Olympia Industries Shows Shift in Market Sentiment Amid Flat Performance and Debt Concerns

2025-03-25 08:03:23Olympia Industries has recently adjusted its evaluation, indicating a shift in technical trends. The company reported flat net sales of Rs 59.49 crore and faces concerns regarding its high Debt to EBITDA ratio. Despite challenges, it maintains an attractive valuation relative to peers and has generated an 8.02% return over the past year.

Read More

Olympia Industries Faces Significant Volatility Amidst Ongoing Market Challenges

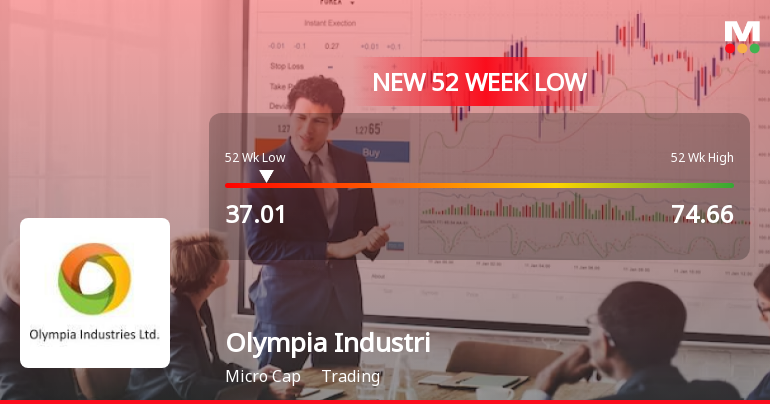

2025-03-03 09:35:14Olympia Industries has faced significant volatility, reaching a new 52-week low of Rs. 37.01, and has underperformed its sector. The stock has seen a consecutive decline over three days, with a notable intraday fluctuation of 11.88%, reflecting ongoing challenges in the market.

Read More

Olympia Industries Hits 52-Week Low Amidst Broader Market Challenges and Underperformance

2025-02-28 10:05:14Olympia Industries, a microcap trading firm, reached a new 52-week low today, reflecting a 27.64% decline over the past year. Despite this, the company outperformed its sector slightly. Currently, the stock trades below its moving averages, indicating ongoing challenges in a competitive market.

Read More

Olympia Industries Faces Significant Volatility Amid Broader Market Trends and Declining Performance

2025-02-27 10:05:12Olympia Industries, a microcap trading firm, has faced notable volatility, nearing its 52-week low. The stock opened lower and has underperformed its sector. Despite an intraday high, it has struggled over the past year, trading below key moving averages, indicating a continued downward trend.

Read More

Olympia Industries Reports Mixed Financial Results Amid Declining Evaluation in February 2025

2025-02-13 10:03:36Olympia Industries announced its financial results for the quarter ending December 2024, revealing an increase in Profit After Tax for the nine-month period. However, challenges persist, including a decline in the operating profit to interest ratio and a decrease in net sales compared to previous quarters.

Read MoreDeclaration In Terms Of Regulation 31(4) Of The Securities And Exchange Board Of India (SAST) Regulations 2011

05-Apr-2025 | Source : BSEDisclosure of Regulation 31(4) of the Securities and Exchange Board of India (SAST) Regulation 2011.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPlease find enclosed the Compliance Certificate under Regulation 74(5) of the SEBI (DP) Regulation 2018 for quarter ended March 31 2025

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available