Surge in Open Interest Signals Shift in Market Dynamics for Oil India Ltd.

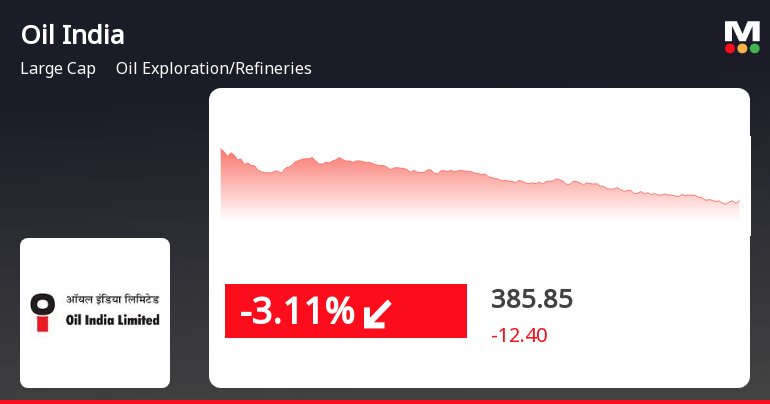

2025-03-25 15:00:09Oil India Ltd. has experienced a significant increase in open interest today, reflecting notable trading activity in the stock. The latest open interest stands at 27,700 contracts, a substantial rise from the previous open interest of 17,712 contracts, marking a change of 9,988 contracts or 56.39%. The trading volume for the day reached 19,656 contracts, indicating robust market engagement. In terms of price performance, Oil India Ltd. has underperformed its sector by 0.42%, with the stock experiencing a decline after seven consecutive days of gains. The stock touched an intraday low of Rs 383.7, representing a decrease of 3.62%. The weighted average price suggests that more volume was traded closer to this low price point. While the stock is currently above its 5-day and 20-day moving averages, it remains below the 50-day, 100-day, and 200-day moving averages. Additionally, the stock boasts a high divide...

Read MoreSurge in Open Interest Signals Shifting Market Dynamics for Oil India Ltd.

2025-03-25 14:00:06Oil India Ltd. has experienced a significant increase in open interest today, with the latest open interest (OI) reported at 27,472 contracts, up from the previous OI of 17,712 contracts. This marks a notable change of 9,760 contracts, reflecting a percentage increase of 55.1%. The trading volume for the day stood at 18,065 contracts, indicating robust activity in the derivatives market. In terms of price performance, Oil India Ltd. underperformed its sector by 2.63%, with the stock touching an intraday low of Rs 383.7, down 3.62% from the previous close. The weighted average price suggests that more volume was traded closer to this low price. While the stock remains above its 20-day moving averages, it is trading below the 5-day, 50-day, 100-day, and 200-day moving averages, indicating a mixed trend. Additionally, the stock has seen a decline in investor participation, with delivery volume dropping by 38...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Oil India Ltd.

2025-03-25 13:00:07Oil India Ltd. has experienced a significant increase in open interest today, with the latest open interest (OI) reported at 27,096 contracts, up from the previous OI of 17,712 contracts. This marks a notable change of 9,384 contracts, representing a percentage increase of 52.98%. The trading volume for the day stood at 16,212 contracts, contributing to a futures value of approximately Rs 50,934.30 lakhs. In terms of price performance, Oil India Ltd. has underperformed its sector by 2.32%, with the stock falling after a streak of seven consecutive gains. The stock reached an intraday low of Rs 383.80, reflecting a decline of 3.59%. The weighted average price indicates that more volume was traded closer to this low price point. While the stock remains above its 20-day moving averages, it is currently below the 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, the stock's delivery volume ha...

Read More

Oil India's Stock Decline Signals Potential Shift in Market Sentiment

2025-03-25 11:45:16Oil India saw a significant decline on March 25, 2025, reversing a brief period of gains. The stock is currently above its short-term moving averages but below longer-term ones. Despite a high dividend yield, its year-to-date performance contrasts with the broader market's slight decline.

Read MoreOil India's Valuation Adjustment Highlights Strong Fundamentals Amidst Industry Dynamics

2025-03-20 08:00:04Oil India has recently undergone a valuation adjustment, reflecting its current standing in the oil exploration and refinery sector. The company boasts a price-to-earnings (P/E) ratio of 8.50 and a price-to-book value of 1.19, indicating a competitive position in the market. Its enterprise value to EBITDA stands at 6.98, while the enterprise value to EBIT is recorded at 8.77, showcasing its operational efficiency. In terms of returns, Oil India has demonstrated notable performance over various time frames. Over the past year, the stock has returned 6.95%, outperforming the Sensex, which returned 4.77%. Over a three-year period, the company has achieved a remarkable 165.44% return, significantly higher than the Sensex's 30.39%. Furthermore, its five-year return of 669.05% highlights its strong historical performance relative to broader market trends. When compared to its peers, Oil India maintains a favora...

