Nuvoco Vistas Adjusts Valuation Amidst Competitive Cement Industry Landscape

2025-03-24 08:01:09Nuvoco Vistas Corporation, a midcap player in the cement industry, has recently undergone a valuation adjustment. The company's financial metrics reflect a complex landscape, with a PE ratio of -267.15 and a price-to-book value of 1.30. Its EV to EBIT stands at 36.76, while the EV to EBITDA ratio is recorded at 12.45. The EV to capital employed is 1.20, and the EV to sales ratio is 1.59. Notably, the return on capital employed (ROCE) is at 4.27%, and the return on equity (ROE) is 0.55%. In comparison to its peers, Nuvoco Vistas holds an attractive valuation, although it faces competition from companies like JK Lakshmi Cement and Star Cement, which exhibit varying valuation metrics. For instance, JK Lakshmi Cement has a PE ratio of 33.25 and an EV to EBITDA of 12.85, while Star Cement shows a significantly higher PE ratio of 65.28 and an EV to EBITDA of 18.30. The recent evaluation revision highlights the...

Read More

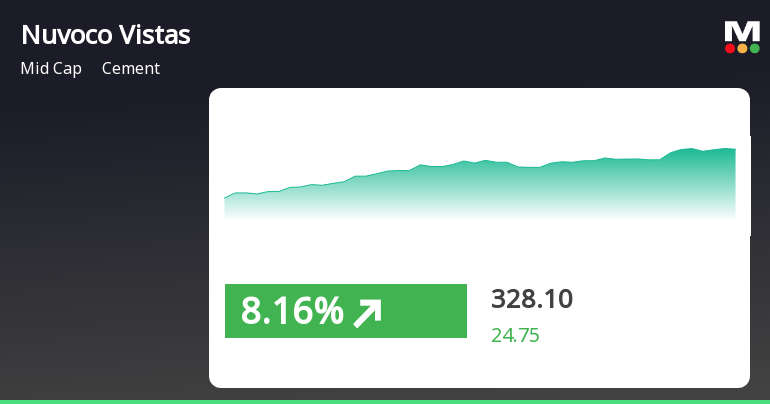

Nuvoco Vistas Corporation Shows Strong Performance Amidst Broader Market Fluctuations

2025-03-21 09:50:28Nuvoco Vistas Corporation has experienced notable stock activity, outperforming its sector and showing a consistent upward trend over the past four days. The stock's current price is above its short-term moving averages, while broader market indices, including the Sensex, have also shown signs of recovery.

Read More

Nuvoco Vistas Faces Significant Volatility Amid Declining Financial Performance and Weak Fundamentals

2025-03-17 09:57:11Nuvoco Vistas Corporation, a midcap cement company, has faced notable volatility, hitting a 52-week low and showing a decline over the past five days. The company has reported negative financial results for three consecutive quarters, with significant drops in profit and net sales, while maintaining a high institutional holding.

Read More

Nuvoco Vistas Faces Financial Struggles Amidst Declining Stock Performance and Weak Fundamentals

2025-03-17 09:57:09Nuvoco Vistas Corporation, a midcap cement company, has faced significant volatility, reaching a new 52-week low. The firm has reported negative financial results for three consecutive quarters, with a notable decline in profit and sales. Despite high institutional holding, its long-term fundamentals show weakness.

Read More

Nuvoco Vistas Faces Significant Financial Challenges Amidst Market Volatility

2025-03-17 09:57:09Nuvoco Vistas Corporation, a midcap cement company, has faced significant volatility, reaching a new 52-week low. The firm has reported negative financial results for three consecutive quarters, with substantial declines in profit metrics and net sales. Its long-term fundamentals appear weak, yet institutional holdings remain strong.

Read More

Nuvoco Vistas Faces Continued Decline Amidst Weak Financial Performance and High Debt Levels

2025-03-13 14:38:14Nuvoco Vistas Corporation, a midcap cement company, has faced notable volatility, reaching a new 52-week low. The stock has declined for four consecutive days, with a negative one-year return. The company reports ongoing challenges, including negative quarterly results and a high debt-to-EBITDA ratio, despite significant institutional holdings.

Read MoreNuvoco Vistas Faces Market Challenges Amid Stock Fluctuations and Negative Momentum

2025-02-25 09:57:40Nuvoco Vistas Corporation, a mid-cap player in the cement industry, has experienced notable fluctuations in its stock performance recently. As of today, the company's market capitalization stands at Rs 11,245.06 crore. Over the past year, Nuvoco's stock has declined by 7.45%, contrasting with the Sensex, which has gained 2.21% during the same period. In the short term, Nuvoco's stock has seen a decrease of 0.58% today, while the Sensex has risen by 0.41%. Over the past week, Nuvoco's performance has improved slightly by 0.80%, diverging from the Sensex's decline of 1.59%. However, the company has faced challenges in the longer term, with a 10.49% drop over the past month and a year-to-date decline of 10.11%, compared to the Sensex's decrease of 4.33%. Key financial metrics indicate a P/E ratio of -260.93 for Nuvoco, significantly higher than the industry average of 47.67. Technical indicators suggest a be...

Read MoreClosure of Trading Window

08-Apr-2025 | Source : BSEKindly refer the attachment

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

25-Mar-2025 | Source : BSEIn terms of Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 please find below the details of the meeting with Investor/Analyst which will be attended by the representatives of the Company. Date and time: March 26 2025 from 11:00 a.m. onwards (IST) Name: DAM Capital Mode: In person Nature of Meeting :One-on-One The schedule and mode of meeting may undergo a change due to exigencies on part of the Investor/Analyst/Company.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Mar-2025 | Source : BSEIn terms of Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 please find below the details of the meeting with Investor/Analyst which will be attended by the representatives of the Company. Date and time: March 8 2025 from 2:00 p.m. onwards (IST) Name: SBI Mutual Fund Mode: In Person Nature of Meeting: One-on-One Meeting The schedule and mode of meeting may undergo a change due to exigencies on part of the Investor/Analyst/Company.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available