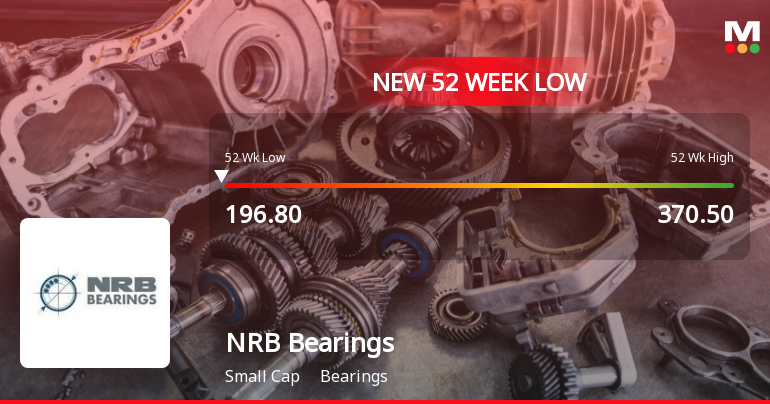

NRB Bearings Hits 52-Week Low Amid Sustained Downward Trend in Competitive Market

2025-03-03 10:07:30NRB Bearings has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below key moving averages, indicating a sustained downward trend. Over the past year, the stock has faced considerable challenges compared to broader market indices.

Read More

NRB Bearings Hits 52-Week Low Amid Sustained Market Weakness and Declining Returns

2025-02-28 10:06:04NRB Bearings has reached a new 52-week low, reflecting ongoing challenges in the bearings industry. The stock has declined consecutively over the past five days and is trading below key moving averages, indicating a sustained period of weakness compared to broader market performance.

Read MoreNRB Bearings Adjusts Valuation Grade Amidst Competitive Industry Landscape and Performance Trends

2025-02-27 08:00:19NRB Bearings has recently undergone a valuation adjustment, reflecting its financial performance and market position within the bearings industry. The company currently exhibits a price-to-earnings (PE) ratio of 19.18 and a price-to-book value of 2.23, indicating a solid valuation relative to its earnings and assets. Additionally, NRB Bearings shows an EV to EBITDA ratio of 11.26 and an EV to sales ratio of 1.82, which are competitive metrics in the sector. The company's return on capital employed (ROCE) stands at 13.86%, while the return on equity (ROE) is recorded at 11.34%, showcasing effective management of resources and shareholder equity. The dividend yield is noted at 1.17%, providing a modest return to shareholders. In comparison to its peers, NRB Bearings has demonstrated resilience, particularly over a three-year period, where it outperformed the broader market index with a return of 81.85% comp...

Read More

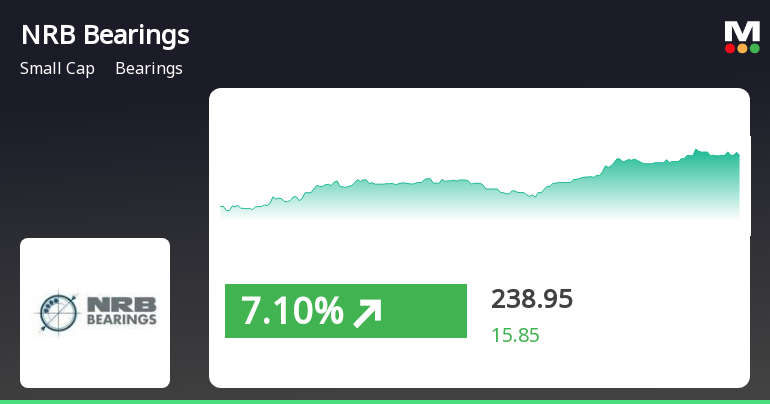

NRB Bearings Experiences Notable Gains Amidst Complex Market Dynamics in February 2025

2025-02-13 12:05:19NRB Bearings experienced notable trading activity, gaining 7.93% on February 13, 2025, and outperforming its sector. Despite recent gains, the stock remains below key moving averages and has faced challenges over the past month, contrasting with the broader market's performance. The company continues to navigate a complex market landscape.

Read More

NRB Bearings Hits 52-Week Low Amid Continued Decline and Market Challenges

2025-02-12 09:37:21NRB Bearings has faced notable volatility, hitting a 52-week low and experiencing a 16.66% decline over the past five days. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in a competitive market, with a year-over-year drop of 38.82%.

Read More

NRB Bearings Faces Significant Volatility Amidst Declining Stock Performance and Market Challenges

2025-02-11 10:05:29NRB Bearings faced notable volatility on February 11, 2025, with the stock hitting a new 52-week low after an initial gain. Over four days, it declined significantly, underperforming its sector. The stock's technical indicators suggest a bearish trend, and intraday volatility was high, reflecting a turbulent trading session.

Read More

NRB Bearings Hits 52-Week Low Amidst Ongoing Market Challenges and Volatility

2025-02-11 09:36:12NRB Bearings has faced notable volatility, hitting a 52-week low of Rs. 225.7 after a four-day decline totaling 10.88%. The stock's performance has lagged behind its sector, with significant fluctuations during the trading session and a year-over-year decline of 35.86%, contrasting with the Sensex's gains.

Read More

NRB Bearings Hits 52-Week Low Amid Ongoing Market Underperformance

2025-02-10 09:35:33NRB Bearings has reached a new 52-week low, reflecting significant volatility and a decline of 31.15% over the past year, contrasting with the Sensex's gains. The stock has underperformed its sector and is currently trading below multiple moving averages, indicating a bearish trend.

Read More

NRB Bearings Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-02-08 10:07:57NRB Bearings has announced its financial results for Q3 FY24-25, showing a flat performance. The company has improved its operating profit to interest ratio and reduced its debt-equity ratio, indicating better financial management. However, concerns include a decline in inventory turnover and a decrease in profit after tax and earnings per share.

Read MoreAnnouncement under Regulation 30 (LODR)-Resignation of Company Secretary / Compliance Officer

25-Mar-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for quarter and year ended March 31 2025

Announcement under Regulation 30 (LODR)-Investor Presentation

19-Mar-2025 | Source : BSEPursuant to Regulation 30 of SEBI (LODR) Regulations 2015 - Investors Presentation

Corporate Actions

No Upcoming Board Meetings

NRB Bearings Ltd has declared 125% dividend, ex-date: 16 Oct 24

NRB Bearings Ltd has announced 2:10 stock split, ex-date: 26 Mar 07

NRB Bearings Ltd has announced 1:1 bonus issue, ex-date: 03 Sep 10

No Rights history available