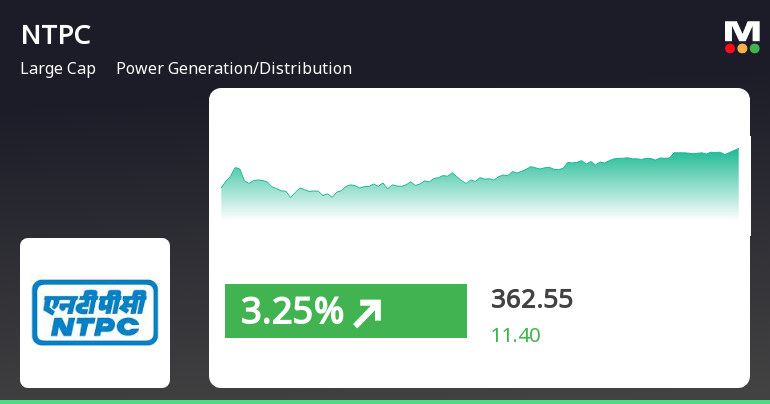

NTPC Ltd. Shows Recovery Amid Broader Power Sector Gains and Favorable Valuation

2025-04-03 12:35:08NTPC Ltd., a prominent player in the Power Generation and Distribution industry, has shown notable activity today, aligning with sector trends. The stock has experienced a reversal after three consecutive days of decline, gaining approximately 1.93% and reaching an intraday high of Rs 359.4. This uptick comes as the broader Power Generation/Distribution sector also saw a rise of 2.25%. In terms of performance metrics, NTPC's price-to-earnings (P/E) ratio stands at 15.52, significantly lower than the industry average of 21.44, indicating a potentially favorable valuation relative to its peers. The stock is currently trading above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Over the past year, NTPC has delivered a return of 2.02%, slightly lagging behind the Sensex's 3.32% performance. However, its year-to-date performance of 7.59% outpaces t...

Read MoreNTPC's Technical Trends Show Mixed Signals Amid Market Evaluation Revision

2025-04-02 08:00:37NTPC, a prominent player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 352.15, down from the previous close of 357.65. Over the past year, NTPC has experienced a 2.89% return, slightly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective indicates a mildly bearish stance. The Bollinger Bands reflect a mildly bullish trend on both weekly and monthly charts, suggesting some volatility in price movements. Moving averages indicate a mildly bearish trend on a daily basis, which may influence short-term trading strategies. The company's performance over various time frames highlights its resilience, particularly in the three-year and five-year perio...

Read MoreNTPC Ltd. Shows Strong Performance Amidst Favorable Valuation Metrics in Power Sector

2025-03-28 09:20:03NTPC Ltd., a prominent player in the power generation and distribution sector, has shown notable activity today, outperforming its sector by 0.31%. The stock has been on a positive trajectory, gaining for the last two days with a total return of 2.5% during this period. NTPC opened at Rs 363 and has maintained this price throughout the trading session. With a market capitalization of Rs 3,52,182.91 crore, NTPC is classified as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 15.92, significantly lower than the industry average of 22.72, indicating a potentially favorable valuation compared to its peers. In terms of performance metrics, NTPC has demonstrated resilience over various time frames. Over the past year, the stock has returned 8.11%, outperforming the Sensex, which recorded a 5.31% gain. Additionally, NTPC's year-to-date performance is 8.94%, while the Sensex has declined ...

Read MoreNTPC Ltd. Shows Mixed Performance Amidst Competitive Power Sector Landscape

2025-03-27 09:25:04NTPC Ltd., a prominent player in the power generation and distribution sector, has experienced notable activity today, aligning closely with sector performance. The stock has faced a consecutive decline over the past three days, resulting in a total drop of 3.8%. Despite this recent downturn, NTPC's moving averages indicate a mixed performance; while it remains above the 20-day, 50-day, and 100-day moving averages, it is currently below the 5-day and 200-day averages. With a market capitalization of Rs 3,43,795.30 crore, NTPC operates within a competitive landscape where 34 companies have reported results, with 10 showing positive outcomes, 15 flat, and 9 negative. The company's price-to-earnings (P/E) ratio stands at 15.62, notably lower than the industry average of 22.15. In terms of performance metrics, NTPC has shown resilience over various time frames. Over the past year, it has delivered a return of...

