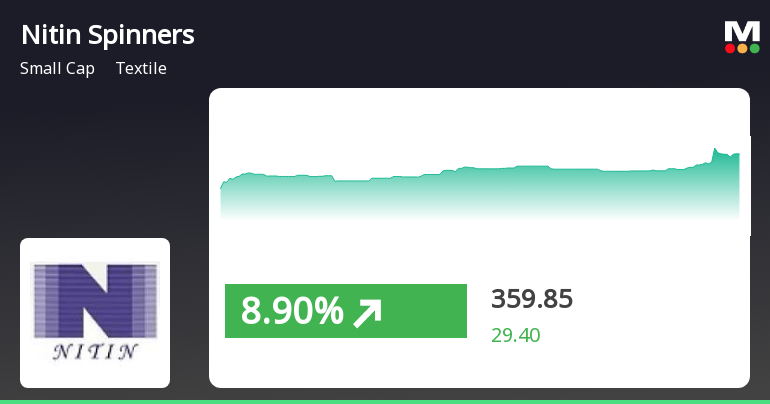

Nitin Spinners Shows Resilience Amid Broader Market Volatility and Decline

2025-04-03 12:00:16Nitin Spinners, a small-cap textile company, experienced notable gains on April 3, 2025, outperforming its sector and showing a consistent upward trend over four days. The stock reached an intraday high while the broader market faced volatility, emphasizing its resilience amid challenging conditions.

Read MoreNitin Spinners Adjusts Valuation Grade, Highlighting Strong Fundamentals in Textile Sector

2025-04-02 08:00:07Nitin Spinners, a small-cap player in the textile industry, has recently undergone a valuation adjustment, reflecting a more favorable assessment of its financial metrics. The company currently boasts a price-to-earnings (P/E) ratio of 11.03 and a price-to-book value of 1.52, indicating a competitive position in the market. Its enterprise value to EBITDA stands at 6.47, while the EV to EBIT ratio is recorded at 9.45, showcasing efficient operational performance. In terms of returns, Nitin Spinners has experienced varied performance against the Sensex. Over the past month, the stock has returned 7.16%, outperforming the Sensex's 3.86%. However, on a year-to-date basis, it has faced a decline of 26.55%, contrasting with the Sensex's modest drop of 2.71%. Notably, the company has demonstrated remarkable growth over the longer term, with a staggering 1,074.91% return over the past five years. When compared to...

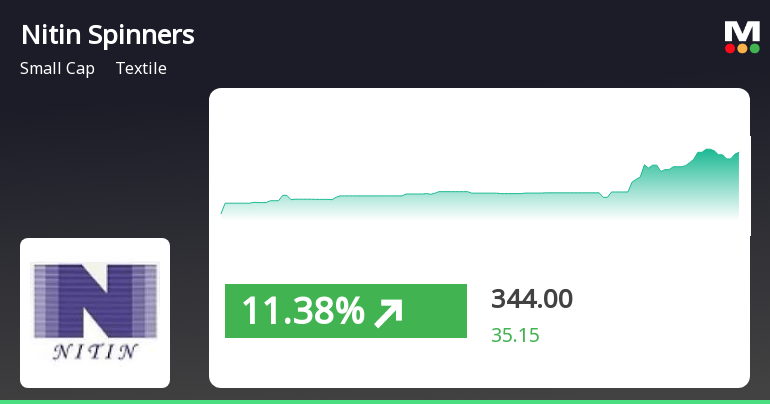

Read MoreNitin Spinners Opens Strong with 6.02% Gain, Outperforming Textile Sector

2025-03-24 12:05:03Nitin Spinners, a small-cap player in the textile industry, has shown significant activity today, opening with a gain of 6.02%. The stock has outperformed its sector by 1.52%, reflecting a positive trend in its recent performance. Over the past two days, Nitin Spinners has recorded a cumulative return of 4.97%, indicating a consistent upward trajectory. Today, the stock reached an intraday high of Rs 366.25. In terms of performance metrics, Nitin Spinners has demonstrated a 2.43% increase in one day, compared to the Sensex's 1.16%. Over the past month, the stock has surged by 10.32%, while the Sensex has only gained 4.49%. From a technical perspective, the stock's moving averages are currently higher than the 5-day and 20-day averages but fall below the 50-day, 100-day, and 200-day averages. The stock is classified as high beta, with an adjusted beta of 1.35, suggesting it tends to exhibit greater volatil...

