Oceanic Foods Adjusts Valuation Grade Amid Competitive FMCG Landscape Dynamics

2025-03-20 08:01:00Oceanic Foods, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (PE) ratio of 10.52 and an EV to EBITDA ratio of 8.29, indicating a competitive position within its industry. Its return on capital employed (ROCE) stands at 10.37%, while the return on equity (ROE) is reported at 12.80%, showcasing its operational efficiency. In comparison to its peers, Oceanic Foods maintains a relatively attractive valuation, particularly when juxtaposed with companies like Vadilal Enterprises, which is positioned at a higher valuation level. Other competitors, such as Sarveshwar Foods and Foods & Inns, present varying valuation metrics, with Oceanic Foods demonstrating a more favorable EV to sales ratio of 0.56. Despite recent fluctuations in stock performance, including a notable return of...

Read MoreOceanic Foods Adjusts Valuation Grade, Signaling Potential in Competitive FMCG Market

2025-03-07 08:01:22Oceanic Foods, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently boasts a PE ratio of 10.15 and an EV to EBITDA ratio of 8.11, indicating a competitive stance within its industry. Its price to book value stands at 1.30, while the EV to sales ratio is notably low at 0.54, suggesting efficient asset utilization. In terms of profitability, Oceanic Foods reports a return on capital employed (ROCE) of 10.37% and a return on equity (ROE) of 12.80%, which are solid indicators of its operational efficiency. However, the company's stock performance has faced challenges, with a year-to-date return of -15.29%, contrasting with a slight gain in the Sensex. When compared to its peers, Oceanic Foods presents a favorable valuation profile. Competitors like Foods & Inns and Integ. Industrie also show strong metr...

Read MoreOceanic Foods Ltd Sees Strong Buying Activity Amidst Market Volatility

2025-03-05 12:40:11Oceanic Foods Ltd is currently witnessing significant buying activity, with the stock rising by 8.75% today, notably outperforming the Sensex, which gained only 1.25%. Despite this daily gain, the stock has faced challenges over the past week, month, and year, showing declines of 3.33%, 11.22%, and 11.22%, respectively, compared to the Sensex's smaller declines. Today, Oceanic Foods opened with a gap down of 8.48%, hitting a new 52-week low of Rs. 36.61 before rebounding to an intraday high of Rs. 43.5. The stock's performance today indicates a strong recovery from its earlier losses, with a notable intraday volatility of 8.59%. The buying pressure may be attributed to various factors, including market sentiment and potential sector-specific developments within the FMCG industry. The stock's current price is above its 5-day moving average but remains below its longer-term moving averages, indicating mixe...

Read More

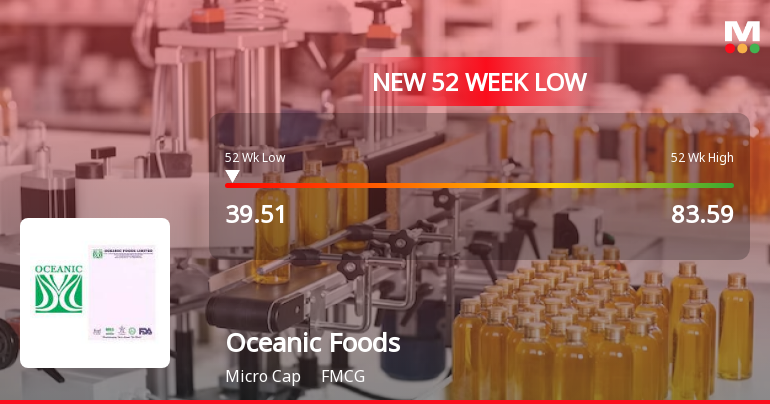

Oceanic Foods Faces Significant Volatility Amidst Competitive Market Challenges

2025-02-28 13:05:40Oceanic Foods, a microcap in the FMCG sector, faced significant volatility, hitting a new 52-week low after four days of gains. The stock experienced an intraday fluctuation of 9.83% and closed below all major moving averages, reflecting ongoing challenges in a competitive market.

Read More

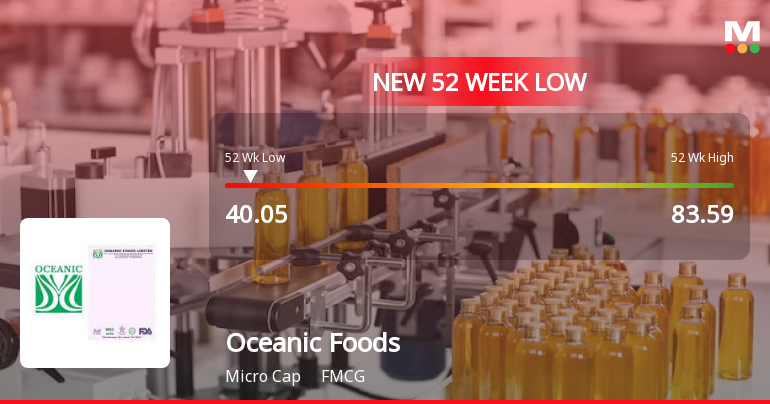

Oceanic Foods Faces Significant Volatility Amid Broader Market Challenges

2025-02-18 13:06:04Oceanic Foods, a microcap in the FMCG sector, has faced notable volatility, hitting a new 52-week low of Rs. 40.4. The stock has declined for six consecutive days, totaling an 18.38% drop, and is trading below key moving averages, indicating a challenging market environment.

Read More

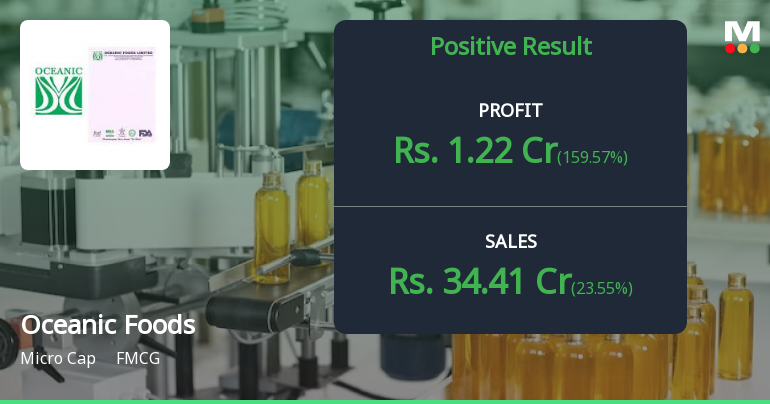

Oceanic Foods Reports Strong Q3 FY24-25 Growth Amid Score Adjustment

2025-02-10 17:44:47Oceanic Foods has announced its third-quarter financial results for FY24-25, showcasing significant year-on-year growth in Profit After Tax and achieving its highest quarterly Operating Profit. The company also reported a peak Operating Profit Margin and solid Net Sales, reflecting improvements in operational efficiency despite a recent adjustment in its overall evaluation score.

Read MoreShareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

07-Apr-2025 | Source : BSEPostal Ballot Outcome

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation regarding Closure of Trading Window for the Quarter and Year ended 31st March2025.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

05-Mar-2025 | Source : BSEPostal Ballot Notice

Corporate Actions

No Upcoming Board Meetings

Oceanic Foods Ltd has declared 1% dividend, ex-date: 19 Sep 19

No Splits history available

Oceanic Foods Ltd has announced 2:1 bonus issue, ex-date: 27 Jun 19

No Rights history available