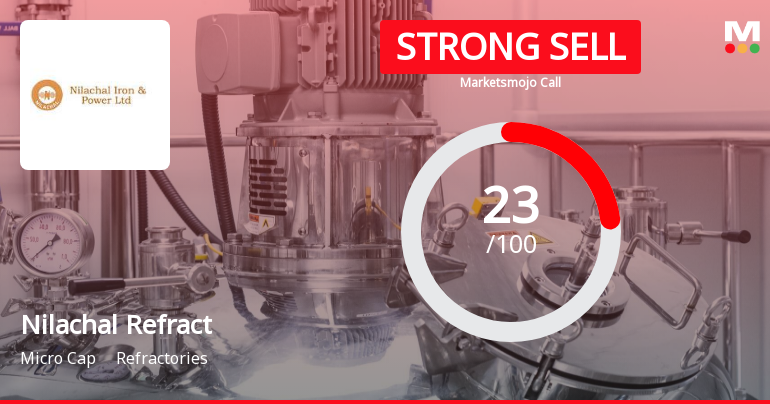

Nilachal Refractories Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-05 13:50:05Nilachal Refractories Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive days of losses, with a notable decline of 9.98% in just one day. Over the past week, the stock has dropped 11.57%, and its performance over the last month reveals a staggering 20.53% decrease. In stark contrast, the Sensex has shown a modest gain of 0.93% today and a decline of only 5.88% over the past month. The stock's year-to-date performance is also concerning, down 18.21%, while the Sensex has only slipped 5.72%. Over the past year, Nilachal Refractories has plummeted 54.33%, significantly underperforming the Sensex, which has remained nearly flat at -0.01%. Today's trading saw the stock open with a loss of 7.78%, reaching an intraday low of Rs 42.13. The stock has exhibited high volatility, with an intraday fluctuation of 5.43%. Additionally,...

Read More

Nilachal Refractories Faces Financial Challenges Amidst Stagnant Growth and High Debt Concerns

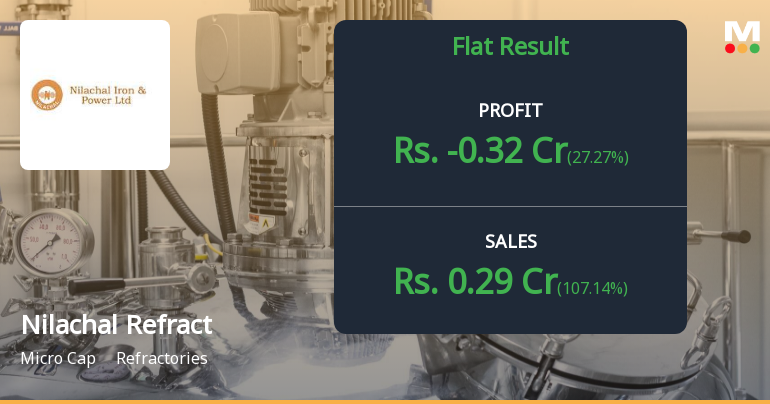

2025-02-27 18:55:33Nilachal Refractories has recently experienced a change in evaluation, reflecting its current financial situation. The company reported flat performance for the quarter ending December 2024, with declining net sales and stagnant operating profit, alongside concerns regarding its high debt-to-equity ratio and negative book value.

Read MoreNilachal Refractories Shows Mixed Technical Trends Amid Market Fluctuations

2025-02-25 10:29:50Nilachal Refractories, a microcap player in the refractories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 47.85, showing a notable increase from the previous close of 42.62. Over the past year, Nilachal Refractories has demonstrated a return of 13.96%, contrasting with a modest gain of 2.08% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the moving averages present a mildly bullish outlook on a daily basis. The Bollinger Bands and KST metrics also reflect bearish tendencies on the weekly and monthly charts, suggesting a cautious market sentiment. In terms of stock performance, Nilachal Refractories has experienced fluctuations, with a 52-week high of 112.00 and a low of 38.13. Notably...

Read More

Nilachal Refractories Faces Operational Challenges Amidst Mixed Market Performance

2025-02-20 18:12:16Nilachal Refractories, a microcap in the refractories sector, has recently adjusted its evaluation amid flat financial performance for the quarter ending December 2024. The company faces challenges with declining net sales, stagnant operating profit, and high debt levels, raising concerns about its long-term sustainability despite a notable stock return.

Read More

Nilachal Refractories Reports Stable Q4 Results Amid Positive Operating Profit Trends

2025-02-06 18:49:36Nilachal Refractories announced its financial results for the quarter ending December 2024 on February 6, 2025, showcasing stable performance. The company achieved its highest operating profit in five quarters, reflecting operational adjustments and market positioning, while its evaluation score shifted from 0 to 1 over the past three months.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Integrated Filing (Financial)

14-Feb-2025 | Source : BSEFinancial For quarter ended 31st December 2024

Board Meeting Outcome for Consideration And Approval Of Financial Results For Quarter Ended 31St December 2024

06-Feb-2025 | Source : BSEfinancial results for quarter ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available