NIIT Experiences Shift in Technical Trends Amidst Mixed Financial Performance

2025-04-02 08:14:36NIIT, an IT education small-cap company, has recently seen a change in its evaluation, reflecting a shift in technical trends. Despite a 12.23% return over the past year, the company faces challenges with declining net sales and operating profit, alongside liquidity concerns. Its low debt-to-equity ratio and institutional holdings may offer some stability.

Read MoreNIIT's Technical Indicators Signal Mixed Trends Amidst Market Volatility

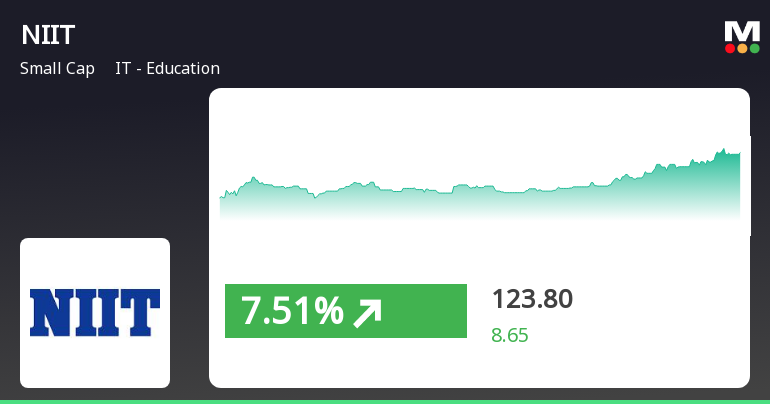

2025-04-02 08:00:54NIIT, a small-cap player in the IT education sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 123.85, showing a slight increase from the previous close of 122.35. Over the past year, NIIT has demonstrated a return of 12.23%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but there is no signal on the monthly chart. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly evaluations. Moving averages indicate a bearish trend on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly outlook. Notably, NIIT's performance over various time f...

Read MoreNIIT Experiences Technical Trend Shift Amid Market Volatility and Mixed Indicators

2025-04-01 08:00:23NIIT, a small-cap player in the IT education sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 122.35, down from a previous close of 126.10, with a notable 52-week high of 233.80 and a low of 90.80. Today's trading saw a high of 130.70 and a low of 121.60, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish conditions. The KST presents a mixed picture, being bearish weekly but bullish monthly, while the Dow Theory indicates a mildly bullish weekly trend juxtaposed with a mildly bearish monthly outlook. In terms of performance, NIIT's stock return over the past week has been negative at -2.16%, contrasting with a posit...

Read MoreNIIT Stock Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-28 08:00:16NIIT, a small-cap player in the IT education sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 126.10, showing a notable increase from the previous close of 121.60. Over the past week, NIIT has demonstrated a stock return of 3.53%, outperforming the Sensex, which returned 1.65% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal on a monthly basis. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly evaluations. Despite some bearish signals, NIIT's performance over the past year has been commendable, with a return of 16.22%, significantly higher than the Sensex's 6.32%. However, the longer-term view reveals challenges, ...

Read More

NIIT Faces Technical Shift Amidst Declining Financial Performance and Profit Challenges

2025-03-27 08:04:36NIIT, an IT education small-cap company, has recently experienced a change in its technical outlook, moving to a more bearish position. The latest quarter showed flat financial performance, with declines in net sales and operating profit, alongside a significant drop in profit before tax and cash reserves.

Read MoreNIIT Faces Technical Trend Shifts Amid Mixed Market Sentiment and Performance Variability

2025-03-27 08:00:14NIIT, a small-cap player in the IT education sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 121.60, down from a previous close of 126.30. Over the past year, NIIT has shown a return of 15.75%, outperforming the Sensex, which recorded a return of 6.65% in the same period. However, the year-to-date performance indicates a decline of 36.30%, contrasting sharply with the Sensex's slight drop of 1.09%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish outlook. Notably, the KST presents a mixed picture with a bearish weekly trend but a bullish monthly trend, indicating some volatility in market sentiment. The company's performance over various time frames highlights its ...

Read More

NIIT's Strong Performance Signals Resilience Amid IT Education Sector Fluctuations

2025-03-19 14:30:49NIIT, a small-cap IT education company, experienced notable gains today, outperforming its sector. The stock has shown a consecutive increase over two days, reflecting resilience amid market fluctuations. While its current price exceeds short-term moving averages, it remains below longer-term averages, indicating mixed trends in performance.

Read More

NIIT Faces Financial Challenges Amidst Market Evaluation Adjustment and Liquidity Concerns

2025-03-19 08:05:31NIIT, an IT education sector player, has recently had its evaluation adjusted due to various financial trends. The company has faced declining net sales and operating profit over the past five years, alongside liquidity concerns. However, it maintains a low debt-to-equity ratio and significant institutional holdings.

Read MoreNIIT Experiences Technical Indicator Shifts Amidst Mixed Market Sentiment

2025-03-19 08:00:26NIIT, a small-cap player in the IT education sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 115.15, showing a notable increase from the previous close of 109.25. Over the past year, NIIT has experienced a stock return of 8.53%, outperforming the Sensex, which recorded a return of 3.51% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) presents a bullish signal weekly, but no signal is noted for the monthly timeframe. Bollinger Bands and On-Balance Volume (OBV) both reflect mildly bearish trends on a weekly and monthly basis, suggesting a cautious market sentiment. Looking at the company's performance over various timeframes, NIIT has faced challenges year-to-date ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find compliance certificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

31-Mar-2025 | Source : BSEPlease find intimation for closure of trading window.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

24-Mar-2025 | Source : BSEPlease find enclosed a copy of the press release for NIIT Limited offers gNIIT a customizable dual qualification program for undergraduate students.

Corporate Actions

No Upcoming Board Meetings

NIIT Ltd has declared 37% dividend, ex-date: 05 Sep 24

NIIT Ltd has announced 2:10 stock split, ex-date: 24 Aug 07

NIIT Ltd has announced 1:2 bonus issue, ex-date: 24 Aug 07

No Rights history available