Read More

Nitin Spinners Outperforms Sector Amid Broader Small-Cap Market Gains

2025-03-05 11:00:15Nitin Spinners, a small-cap textile company, has seen notable activity, gaining 8.79% on March 5, 2025, and outperforming its sector. The stock reached an intraday high of Rs 318.8 and is currently above its 5-day moving average, while the broader market shows mixed trends.

Read More

Nitin Spinners Faces Significant Volatility Amidst Broader Market Challenges

2025-03-03 14:20:13Nitin Spinners, a small-cap textile company, has hit a new 52-week low, reflecting significant volatility and a 9.39% decline over the past six days. The stock is trading below all major moving averages and has underperformed its sector and the broader market over the past year.

Read MoreNitin Spinners Faces Stock Volatility Amidst Broader Market Gains and Long-Term Resilience

2025-02-28 10:24:43Nitin Spinners Ltd, a small-cap player in the textile industry, has experienced significant volatility in its stock performance recently. With a market capitalization of Rs 1,706.28 crore, the company currently has a price-to-earnings (P/E) ratio of 10.52, notably lower than the industry average of 28.67. Over the past year, Nitin Spinners has seen a decline of 13.88%, contrasting sharply with the Sensex, which has gained 1.99% during the same period. The stock's performance has been particularly challenging in recent weeks, with a 6.43% drop over the last week and a staggering 21.17% decline in the past month. Year-to-date, the stock is down 32.48%, while the Sensex has only decreased by 5.63%. Technical indicators suggest a bearish trend, with the MACD and Bollinger Bands reflecting negative momentum. Despite these challenges, Nitin Spinners has shown resilience over the long term, boasting a remarkabl...

Read MoreNitin Spinners Faces Bearish Technical Trends Amid Market Volatility and Declining Returns

2025-02-28 08:01:29Nitin Spinners, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 314.65, down from a previous close of 319.75. Over the past year, Nitin Spinners has experienced significant volatility, with a 52-week high of 493.90 and a low of 292.65. The technical summary indicates a bearish sentiment across various indicators, including MACD and Bollinger Bands, which are both signaling bearish trends on a weekly and monthly basis. The moving averages also reflect a bearish stance, suggesting a challenging market environment for the company. In terms of performance, Nitin Spinners has faced notable declines in stock returns compared to the Sensex. Over the past week, the stock has returned -4.42%, while the Sensex saw a decline of only -1.48%. The one-month performance shows a stark contrast, wi...

Read MoreNitin Spinners Shows Volatility Amidst Broader Textile Sector Challenges

2025-02-20 11:55:02Nitin Spinners, a small-cap player in the textile industry, has shown significant activity today, opening with a notable gain of 7.78%. The stock's performance has outpaced its sector by 1.71%, reflecting a positive shift in market sentiment. Over the past two days, Nitin Spinners has recorded a cumulative return of 5.45%, indicating a potential recovery from previous declines. Today, the stock reached an intraday high of Rs 347, showcasing its volatility with an intraday fluctuation of 6.57%. Despite this upward movement, Nitin Spinners is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging trend in the longer term. In terms of broader market performance, Nitin Spinners has outperformed the Sensex today, which has seen a decline of 0.30%. However, over the past month, the stock has faced a downturn of 20.85%, contrasting with the Sensex's mode...

Read More

Nitin Spinners Reports Strong Q3 Performance, Highlights Operational Efficiency and Growth Potential

2025-02-12 18:35:45Nitin Spinners, a small-cap textile company, has reported strong financial performance for Q3 FY24-25, with a notable return on capital employed of 16.72% and a 28.21% growth in operating profit. The company has consistently delivered positive results over the last three quarters, reflecting its operational efficiency and market strength.

Read MoreINTIMATION UNDER REGULATION 30 OF SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS 2015

08-Apr-2025 | Source : BSEINTIMATION UNDER REGULATION 30 OF SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS 2015

Closure of Trading Window

31-Mar-2025 | Source : BSEINTIMATION OF CLOSURE OF TRADING WINDOW

Disclosure Under SEBI (PIT) Reg 2015

22-Feb-2025 | Source : BSEDisclosure under SEBI (PIT) Reg 2015

Corporate Actions

No Upcoming Board Meetings

Nitin Spinners Ltd has declared 25% dividend, ex-date: 09 Sep 24

No Splits history available

No Bonus history available

No Rights history available