Nikhil Adhesives Faces Market Challenges Amid Signs of Potential Recovery

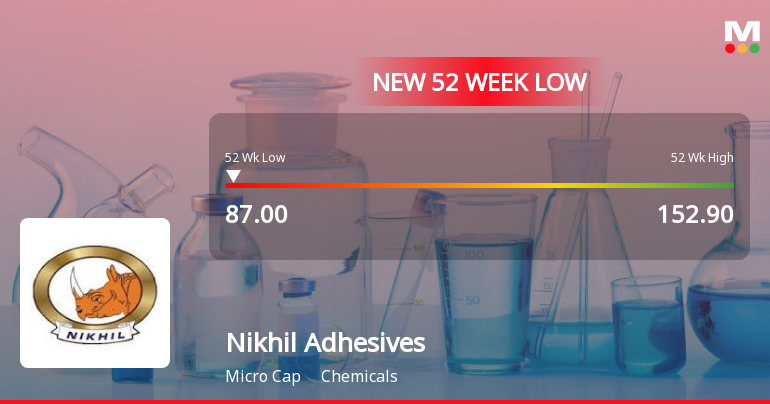

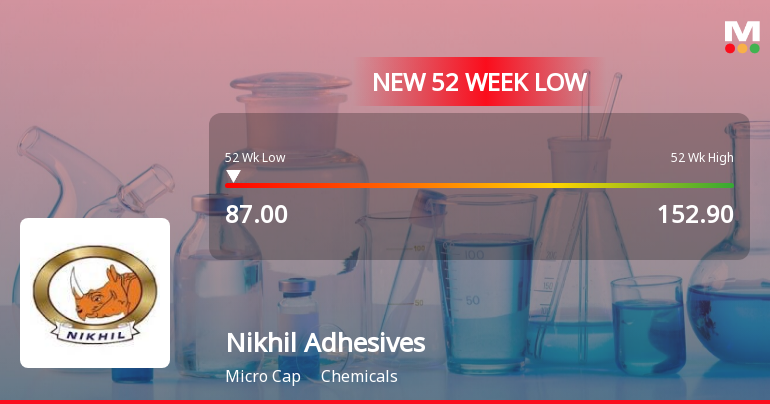

2025-03-17 09:48:23Nikhil Adhesives, a microcap in the chemicals sector, has reached a new 52-week low amid a five-day losing streak, despite recent gains. Over the past year, the company has faced a 29.31% decline in stock value, with recent quarterly results showing decreased net sales and profit after tax. However, it boasts a high return on capital employed and a low debt-to-EBITDA ratio, indicating strong management efficiency.

Read More

Nikhil Adhesives Faces Continued Challenges Amid Declining Stock Performance and Financial Concerns

2025-03-17 09:48:17Nikhil Adhesives, a microcap in the chemicals sector, reached a new 52-week low, continuing a downward trend with a significant annual decline. Despite a slight recovery, the stock remains below key moving averages, and recent financial results show declines in net sales and operating profit, raising market concerns.

Read More

Nikhil Adhesives Faces Ongoing Challenges Amid Declining Stock Performance and Financial Metrics

2025-03-17 09:48:17Nikhil Adhesives, a microcap in the chemicals sector, has reached a new 52-week low, continuing a downward trend with a significant annual decline. Despite a slight recovery, the stock remains below key moving averages, and recent financial results show declines in net sales and operating profit, raising concerns about its performance.

Read More

Nikhil Adhesives Faces Significant Volatility Amidst Declining Performance Metrics

2025-03-13 15:38:47Nikhil Adhesives, a microcap in the chemicals sector, has faced significant volatility, hitting a new 52-week low and experiencing a five-day losing streak. Over the past year, the company has underperformed the market, with minimal growth in net sales and profit, despite strong management efficiency metrics.

Read MoreNikhil Adhesives Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-02-24 12:57:22Nikhil Adhesives, a microcap player in the chemicals industry, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 28.77, while its price-to-book value is recorded at 3.83. Other notable financial metrics include an EV to EBIT ratio of 18.37 and an EV to EBITDA ratio of 14.81, indicating its operational efficiency relative to its enterprise value. In terms of returns, Nikhil Adhesives has experienced a challenging year, with a year-to-date stock return of -17.66%, contrasting with a modest gain of 1.96% in the Sensex over the same period. However, the company has shown resilience over a longer horizon, with a remarkable five-year return of 653.08%, significantly outperforming the Sensex's 84.76% during that timeframe. When compared to its peers, Nikhil Adhesives presents a competitive valuation profile, particularly against ...

Read More

Nikhil Adhesives Faces Market Challenges Amidst Broader Chemicals Sector Trends

2025-02-20 12:05:19Nikhil Adhesives, a microcap in the chemicals sector, is facing significant challenges, trading near its 52-week low. The stock has underperformed its sector and is below key moving averages, indicating a sustained downward trend. Over the past year, it has declined notably compared to the broader market.

Read More

Nikhil Adhesives Faces Significant Volatility Amidst Sustained Downward Trend in Chemicals Sector

2025-02-18 15:35:25Nikhil Adhesives, a microcap in the chemicals sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has faced consecutive losses over three days and is trading below key moving averages, indicating ongoing challenges in its market performance.

Read More

Nikhil Adhesives Reports Stable Q3 FY24-25 Results Amid Score Evaluation Shift

2025-02-10 21:36:09Nikhil Adhesives has announced its financial results for the quarter ending February 2025, showing stable performance in Q3 FY24-25 without significant fluctuations in key metrics. However, the company's stock evaluation has seen a notable adjustment, reflecting changes in its financial health and market position.

Read More

Nikhil Adhesives Faces Significant Volatility Amidst Persistent Downward Trend in Chemicals Sector

2025-01-28 16:05:18Nikhil Adhesives, a microcap in the chemicals sector, has reached a new 52-week low amid significant volatility, trailing its sector by a notable margin. The stock has seen a consecutive decline over three days, with a year-over-year performance drop contrasting sharply with broader market gains.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation for closure of Trading window as per SEBI PIT Regulations Trading window for dealing in securities of the Company will be closed for all the officers and designated employees with effect from 01 April 2025 till 48 hours after the declaration on Audited Financial Results for the quarter and year ended on 31st March 2025.

Announcement under Regulation 30 (LODR)-Change in Management

17-Mar-2025 | Source : BSEAppointment of Mr. Sethunathan Charlayath Laxmanan as a Additional Non Executive Independent Director of the Company for the first term of 5 consecutive years commencing from March 17 2025 subject to the approval of the shareholders of the company to be obtained within 3 months hereof.

Integrated Filing (Financial)

17-Feb-2025 | Source : BSEIntegrated Filling for the quarter and nine months ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Nikhil Adhesives Ltd has declared 20% dividend, ex-date: 19 Sep 24

Nikhil Adhesives Ltd has announced 1:10 stock split, ex-date: 12 Oct 22

No Bonus history available

No Rights history available