NDR Auto Components Experiences Valuation Grade Change Amid Competitive Market Landscape

2025-03-28 08:00:51NDR Auto Components, a small-cap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 681.00, reflecting a notable decline from its previous close of 701.35. Over the past year, NDR Auto has demonstrated a strong performance with a return of 54.17%, significantly outpacing the Sensex, which recorded a return of 6.32% during the same period. Key financial metrics for NDR Auto include a PE ratio of 33.42 and an EV to EBITDA ratio of 23.55, indicating a robust market position. The company's return on capital employed (ROCE) is reported at 17.08%, while the return on equity (ROE) stands at 16.01%. These figures suggest a solid operational efficiency relative to its peers. In comparison to other companies in the auto ancillary industry, NDR Auto's valuation metrics are higher than those of several competitors, such as Banco Products and Shard...

Read More

NDR Auto Components Faces Mixed Financial Signals Amid Technical Outlook Shift

2025-03-27 08:12:58NDR Auto Components has experienced a recent evaluation adjustment reflecting a shift in its technical outlook. The company reported significant annual growth in net sales and operating profit, but faces challenges with profitability and valuation compared to peers. Its low debt-to-equity ratio indicates a conservative financial strategy.

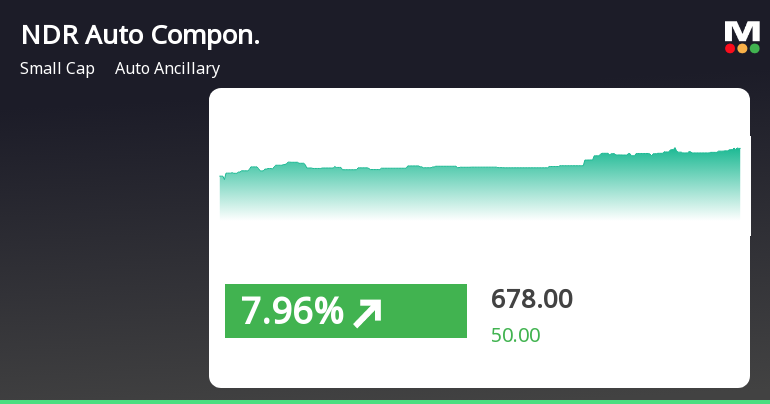

Read MoreNDR Auto Components Faces Mixed Technical Signals Amid Market Volatility

2025-03-27 08:04:00NDR Auto Components, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 701.35, down from a previous close of 722.20, with a notable 52-week high of 1,040.50 and a low of 361.00. Today's trading saw a high of 727.75 and a low of 697.20, indicating some volatility. The technical summary reveals a mixed picture, with the MACD showing mildly bearish signals on both weekly and monthly charts. The Relative Strength Index (RSI) indicates no significant signals, while Bollinger Bands present a bearish outlook on the weekly scale but a bullish one monthly. Moving averages suggest a mildly bullish trend on a daily basis, contrasting with the bearish signals from the KST and Dow Theory on the weekly and monthly fronts. In terms of performance, NDR Auto Components has shown varied returns compared to ...

Read More

NDR Auto Components Reports Strong Growth Amid Management Efficiency Challenges

2025-03-19 08:12:09NDR Auto Components has recently adjusted its evaluation, reflecting strong financial performance in Q3 FY24-25, with significant growth in net sales and operating profit. The company maintains a low debt-to-equity ratio and a high return on capital employed, though it faces challenges in management efficiency.

