New India Assurance Faces Declining Performance Amid Cautious Market Sentiment

2025-04-02 08:36:27New India Assurance Company has experienced a recent evaluation adjustment, reflecting a shift in its technical trends. The company's financial performance for Q3 FY24-25 shows declines in key metrics, including operating profit and profit after tax, contributing to a cautious outlook and limited appeal among domestic mutual funds.

Read MoreNew India Assurance Faces Technical Trend Shifts Amid Market Volatility

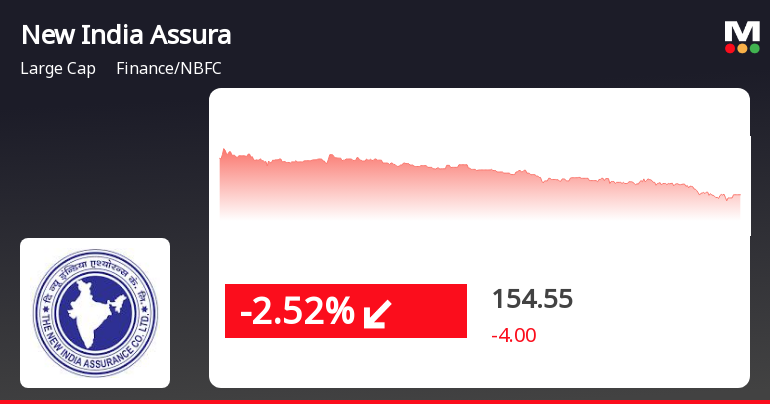

2025-04-02 08:09:15New India Assurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 158.25, showing a slight increase from the previous close of 154.55. Over the past year, the stock has experienced significant volatility, with a 52-week high of 309.90 and a low of 135.85. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The moving averages also reflect a bearish sentiment on a daily basis. Notably, the Bollinger Bands indicate a mildly bearish trend for both weekly and monthly assessments, suggesting a cautious outlook. When comparing the company's performance to the Sensex, New India Assurance has faced challenges. Over the past year, the stock has declined by 34.04%, contrasting sha...

Read More

New India Assurance Faces Mixed Performance Amid Broader Market Decline

2025-03-28 15:35:29New India Assurance Company saw a decline on March 28, 2025, underperforming its sector. The stock fluctuated between an intraday high and low, showing mixed performance against various moving averages. Despite a recent one-month increase, it has faced significant challenges over the past year compared to the broader market.

Read MoreNew India Assurance Faces Mixed Technical Trends Amid Market Evaluation Revision

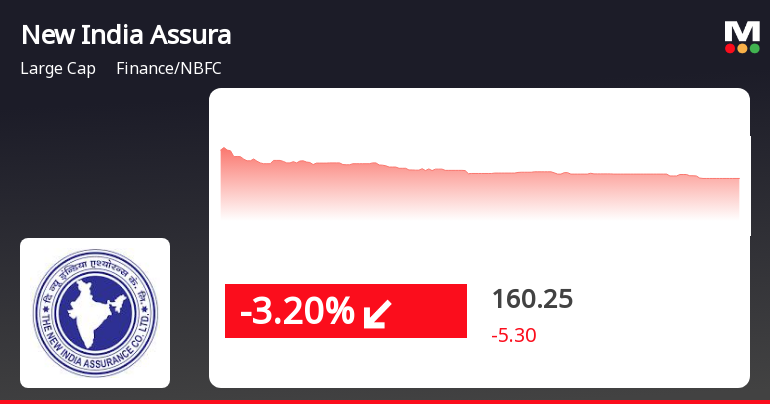

2025-03-27 08:03:44New India Assurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 157.10, down from a previous close of 160.50, with a notable 52-week high of 309.90 and a low of 135.85. Today's trading saw a high of 170.25 and a low matching the current price. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis while leaning mildly bearish monthly. Similarly, Bollinger Bands and KST reflect bearish trends weekly and mildly bearish monthly. However, the On-Balance Volume (OBV) stands out with bullish signals on both weekly and monthly assessments, suggesting some underlying strength. In terms of returns, New India Assurance has experienced a challenging year-to-date performance, with a decline of 21.84%, co...

