NPR Finance Adjusts Valuation Grade Amidst Competitive Market Landscape and Performance Concerns

2025-03-06 08:00:54NPR Finance, a microcap player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently holds a PE ratio of 14.67 and an EV to EBITDA ratio of 7.66, indicating its market valuation relative to earnings before interest, taxes, depreciation, and amortization. Additionally, NPR Finance's price to book value stands at 0.31, suggesting a potential undervaluation compared to its net assets. In terms of performance metrics, the company has reported a return on equity (ROE) of 1.71% and a return on capital employed (ROCE) of -3.76%, which may raise concerns about its profitability and efficiency. Over the past year, NPR Finance has experienced a stock return of 9.42%, outperforming the Sensex, which recorded a slight increase of 0.07% during the same period. When compared to its peers, NPR Finance's valuation metrics appear less...

Read More

NPR Finance Faces Declining Sales and Shifting Market Sentiment Amid Evaluation Adjustment

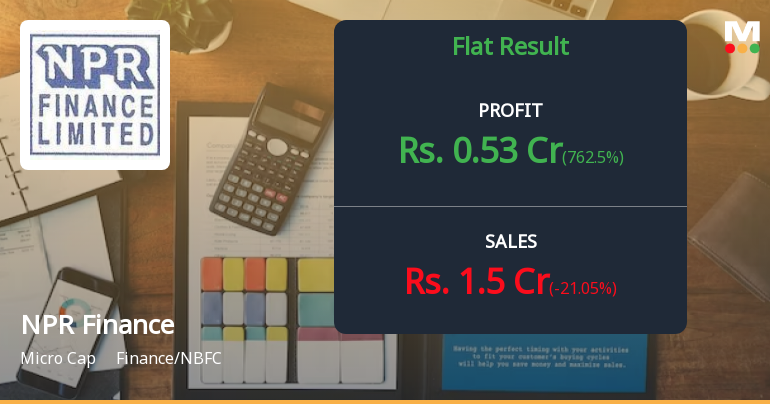

2025-03-05 08:05:30NPR Finance, a microcap company in the finance sector, has recently adjusted its evaluation amid flat financial performance for Q3 FY24-25. With net sales down significantly year-over-year and declining growth metrics, the company faces challenges, although it retains an attractive valuation compared to peers.

Read More

NPR Finance Reports Mixed Financial Results, Highlighting Profit Growth Amid Sales Decline in February 2025

2025-02-12 22:20:50NPR Finance has announced its financial results for the quarter ending December 2024, revealing a significant improvement in profitability with a Profit After Tax of Rs 0.53 crore and an Earnings per Share of Rs 0.88. However, net sales declined by 31.99% year-on-year, indicating mixed performance.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | NPR Finance Ltd |

| 2 | CIN NO. | L65921WB1989PLC047091 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.25 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY

EmailId: investors@nprfinance.com

Designation: CHIEF FINANCIAL OFFICER

EmailId: accounts@nprfinance.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find enclosed herewith the Disclosure under regulation 74(5) of the SEBI (Depositories and Participants ) Regulations 2018 for the Quarter ended 31st March 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPLEASE FIND ENCLOSED HEREWITH THE DISCLOSURE UNDER REGULATION 74(5) OF THE SEBI ( DEPOSITORIES AND PARTICIPANTS) REGULATIONS 2018 FOR THE QUARTER ENDED 31ST MARCH 2025.

Corporate Actions

No Upcoming Board Meetings

NPR Finance Ltd has declared 10% dividend, ex-date: 10 Sep 07

No Splits history available

No Bonus history available

No Rights history available