

Read MoreNBCC (India) Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:02:24NBCC (India), a prominent player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 83.31, showing a notable increase from the previous close of 79.77. Over the past year, NBCC has demonstrated a return of 15.33%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) presents no signal on a weekly basis but is bullish when viewed monthly. The Bollinger Bands suggest a mildly bearish trend weekly, with a sideways movement monthly. Additionally, moving averages indicate a bearish trend daily, while the KST reflects a bearish stance weekly and mildly bearish monthly. The company's...

Read More

NBCC (India) Shows Resilience Amid Broader Market Trends and Sector Performance

2025-03-19 13:45:53NBCC (India) has demonstrated strong performance, gaining 3.38% on March 19, 2025, and achieving a total return of 5.97% over three consecutive days. The stock is currently above its short-term moving averages but below longer-term ones, indicating mixed performance. Over the past year, NBCC has outperformed the Sensex significantly.

Read MoreNBCC Successfully Concludes E-Auction Of Residential Units At Aspire Dream Valley Ph-III Greater Noida (W) U.P.

09-Apr-2025 | Source : BSEAs per attached intimation

Memorandum Of Understanding Between NBCC (India) Limited And RAILTEL

08-Apr-2025 | Source : BSEAs per intimation attached herewith

Intimation Of Work Order Received By NBCC In Normal Course Of Business Amounting Rs. 120.90 Crore (Approx.)

08-Apr-2025 | Source : BSEAs per intimation attached herewith

Corporate Actions

No Upcoming Board Meetings

NBCC (India) Ltd has declared 53% dividend, ex-date: 18 Feb 25

NBCC (India) Ltd has announced 1:2 stock split, ex-date: 25 Apr 18

NBCC (India) Ltd has announced 1:2 bonus issue, ex-date: 07 Oct 24

No Rights history available