Read More

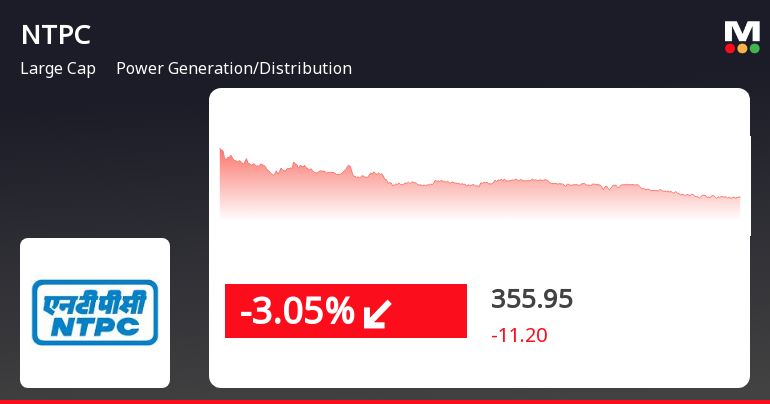

NTPC Ltd. Faces Short-Term Challenges Amidst Broader Market Resilience

2025-03-26 14:45:14NTPC Ltd. has faced a decline in its stock performance, marking a two-day losing streak. Despite this, the company has shown strong year-to-date growth and significant gains over the past five years. The broader market, represented by the Sensex, also experienced a downturn, closing lower.

Read MoreNTPC Ltd. Faces Volatility Amidst Strong Long-Term Performance in Power Sector

2025-03-26 09:25:05NTPC Ltd., a prominent player in the power generation and distribution sector, has experienced notable activity today, underperforming its sector by 0.71%. The stock has faced consecutive declines over the past two days, resulting in a total return drop of 0.64%. Today's trading has been marked by high volatility, with an intraday volatility rate of 77.91%, indicating significant price fluctuations. In terms of market positioning, NTPC boasts a market capitalization of Rs 3,54,655.56 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 16.20, which is below the industry average of 22.44, suggesting a relative valuation perspective within its sector. Over the past year, NTPC has delivered a return of 11.10%, outperforming the Sensex, which recorded a return of 7.78%. In the shorter term, NTPC's performance has also been strong, with a 14.67% increase over the p...

Read MoreNTPC Ltd. Shows Mixed Performance Amid Competitive Power Sector Landscape

2025-03-25 09:25:06NTPC Ltd., a prominent player in the power generation and distribution sector, has experienced notable activity today, underperforming its sector by 0.49%. After a streak of five consecutive days of gains, the stock has seen a reversal in trend. Currently, NTPC's stock price is above its 5-day, 20-day, 50-day, and 100-day moving averages, yet it remains below the 200-day moving average, indicating mixed short- to medium-term performance. With a market capitalization of Rs 3,57,079.73 crore, NTPC operates within a competitive industry where 34 companies have reported results, with 10 showing positive outcomes, 15 flat, and 9 negative. The company's price-to-earnings (P/E) ratio stands at 16.21, significantly lower than the industry average of 22.82. In terms of performance metrics, NTPC has shown a robust 13.33% increase over the past year, outperforming the Sensex, which has risen by 7.30%. Over the last ...

Read More

NTPC Ltd. Shows Strong Performance Amid Broader Market Gains and Positive Trends

2025-03-24 11:00:15NTPC Ltd. has demonstrated strong performance in the power sector, achieving consecutive gains over five days and a notable return over the past year. The stock is currently above several key moving averages, while the broader market, represented by the Sensex, has also shown positive momentum recently.

Read MoreNTPC Ltd. Shows Strong Performance Amid Market Trends and Increased Volatility

2025-03-24 09:30:08NTPC Ltd., a prominent player in the power generation and distribution sector, has shown significant activity today, aligning with broader market trends. The stock opened with a gain of 2.15% and reached an intraday high of Rs 359.45, reflecting a 2.36% increase. Over the past five days, NTPC has demonstrated a robust performance, accumulating returns of 7.66%. The stock's volatility has been notable, with an intraday volatility of 238.34%, indicating fluctuations in trading activity. In terms of moving averages, NTPC's current price is above the 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. With a market capitalization of Rs 3,40,498.00 crore, NTPC's price-to-earnings ratio stands at 15.49, significantly higher than the industry average of 10.46. Over the past year, NTPC has outperformed the Sensex, delivering a return of 9.31% compared to the ...

Read MoreDeclaration Of COD Of Second Part Capacity Of 90 MW Out Of 150 MW Dayapar Wind Energy Project Phase-I Of NTPC Renewable Energy Limited (NTPC REL)

08-Apr-2025 | Source : BSEDisclosure attached.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018. Kindly refer attached letter for further details.

Disclosure Under Regulation 30 Of SEBI (LODR) Regulations 2015-Cautionary Notices

02-Apr-2025 | Source : BSEKindly refer attached letter for further details.

Corporate Actions

No Upcoming Board Meetings

NTPC Ltd. has declared 25% dividend, ex-date: 31 Jan 25

No Splits history available

NTPC Ltd. has announced 1:5 bonus issue, ex-date: 19 Mar 19

No Rights history available