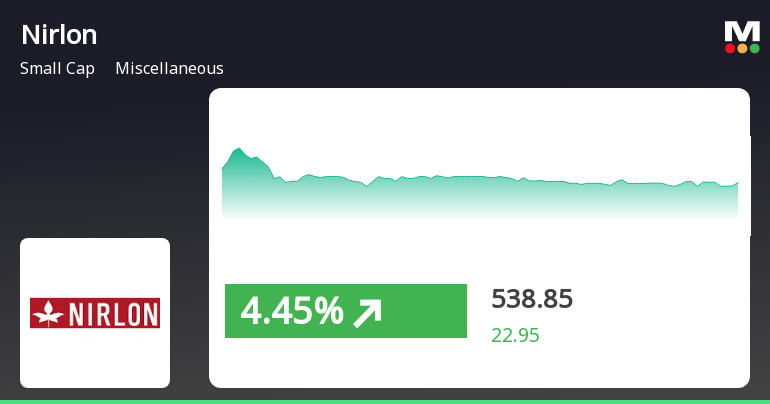

Nirlon Achieves 52-Week High Amid Broader Market Challenges and Strong Fundamentals

2025-04-01 11:47:13Nirlon has reached a new 52-week high of Rs. 575, showcasing strong performance with significant gains over recent days. The company boasts a high return on capital employed and impressive quarterly results, including record net sales. Despite broader market challenges, Nirlon has outperformed its sector and offers a notable dividend yield.

Read More

Nirlon Achieves 52-Week High Amid Strong Financial Performance and Market Resilience

2025-04-01 11:47:11Nirlon has reached a new 52-week high of Rs. 575, reflecting strong performance with an 8.23% gain over four days. The company reported record net sales of Rs. 161.34 crore and a high return on capital employed of 20.75%, showcasing resilience amid market challenges.

Read More

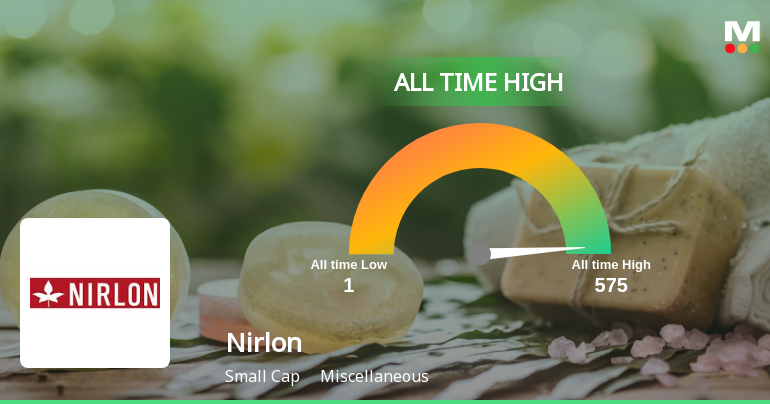

Nirlon Ltd Achieves All-Time High, Signaling Strong Market Confidence and Performance

2025-04-01 11:40:36Nirlon Ltd has achieved an all-time high of Rs. 575, reflecting strong performance with an 8.04% gain over four days. The stock trades above key moving averages and has delivered a 25.47% return over the past year, significantly outperforming the BSE 500. The company also boasts a high dividend yield and strong management efficiency.

Read More

Nirlon Achieves All-Time High Amid Mixed Market Sentiment and Strong Dividend Yield

2025-04-01 10:15:24Nirlon, a small-cap company in the miscellaneous industry, reached a new all-time high of Rs. 575, marking a significant milestone. The stock has shown strong performance over the past year, rising 26.60%, and is currently trading above key moving averages, indicating a positive trend despite mixed market sentiment.

Read MoreNirlon Shows Mixed Technical Trends Amid Strong Yearly Performance Against Sensex

2025-04-01 08:00:59Nirlon, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision that reflects its evolving market dynamics. The stock is currently priced at 515.90, showing a notable increase from the previous close of 500.10. Over the past year, Nirlon has demonstrated a strong performance, with a return of 20.96%, significantly outpacing the Sensex's return of 5.11% during the same period. The technical summary indicates a mixed outlook, with the MACD showing a bullish trend on a monthly basis, while the weekly analysis presents a mildly bearish signal. The Bollinger Bands and moving averages are aligned with a bullish sentiment, suggesting positive momentum. Additionally, the KST reflects a bullish trend on both weekly and monthly scales, while the Dow Theory indicates a mildly bullish stance on a weekly basis. In terms of stock performance relative to the Sensex, Nirlon has sho...

Read More

Nirlon Reports Strong Financial Performance Amid High Debt Concerns and Valuation Challenges

2025-03-18 08:04:16Nirlon, a small-cap company in the miscellaneous industry, has reported strong financial results for Q3 FY24-25, including a notable return on capital employed of 20.75% and record net sales of Rs 161.34 crore. However, it faces challenges with a high debt to EBITDA ratio and expensive valuation metrics.

Read MoreNirlon Shows Mixed Technical Trends Amid Strong Long-Term Performance Against Sensex

2025-03-17 08:00:30Nirlon, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 497.50, slightly down from its previous close of 500.00. Over the past year, Nirlon has shown a notable return of 18.55%, significantly outperforming the Sensex, which recorded a return of 1.47% in the same period. In terms of technical indicators, the company exhibits a mixed performance. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish monthly. The Bollinger Bands indicate a bullish stance on both weekly and monthly charts, suggesting some volatility but overall positive momentum. Moving averages reflect a mildly bullish trend daily, while the KST remains bullish on both timeframes. When comparing Nirlon's performance to the Sensex over various periods, it has demonstrated resilience, particularly o...

Read More

Nirlon Reports Strong Financial Performance Amidst Market Challenges and High Debt Concerns

2025-03-11 08:04:37Nirlon, a small-cap company in the miscellaneous industry, has recently adjusted its evaluation following strong financial results for Q3 FY24-25. The firm reported a 20.75% return on capital employed and positive outcomes for three consecutive quarters, despite facing challenges such as a high debt to EBITDA ratio.

Read MoreNirlon Shows Positive Technical Trends Amidst Market Resilience and Stability

2025-03-11 08:01:26Nirlon, a small-cap company operating in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 500.00, showing a slight increase from the previous close of 496.00. Over the past year, Nirlon has demonstrated a notable return of 18.01%, significantly outperforming the Sensex, which remained virtually unchanged at -0.01%. In terms of technical indicators, the weekly and monthly MACD and Bollinger Bands are signaling a positive trend, while the daily moving averages indicate a mildly positive outlook. The KST also reflects bullish sentiment on both weekly and monthly bases. However, the RSI shows no significant signals, and Dow Theory indicates no clear trend at this time. When comparing Nirlon's performance to the Sensex over various periods, the company has shown resilience, particularly over the last three years w...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEConfirmation Certificate for the quarter ended March 31 2025

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

03-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Nirlon Ltd |

| 2 | CIN NO. | L17120MH1958PLC011045 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 1150.00 |

| 4 | Highest Credit Rating during the previous FY | AA+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CARE RATINGS LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY VICE PRESIDENT LEGAL COMPLAINCE OFFICER

EmailId: jasminbhavsar@nirlonltd.com

Designation: CFO VICE PRESIDENT FINANCE

EmailId: manishparikh@nirlonltd.com

Date: 03/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSEThe Newspaper advertisement for the Board meeting and Prohibited Trading Window issued on March 31 2025

Corporate Actions

21 May 2025

Nirlon Ltd has declared 150% dividend, ex-date: 21 Feb 25

No Splits history available

No Bonus history available

No Rights history available