NIIT Learning Systems Adjusts Valuation Grade Amid Strong Financial Metrics and Market Challenges

2025-03-28 08:00:55NIIT Learning Systems, a midcap player in the IT education sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 22.97, while its price-to-book value is recorded at 5.11. Additionally, NIIT's enterprise value to EBITDA ratio is 13.29, and its enterprise value to EBIT is 15.74, indicating a solid operational performance. The company also showcases a robust return on capital employed (ROCE) of 64.09% and a return on equity (ROE) of 21.50%, highlighting its efficiency in generating profits from its capital. Despite these strong metrics, NIIT has faced challenges in stock performance, with a year-to-date return of -9.3%, contrasting with a slight decline in the Sensex of -0.68% during the same period. In comparison to its peers, NIIT's valuation metrics suggest a competitive stance within the IT education in...

Read More

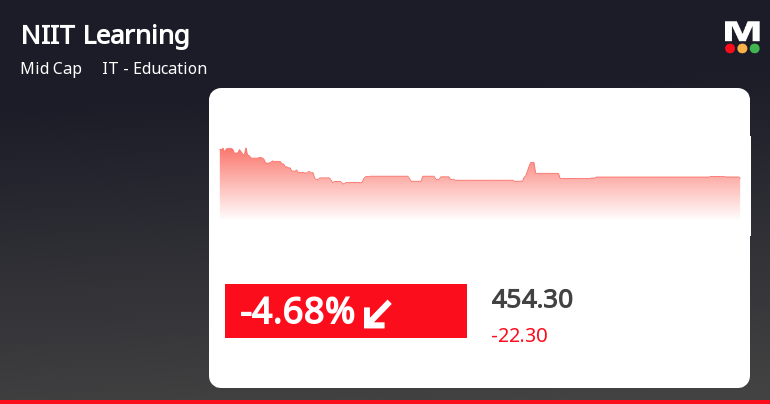

NIIT Learning Systems Faces Continued Decline Amid Broader IT Education Sector Resilience

2025-03-27 15:05:35NIIT Learning Systems has faced a notable decline in its stock price, marking three consecutive days of losses and underperforming its sector. While the broader IT education sector has shown gains, NIIT's performance remains weak, trading below key moving averages and reflecting a year-to-date decline.

Read More

NIIT Learning Systems Hits 52-Week Low Amid Broader IT Education Sector Challenges

2025-03-03 09:37:59NIIT Learning Systems has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below various moving averages, indicating a consistent downward trend. Over the past year, it has experienced a notable decline compared to the broader market.

Read MoreNIIT Learning Systems Adjusts Valuation Amidst Competitive IT Education Landscape

2025-02-24 12:57:57NIIT Learning Systems, a midcap player in the IT education sector, has recently undergone a valuation adjustment. The company's current price stands at 445.55, reflecting a slight increase from the previous close of 440.05. Over the past year, NIIT has experienced a stock return of -16.39%, contrasting with a positive return of 1.96% for the Sensex. Key financial metrics for NIIT include a PE ratio of 24.82 and an EV to EBITDA ratio of 14.49, indicating its market positioning within the industry. The company also boasts a robust return on capital employed (ROCE) of 64.09% and a return on equity (ROE) of 21.50%, showcasing its operational efficiency and profitability. In comparison to its peers, NIIT's valuation metrics present a competitive landscape. While the company maintains an attractive valuation, its performance indicators suggest a need for strategic focus to enhance returns relative to the broade...

Read More

NIIT Learning Systems Reports Strong Q4 Performance Amidst Market Adjustments

2025-01-28 18:58:11NIIT Learning Systems, a midcap IT education firm, has recently adjusted its evaluation, reflecting strong long-term fundamentals, including a 21.50% average Return on Equity and low Debt to Equity ratio. The company reported impressive quarterly results, with net sales of Rs 418.88 crore and a profit before tax of Rs 75.21 crore.

Read More

NIIT Learning Systems Faces Consecutive Losses Amidst Sector Underperformance

2025-01-27 10:31:10NIIT Learning Systems, a midcap IT-Education firm, has seen a significant decline in its stock, down 5.17% today and 7.84% over two days. The stock is trading below key moving averages, indicating a challenging trend, while its performance contrasts with the broader market's lesser decline.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find compliance certificate under Regulation 74(5) of SEBI (DP) Regulations 2018.

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

06-Apr-2025 | Source : BSEPlease find intimation for allotment equity shares under NIIT Learning Systems Limited Employee Stock Option Plan 2023-0 of the Company.

Closure of Trading Window

28-Mar-2025 | Source : BSEPlease find intimation for closure of trading window.

Corporate Actions

No Upcoming Board Meetings

NIIT Learning Systems Ltd has declared 137% dividend, ex-date: 05 Sep 24

No Splits history available

No Bonus history available

No Rights history available