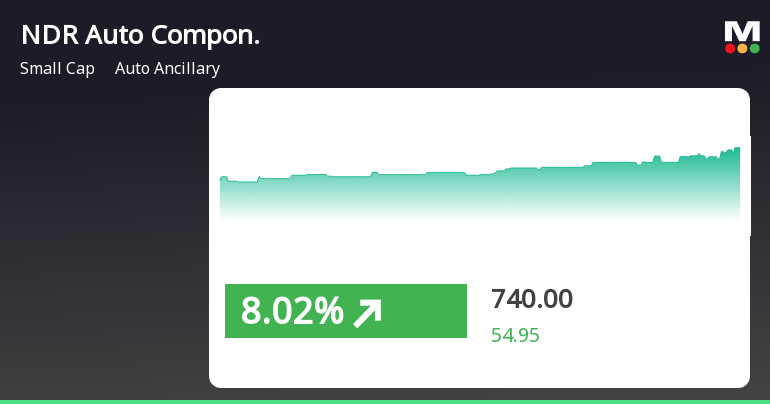

Read MoreNDR Auto Components Shows Mixed Technical Trends Amid Strong Performance Surge

2025-03-19 08:05:01NDR Auto Components, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 740.00, showing a notable increase from the previous close of 685.05. Over the past year, NDR Auto has demonstrated impressive performance, with a return of 82.24%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates a mixed outlook, with weekly and monthly MACD readings showing mildly bearish signals. However, the Bollinger Bands suggest a bullish trend on both weekly and monthly bases, while daily moving averages also reflect a bullish stance. The KST and OBV metrics present a mildly bearish trend on a monthly basis, indicating some caution in the market. In terms of stock performance, NDR Auto has excelled over various time frames, including a...

Read More

NDR Auto Components Surges, Signaling Strong Small-Cap Market Resilience

2025-03-18 15:31:03NDR Auto Components has experienced notable stock activity, achieving significant gains and outperforming its sector, the Auto Ancillary. The stock is trading above key moving averages, reflecting a strong short-term trend. Over the past year and three years, it has delivered impressive returns compared to broader market indices.

Read MoreNDR Auto Components Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-12 08:00:50NDR Auto Components, a small-cap player in the auto ancillary sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 32.90, while its price-to-book value is noted at 5.85. Other key indicators include an EV to EBITDA ratio of 23.19 and a PEG ratio of 1.07, which provide insights into its valuation relative to earnings growth. In terms of profitability, NDR Auto Components reports a return on capital employed (ROCE) of 17.08% and a return on equity (ROE) of 16.01%. The company also offers a modest dividend yield of 0.28%. When compared to its peers, NDR Auto Components exhibits a higher valuation profile, particularly in the context of its price-to-earnings and EV to EBITDA ratios. Competitors such as Banco Products and Sharda Motor present more attractive valuations, with significantly lower PE ratios. Th...

Read More

NDR Auto Components Shows Strong Performance Amid Market Volatility and Sector Outperformance

2025-03-11 15:20:25NDR Auto Components has experienced notable activity, achieving consecutive gains over six days and a total return of 18.85%. The stock reached an intraday high of Rs 680.05, despite initial volatility. In the broader market, the Sensex showed resilience, with mid-cap stocks leading gains.

Read MoreNDR Auto Components Shows Mixed Technical Trends Amid Strong Performance Surge

2025-03-10 08:02:03NDR Auto Components, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 615.00, showing a notable increase from the previous close of 597.35. Over the past year, NDR Auto has demonstrated a strong performance with a return of 46.05%, significantly outpacing the Sensex, which recorded a mere 0.29% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The MACD and KST indicators are showing mildly bearish trends on both weekly and monthly bases, while the moving averages indicate a mildly bullish stance on a daily timeframe. The Bollinger Bands present a contrasting view, with a bullish signal on a monthly basis, suggesting potential volatility in the stock's price movement. Looking at the broader context, NDR Auto's performance over three years has ...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

03-Apr-2025 | Source : BSEAs per attachment

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEAs per attachment

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

01-Apr-2025 | Source : BSEAs per attachment

Corporate Actions

No Upcoming Board Meetings

NDR Auto Components Ltd has declared 37% dividend, ex-date: 15 Jul 24

No Splits history available

NDR Auto Components Ltd has announced 1:1 bonus issue, ex-date: 25 Sep 24

No Rights history available