Read More

Oil India's Intraday Gains Highlight Divergence from Broader Market Trends

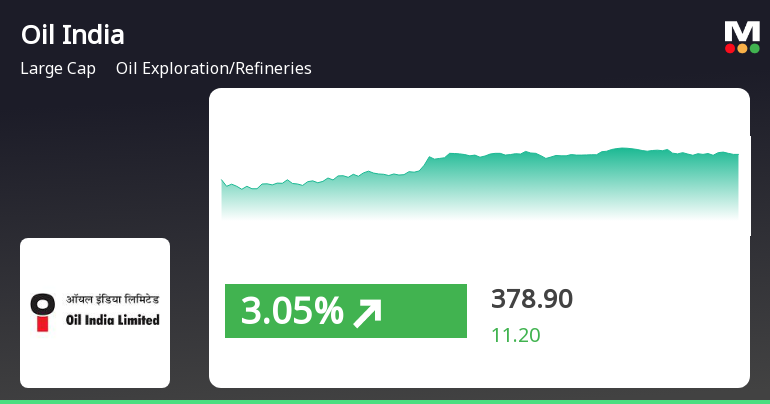

2025-03-13 10:15:14Oil India experienced a notable increase in stock performance on March 13, 2025, reaching an intraday high while outperforming its sector. Despite a recent decline over the past month, the stock remains above its 5-day moving average and offers a high dividend yield, appealing to income-focused investors.

Read More

Oil India's Recent Gains Highlight Divergence from Broader Market Trends

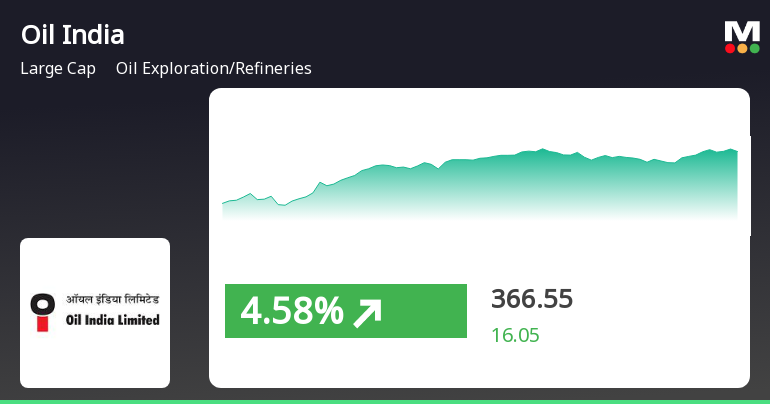

2025-03-05 09:45:13Oil India has experienced significant gains, outperforming its sector and achieving a total return of 6.36% over two days. The stock is currently above its 5-day moving average but below longer-term averages. The broader market, led by small-cap stocks, has also seen positive movement.

Read More

Oil India's Recovery Highlights Resilience Amid Broader Market Declines

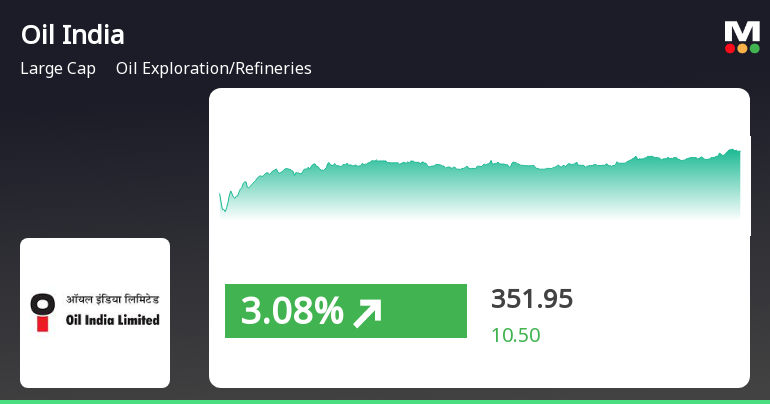

2025-03-04 15:30:13Oil India saw a rebound on March 4, 2025, after six days of decline, reaching an intraday high while also hitting a new 52-week low. The stock outperformed its sector amid broader market challenges, trading below key moving averages but offering a high dividend yield that may attract income-focused investors.

Read More

Oil India's Stock Faces Significant Volatility Amidst Underperformance and Technical Challenges

2025-03-04 09:37:17Oil India has reached a new 52-week low, reflecting significant volatility and a decline over the past week. The stock is trading below key moving averages, indicating a bearish trend. Despite recent challenges, the company shows strong long-term growth potential and a stable financial position.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for Quarter ended 31.03.2025

Change Of Chief Investors Relations Officer (CIRO) Of The Company

01-Apr-2025 | Source : BSEChange of Chief Investors Relations Officer (CIRO) of the Company

Appointment Of Non-Official (Independent) Directors

28-Mar-2025 | Source : BSEAppointment of Non-Official (Independent) Directors

Corporate Actions

No Upcoming Board Meetings

Oil India Ltd. has declared 70% dividend, ex-date: 17 Feb 25

No Splits history available

Oil India Ltd. has announced 1:2 bonus issue, ex-date: 02 Jul 24

No Rights history available