Read MoreNew India Assurance Faces Technical Trend Shifts Amid Market Volatility

2025-03-26 08:04:29New India Assurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock, currently priced at 160.50, has seen fluctuations with a 52-week high of 309.90 and a low of 135.85. The latest trading session recorded a high of 167.95 and a low of 160.00, indicating some volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also align with this bearish outlook. Notably, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, indicating some underlying strength despite the overall bearish sentiment. When comparing the company's performance to the Sensex, New India Assurance has shown varied returns. Over the past week, it outperformed the Sensex...

Read More

New India Assurance Faces Potential Trend Reversal Amid Broader Market Fluctuations

2025-03-25 11:45:43New India Assurance Company saw a decline on March 25, 2025, following a five-day gain streak. The stock's performance has been mixed, with a significant increase over three years but a decline over the past year. The broader market also experienced a slight downturn despite recent gains.

Read More

New India Assurance Adjusts Evaluation Amid Mixed Market Sentiment and Performance Challenges

2025-03-25 08:24:13New India Assurance Company has experienced a recent adjustment in its evaluation, reflecting changes in technical trends. Despite facing challenges in Q3 FY24-25, including a decline in profit margins, the stock has shown resilience over three years, although its performance has lagged behind the market average in the past year.

Read MoreNew India Assurance Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:05:47New India Assurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 165.55, showing a slight increase from the previous close of 165.20. Over the past year, the stock has experienced significant fluctuations, with a 52-week high of 309.90 and a low of 135.85. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish stance on both weekly and monthly assessments. Notably, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, suggesting some underlying strength despite the overall bearish signals. When comparing the company's performance to the Sensex, New India Assurance has shown a strong return over the past week, outperf...

Read More

New India Assurance Company Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

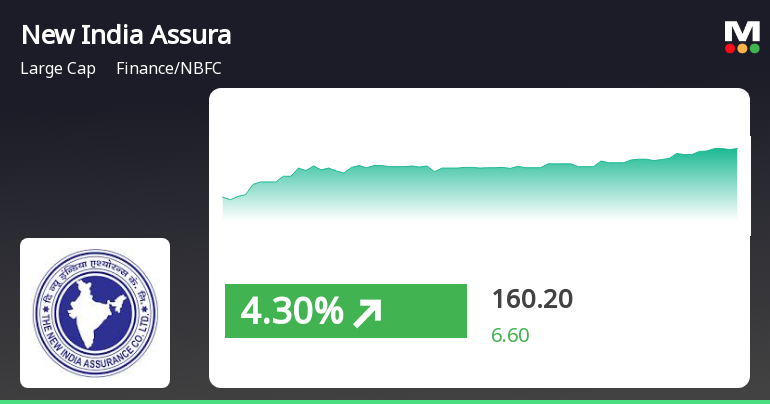

2025-03-21 10:20:29New India Assurance Company has experienced a notable increase, marking its fourth consecutive day of gains and outperforming its sector. The stock is currently above its short-term moving averages but below its longer-term ones. In the broader market, small-cap stocks are leading, with the Sensex showing a modest recovery.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | The New India Assurance Company Ltd |

| 2 | CIN NO. | L66000MH1919GOI000526 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | AAA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | NSE |

Designation: CS and Chief Compliance Officer

EmailId: cs.nia@newindia.co.in

Designation: CFO

EmailId: vimal.jain@newindia.co.in

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Disclosure Under Regulation 30 Of SEBI (LODR) Regulations 2015 To Stock Exchanges

28-Mar-2025 | Source : BSEPFA the letter wrt the captioned subject.

Closure of Trading Window

27-Mar-2025 | Source : BSETrading Window Closure for the Quarter and Year ended 31.03.2025

Corporate Actions

No Upcoming Board Meetings

New India Assurance Company Ltd has declared 41% dividend, ex-date: 06 Sep 24

No Splits history available

New India Assurance Company Ltd has announced 1:1 bonus issue, ex-date: 27 Jun 18

No Rights history available