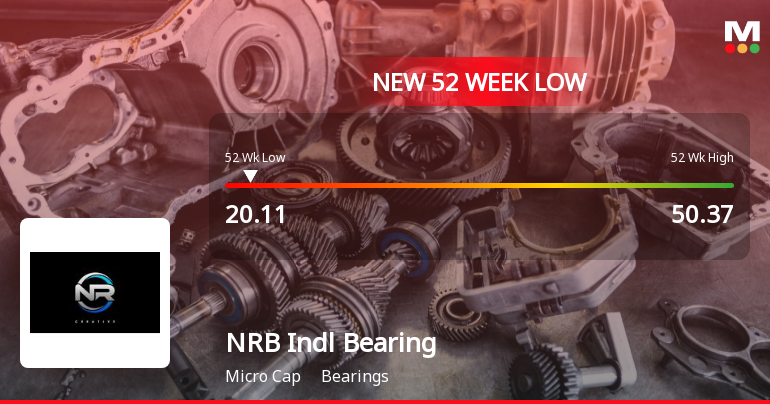

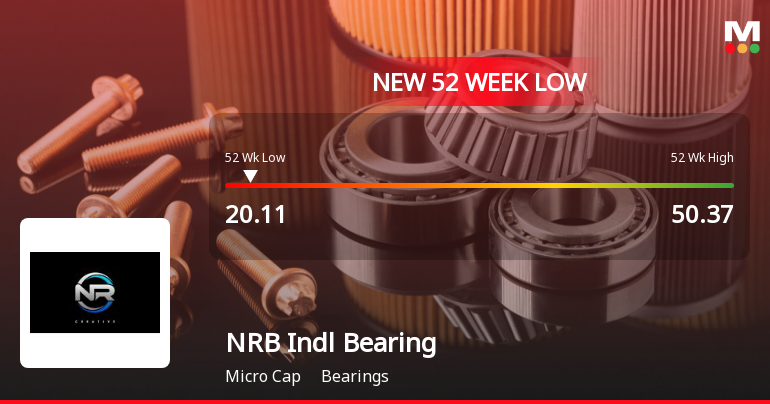

NRB Industrial Bearings Faces Significant Volatility Amid Weak Fundamentals and Market Challenges

2025-03-28 09:51:33NRB Industrial Bearings has faced significant volatility, hitting a new 52-week low and showing a notable decline over the past year. The stock is trading below key moving averages and grappling with financial challenges, while the broader bearings sector and small-cap stocks have shown some resilience today.

Read More

NRB Industrial Bearings Faces Financial Challenges Amid Market Volatility and Stagnant Growth

2025-03-28 09:51:28NRB Industrial Bearings has hit a new 52-week low, reflecting a significant decline over the past year. Despite today's volatility, the stock outperformed its sector slightly. The company faces challenges, including a negative book value and stagnant sales growth, amid broader market pressures in the bearings sector.

Read More

NRB Industrial Bearings Faces Market Scrutiny Amid Significant Stock Volatility

2025-03-28 09:51:18NRB Industrial Bearings has faced notable volatility, reaching a new 52-week low while briefly recovering during the trading session. The stock has underperformed over the past year, trading below key moving averages and grappling with financial challenges, including a negative book value and high debt-to-equity ratio.

Read MoreNRB Industrial Bearings Hits Upper Circuit Limit Amid Mixed Performance Indicators

2025-03-13 12:00:06NRB Industrial Bearings Ltd, a microcap company in the bearings industry, has made headlines today by hitting its upper circuit limit. The stock reached a high price of Rs 23.27, reflecting a notable increase of Rs 1.1 or 4.96% from its previous close. This performance marks a significant turnaround for NRB Industrial Bearings, which had experienced five consecutive days of decline prior to today. The stock's trading activity saw a total volume of approximately 30,000 shares, resulting in a turnover of around Rs 6.98 lakh. Despite the positive movement today, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a mixed performance over a longer timeframe. Interestingly, the stock outperformed its sector by 5.13%, while the broader market, represented by the Sensex, recorded a slight decline of 0.18%. However, investor participation appears to be ...

Read MoreNRB Industrial Bearings Faces Persistent Bearish Trend Amid Decreased Investor Participation

2025-03-12 15:00:04NRB Industrial Bearings Ltd, a microcap company in the bearings industry, has experienced significant trading activity today, hitting its lower circuit limit. The stock closed at a last traded price of Rs 22.48, reflecting a decline of Rs 0.54 or 2.35%. The stock's performance has been notably weak, underperforming its sector by 3.73% and recording a 1D return of -5.00%. During the trading session, NRB Industrial Bearings reached an intraday high of Rs 23.90 and a low of Rs 21.86, indicating a price band of 5%. The total traded volume was approximately 0.06944 lakh shares, with a turnover of Rs 0.0154 crore. The stock has been on a downward trend, having fallen for five consecutive days, resulting in an overall decline of 11.01% during this period. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, highlighting a persistent bearish trend. I...

Read MoreNRB Industrial Bearings Faces Increased Trading Activity Amid Bearish Market Trends

2025-03-04 13:20:53NRB Industrial Bearings Ltd, operating in the bearings industry, has experienced significant trading activity today, closing at a last traded price of Rs 22.7, reflecting a decline of Rs 1.12 or 4.7%. The stock hit an intraday high of Rs 24.3, marking a 2.97% increase at the opening, but subsequently fell to a low of Rs 22.4, representing a drop of 5.08%. The stock's performance today has underperformed compared to its sector, which gained 4.04%. Notably, NRB Industrial Bearings is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The total traded volume reached approximately 0.02612 lakh shares, with a turnover of Rs 0.00599 crore. The stock's year high stands at Rs 50.4, while the year low is Rs 21.2. Additionally, there has been a notable increase in investor participation, with delivery volume rising by 191.39% compared to the 5-day ...

Read More

NRB Industrial Bearings Reports Flat Q3 FY24-25 Results Amid Positive Financial Trends

2025-02-05 15:31:51NRB Industrial Bearings has announced its financial results for Q3 FY24-25, showing a stable performance. Key highlights include an improved Debtors Turnover Ratio and Operating Profit figures, alongside rising Profit Before Tax and Profit After Tax. However, the Debt-Equity Ratio indicates increased reliance on borrowing.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | NRB Industrial Bearings Ltd |

| 2 | CIN NO. | L29253MH2011PLC213963 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: investorcare@nibl.in

Designation: Chief Financial Officer

EmailId: investorcare@nibl.in

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation for Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available